Get the free Insured company:

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insured company

Edit your insured company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insured company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insured company online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insured company. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

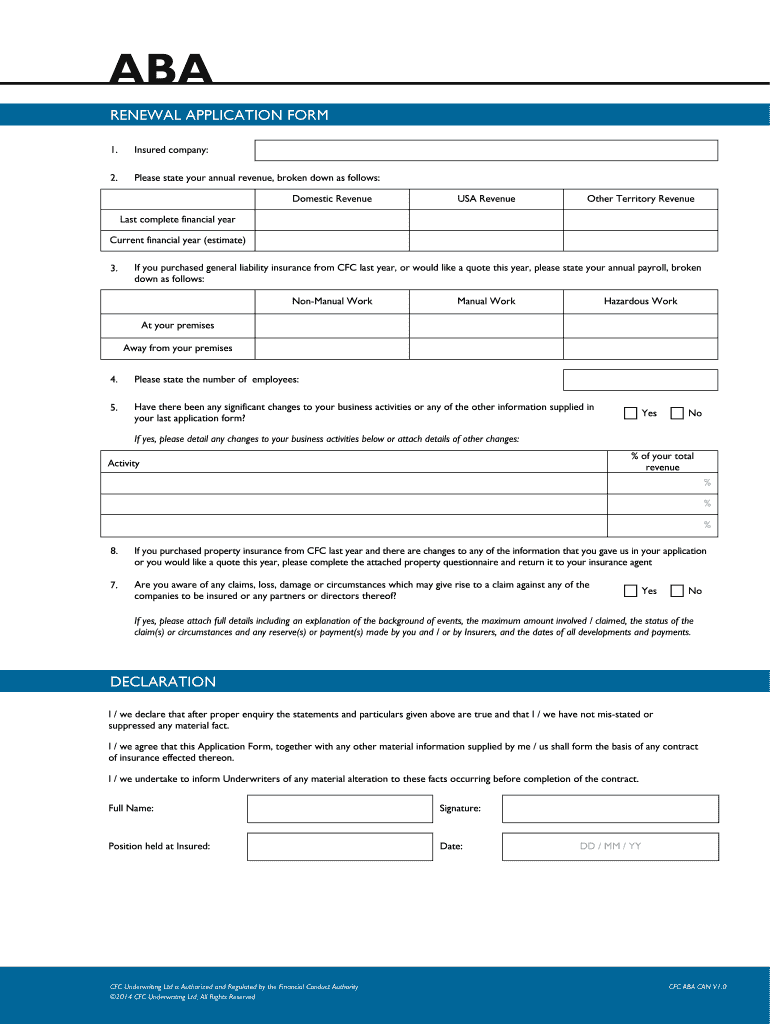

How to fill out insured company

How to fill out insured company:

01

Start by gathering all the necessary information about your company, such as its legal name, address, and contact details.

02

Determine the type of insurance coverage you need for your company. This may include general liability, property, professional liability, workers' compensation, or any other relevant policies based on your industry and business activities.

03

Research different insurance providers and compare their offerings, coverage limits, and pricing. Consider seeking recommendations from other business owners or consulting with an insurance broker to find the best fit for your company's needs.

04

Once you have chosen an insurance provider, reach out to them and request a quote. Provide them with the necessary details about your company and the coverage you require.

05

Carefully review the insurance policy documents they provide. Pay attention to the coverage limits, deductibles, exclusions, and any additional terms or conditions.

06

Fill out the required application forms provided by the insurance company. Ensure that you provide accurate and complete information to avoid any potential issues with claims in the future.

07

Attach any supporting documents that may be required, such as financial statements, business licenses, or proof of safety measures in place.

08

Double-check all the provided information before submitting the application. It is crucial to ensure accuracy to prevent any complications during the underwriting or claims process.

09

Pay the premium amount as per the payment options provided by the insurance company. Keep track of the payment receipt or confirmation for future reference.

10

After submitting the application and payment, follow up with the insurance provider to ensure that your policy has been issued and is in effect.

Who needs insured company:

01

Business owners: Insured companies are primarily required by business owners who want to protect their investments and assets from various risks and potential liabilities.

02

Contractors and freelancers: Independent contractors and freelancers often need insured companies to meet the insurance requirements of their clients or to safeguard themselves against any potential claims or damages arising from their work.

03

Employers: Companies with employees are typically required by law to have certain types of insurance, such as workers' compensation insurance, to provide coverage for workplace injuries or illnesses.

04

Property owners and landlords: Individuals or companies who own properties, whether residential or commercial, may need insured companies to protect against property damage, liability claims, or lawsuits from tenants or visitors.

05

Professionals: Professionals such as doctors, lawyers, accountants, and consultants often require professional liability insurance (also known as errors and omissions insurance) to protect themselves from claims of negligence, errors, or omissions in their professional services.

06

Non-profit organizations: Non-profit organizations may opt for insurance coverage to protect their board members, volunteers, and assets from potential risks or legal liabilities related to their operations.

07

Contractors and suppliers: Companies providing services or products to others may need insured companies as a prerequisite to secure contracts or business partnerships, ensuring that they have adequate coverage in case of accidents, property damage, or other unforeseen events.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send insured company for eSignature?

insured company is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get insured company?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific insured company and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit insured company on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign insured company on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is insured company?

Insured company refers to a company that has obtained an insurance policy to protect itself against potential risks or losses.

Who is required to file insured company?

Any company that has purchased an insurance policy must file as an insured company.

How to fill out insured company?

To fill out insured company, one must provide information about the insurance policy purchased and the coverage it offers.

What is the purpose of insured company?

The purpose of insured company is to ensure that businesses are financially protected in case of unforeseen events that may result in losses.

What information must be reported on insured company?

Information such as the insurance policy number, coverage details, and the insurance provider must be reported on insured company.

Fill out your insured company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insured Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.