Get the free Independent Contractor vs Employee Worksheet - csuchico

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor vs employee

Edit your independent contractor vs employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor vs employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent contractor vs employee online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit independent contractor vs employee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor vs employee

How to fill out independent contractor vs employee:

01

Determine the nature of the work: Begin by understanding the type of work that will be performed. If the individual will have control over their own methods and outcomes, they are likely an independent contractor. On the other hand, if they will work under your direction and use your resources, they are likely an employee.

02

Review legal requirements: Familiarize yourself with the legal requirements and regulations regarding independent contractors and employees in your jurisdiction. Consult with an attorney or use online resources to ensure compliance.

03

Use the right forms: Depending on your location, you may need to fill out specific forms to classify a worker as an independent contractor or an employee. Examples include IRS Form SS-8 and Form W-9 for independent contractors, and Form W-2 for employees.

04

Document the relationship: Maintain clear documentation that reflects the true nature of the working relationship. This may include written contracts, agreements, or statements of work that outline the expectations, responsibilities, and payment terms.

05

Keep records: Maintain thorough records of payments made to contractors or employees. This includes invoices, receipts, timesheets, and any other relevant documentation. Proper record-keeping is essential for tax purposes and can also help in case of any legal disputes.

Who needs independent contractor vs employee?

01

Employers: Businesses or organizations that require additional help on a temporary or project basis may opt to hire independent contractors. By doing so, they can avoid the costs and responsibilities associated with hiring and managing employees.

02

Freelancers and consultants: Professionals who offer their services to multiple clients at a time often prefer working as independent contractors. This allows them to maintain flexibility, choose their projects, and potentially earn higher rates.

03

Individuals with specialized skills: Independent contractors are often sought after for their specialized expertise. Businesses may require their services for specific tasks or projects, such as IT consulting, graphic design, or marketing campaigns.

04

Employees seeking work flexibility: Some individuals prefer the flexibility of working as independent contractors. They can choose when and where to work, negotiate rates, and have more control over their own work-life balance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my independent contractor vs employee in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your independent contractor vs employee and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit independent contractor vs employee on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share independent contractor vs employee on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out independent contractor vs employee on an Android device?

Complete independent contractor vs employee and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

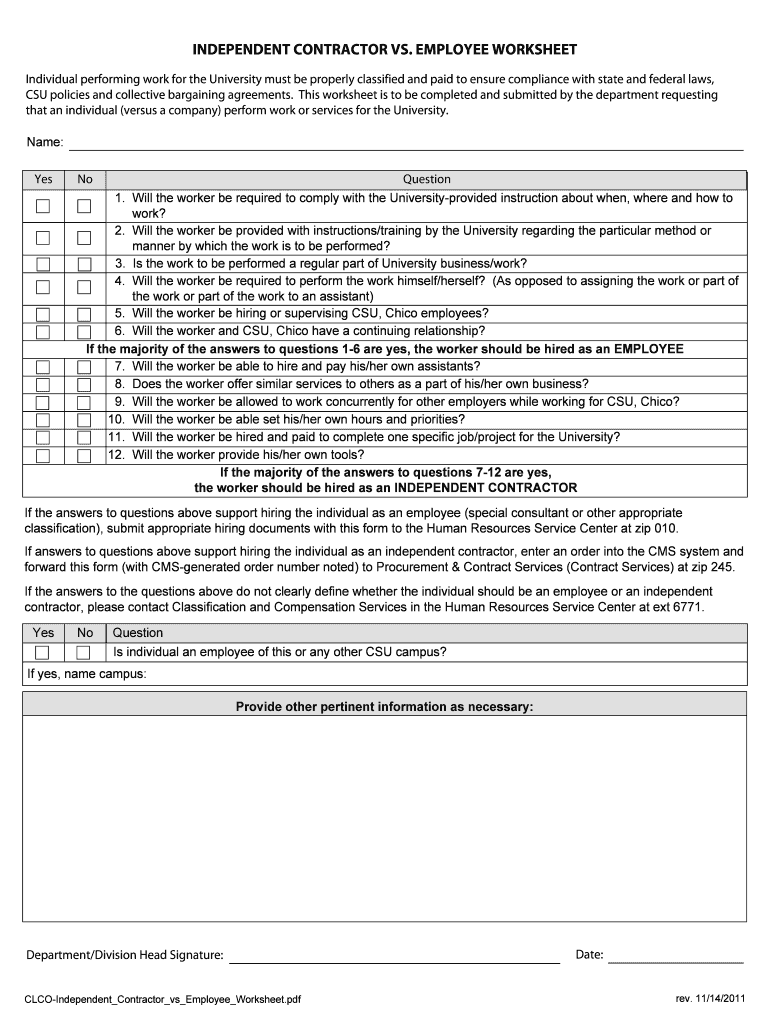

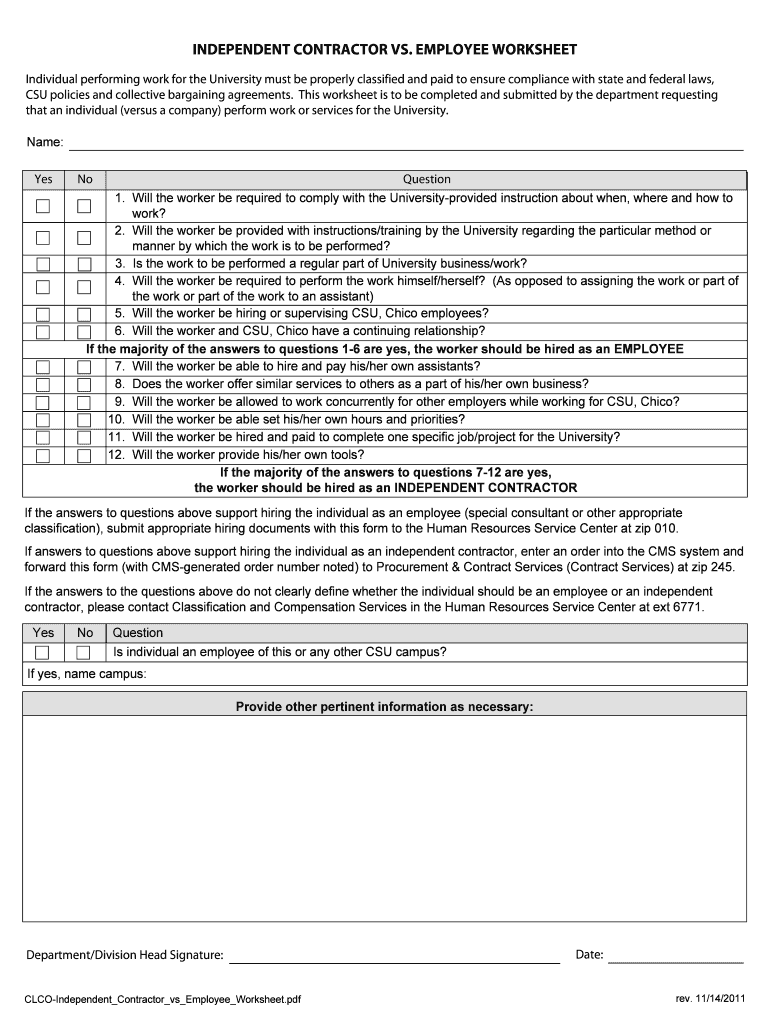

What is independent contractor vs employee?

Independent contractors work for themselves and are not employees of the company. They are responsible for their own taxes and do not receive benefits like health insurance or paid time off. Employees, on the other hand, work for a company and receive benefits and have taxes withheld from their paycheck.

Who is required to file independent contractor vs employee?

Employers are required to classify their workers as either independent contractors or employees and file the appropriate tax forms.

How to fill out independent contractor vs employee?

To fill out the classification for independent contractor vs employee, employers need to gather information about the work arrangement, control over the work, payment terms, and benefits provided.

What is the purpose of independent contractor vs employee?

The purpose of determining if a worker is an independent contractor or an employee is to ensure that the correct taxes are being withheld and that workers are receiving the appropriate benefits and protections.

What information must be reported on independent contractor vs employee?

Employers must report information such as the worker's name, address, social security number, type of work performed, and the amount paid to the worker.

Fill out your independent contractor vs employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Vs Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.