Get the free Advising your client - The Chartered Institute of Taxation

Show details

024-026 TA 1007.QED 27/09/2007 12:24-Page 1 ADVISING YOUR CLIENT A fair share of their business When a divorcing couple have been running a business together, carving up the family company can be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign advising your client

Edit your advising your client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your advising your client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit advising your client online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit advising your client. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

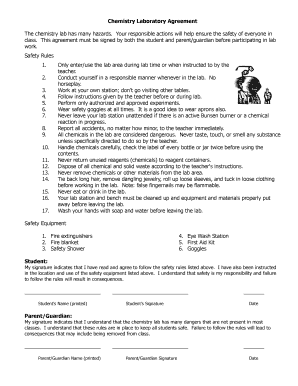

How to fill out advising your client

How to Fill Out Advising Your Client:

01

Begin by gathering all the necessary information about your client, such as their name, contact details, and any relevant background or history.

02

Assess the client's needs and goals. What are they looking to achieve through your advising services? Understanding their objectives will help you tailor your recommendations and advice.

03

Conduct a thorough analysis of the client's current situation. This may involve reviewing their financial statements, investment portfolios, or business strategies, depending on the nature of your advising services.

04

Identify any potential risks or challenges that the client may face. It is essential to assess and address these upfront to ensure that your advice is well-rounded and comprehensive.

05

Develop a personalized plan for the client based on their specific needs, goals, and situation. This plan should outline actionable steps, timeline, and measurable objectives.

06

Clearly communicate your recommendations and advice to the client in a way that they can understand and make informed decisions. Use plain language and avoid jargon to ensure transparency and clarity.

07

Continually monitor the client's progress and make any necessary adjustments to the plan as circumstances change. Regular reviews and updates will help ensure that the advice remains relevant and effective.

08

Provide ongoing support and guidance to the client as they implement the advising plan. Address any questions or concerns they may have, and be available to offer guidance or reassurance.

09

Regularly evaluate the effectiveness of your advising services by seeking feedback from the client. Their input will help you improve and enhance your approach in the future.

10

Finally, maintain confidentiality and professionalism throughout the advising process. Respect the client's privacy and handle any sensitive information with care and discretion.

Who Needs Advising Your Client:

01

Individuals seeking financial guidance: Many people require advising to manage their personal finances, plan for retirement, or make sound investment decisions.

02

Business owners and entrepreneurs: Advising services can be invaluable for business owners seeking strategic advice, help with financial planning, or guidance in growing their enterprises.

03

High-net-worth individuals: Clients with significant wealth often require specialized advising to manage their assets, ensure proper estate planning, or explore investment opportunities.

04

Professionals in career transitions: Individuals looking to change careers or advance in their professions can benefit from advising to help them navigate the job market or develop a career strategy.

05

Startups and small businesses: Entrepreneurs launching new ventures or running small businesses may seek advising to address challenges, develop growth strategies, or access capital.

06

Individuals facing significant life changes: Whether it's getting married, starting a family, or going through a divorce, people experiencing life events often need advising to adjust their financial plans accordingly.

07

Retirees and pre-retirees: Planning for retirement and managing finances during the golden years can be complex. Advising services can assist individuals in maximizing their savings, minimizing taxes, and ensuring a comfortable retirement.

Overall, advising services cater to a wide range of individuals and businesses, providing personalized guidance, financial planning, and strategic support to help clients achieve their goals and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute advising your client online?

pdfFiller has made it simple to fill out and eSign advising your client. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in advising your client?

The editing procedure is simple with pdfFiller. Open your advising your client in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit advising your client straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit advising your client.

What is advising your client?

Advising your client involves providing guidance, recommendations, and advice on legal, financial, or business matters.

Who is required to file advising your client?

All professionals and experts tasked with providing services or counsel to a client are required to file advising your client.

How to fill out advising your client?

To fill out advising your client, one must gather all relevant information, assess the client's needs, provide informed advice, and maintain accurate records of the advisory services.

What is the purpose of advising your client?

The purpose of advising your client is to ensure that individuals or businesses receive proper guidance and support to make informed decisions in various aspects of their life or operations.

What information must be reported on advising your client?

Information such as the nature of the advice given, any potential risks or limitations, the client's goals or objectives, and any additional services provided must be reported on advising your client.

Fill out your advising your client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Advising Your Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.