Get the free Virginia Schedule OSC Credit for Taxes paid to Another State 2016

Show details

We are not affiliated with any brand or entity on this form

Instructions and Help about virginia schedule osc credit

How to edit virginia schedule osc credit

How to fill out virginia schedule osc credit

Instructions and Help about virginia schedule osc credit

How to edit virginia schedule osc credit

To edit the virginia schedule osc credit, download the form from the Virginia Department of Taxation website or access it via pdfFiller. Use the editing features of pdfFiller to make changes by selecting the relevant fields you wish to modify. It is important to ensure that all information is accurate and up-to-date before final submission to avoid delays or penalties.

How to fill out virginia schedule osc credit

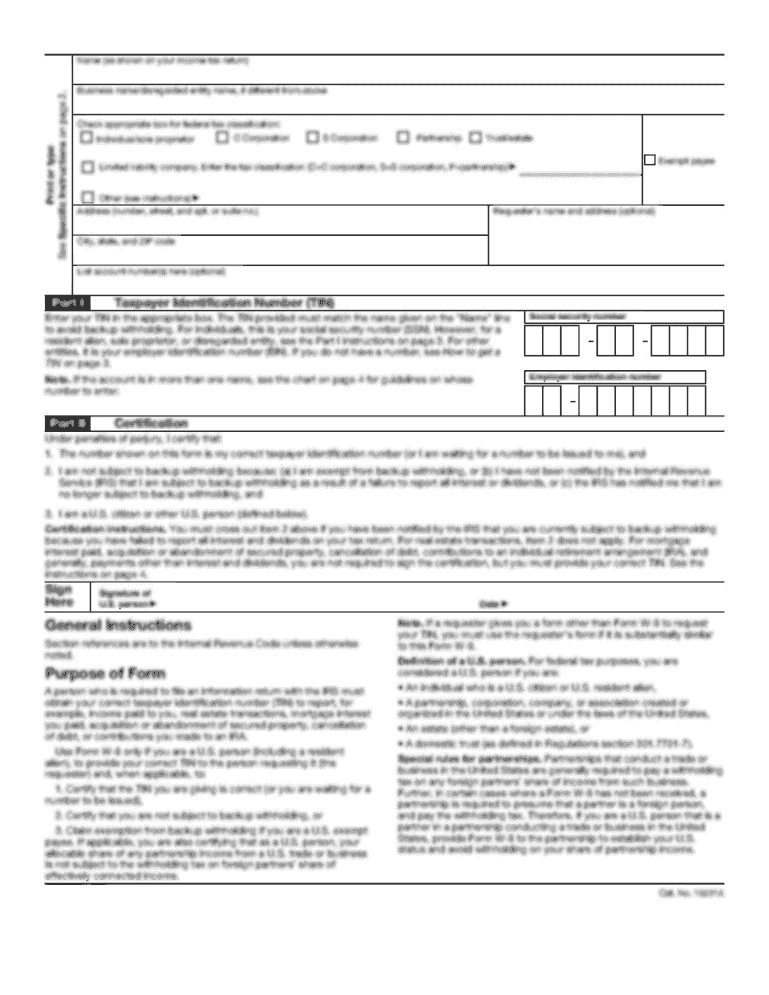

Filling out the virginia schedule osc credit involves several key steps. First, gather all necessary information, including your tax details and any relevant purchase or payment information. Next, follow these steps:

01

Download the virginia schedule osc credit form.

02

Fill in your personal identification information at the top of the document.

03

Provide details about your qualifying purchases or payments in the designated sections.

04

Review the information for accuracy.

05

Sign and date the form before submission.

Latest updates to virginia schedule osc credit

Latest updates to virginia schedule osc credit

Updates to the virginia schedule osc credit may occur annually, reflecting changes in tax law or regulations. Always check the Virginia Department of Taxation website for the most current version of the form and any specific instructions related to the filing process.

All You Need to Know About virginia schedule osc credit

What is virginia schedule osc credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About virginia schedule osc credit

What is virginia schedule osc credit?

The virginia schedule osc credit is a tax form used by Virginia taxpayers to claim credits for specific purchases or expenses related to certain tax benefits. This form helps in calculating the eligible credit amount that can be deducted from the total tax liability.

What is the purpose of this form?

The purpose of the virginia schedule osc credit is to provide taxpayers with a structured way to report qualifying purchases or expenses that can lead to tax credits. Completing this form accurately allows individuals and businesses to reduce their tax burden legally.

Who needs the form?

Individuals and businesses who have made specific purchases eligible for tax credits should file the virginia schedule osc credit. This includes those who engage in qualified transactions as defined by Virginia tax laws, aiming to benefit from applicable credits.

When am I exempt from filling out this form?

You may be exempt from filling out the virginia schedule osc credit if you have not made any qualifying purchases during the tax year or if your situation meets specific criteria outlined by the Virginia Department of Taxation. Always check the current guidelines to confirm eligibility for exemption.

Components of the form

The virginia schedule osc credit consists of several key components, including personal identification information, sections for reporting qualifying purchases, and the calculation of the credit amount. It is essential to complete each part accurately to ensure the proper tax credit is claimed.

What are the penalties for not issuing the form?

Failing to issue the virginia schedule osc credit when required can result in penalties imposed by the Virginia Department of Taxation. These penalties may include fines or the inability to claim tax credits in future tax filings. It is crucial to comply with all filing requirements to avoid unnecessary complications.

What information do you need when you file the form?

When filing the virginia schedule osc credit, you will need personal identification details, information about the qualifying purchases or expenses, and any relevant supporting documentation. Ensuring you have all required information ready will streamline the filing process.

Is the form accompanied by other forms?

In certain situations, the virginia schedule osc credit may need to be submitted alongside other tax forms, depending on your overall tax situation. Refer to the filing instructions for guidance on whether additional documentation is necessary for your claim.

Where do I send the form?

The completed virginia schedule osc credit should be mailed to the address specified in the filing instructions on the form. Ensure that you send it to the correct location to facilitate timely processing by the Virginia Department of Taxation.

See what our users say