Get the free Lot Loan Application - Englewood Bank & Trust

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lot loan application

Edit your lot loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lot loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lot loan application online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lot loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

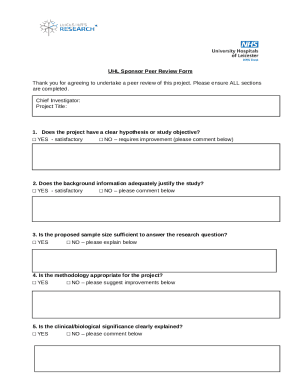

How to fill out lot loan application

How to Fill Out a Lot Loan Application:

01

Gather all required documents: Before filling out the lot loan application, make sure you have all the necessary documents handy. These typically include personal identification, income statements, financial records, and any other documents specific to your loan application.

02

Research and find a lender: Look for lenders who offer lot loans and compare their terms and interest rates. It's essential to find a reputable lender that suits your specific needs and financial situation.

03

Complete the application form: Carefully fill out all the sections of the lot loan application form. Make sure you provide accurate and up-to-date personal and financial information as required. Double-check for any errors or omissions before submitting your application.

04

Provide additional documentation: In some cases, lenders may require additional documents to support your lot loan application. These can include property details, zoning information, lot surveys, or other specific requirements. Be prepared to provide any additional documentation as requested by the lender.

05

Submit the application: Once you have filled out the lot loan application form and gathered all necessary supporting documents, submit your application to the lender. Ensure that you follow their preferred method of submission, whether it's online, via email, or in person.

06

Wait for the lender's response: After submitting the application, the lender will review your information and assess your eligibility for the lot loan. The duration of the review process may vary depending on the lender and other factors. Be patient and wait for their response.

Who needs a Lot Loan Application?

01

Individuals planning to purchase land: If you're looking to buy a lot or land, you will likely need to fill out a lot loan application. Whether you're interested in developing the lot, using it for agricultural purposes, or any other purpose, a lot loan application is necessary to secure financing.

02

Property developers: Developers who specialize in constructing residential or commercial properties often require lot loan applications. These developers purchase land to build their projects, and obtaining a lot loan is a crucial step in the development process.

03

Investors: Investors who seek to invest in land or lots for potential appreciation or future development may also need to fill out lot loan applications. These investors typically aim to purchase lots at a lower price with the intention of selling them at a higher value in the future.

In summary, filling out a lot loan application involves gathering the necessary documents, researching lenders, completing the application form accurately, providing additional documentation if required, and submitting the application to the lender. Individuals who are planning to purchase land, property developers, and investors are the ones who typically need to fill out lot loan applications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lot loan application to be eSigned by others?

When your lot loan application is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete lot loan application online?

pdfFiller has made filling out and eSigning lot loan application easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the lot loan application in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your lot loan application in seconds.

What is lot loan application?

A lot loan application is a request for financial assistance to purchase a piece of land.

Who is required to file lot loan application?

Anyone looking to purchase land with the help of a loan must file a lot loan application.

How to fill out lot loan application?

To fill out a lot loan application, you will need to provide information about your financial situation, the land you wish to purchase, and your borrowing needs.

What is the purpose of lot loan application?

The purpose of a lot loan application is to secure funding to purchase land for personal or investment use.

What information must be reported on lot loan application?

You must report information about your income, credit history, the property you wish to purchase, and the amount you are requesting to borrow on a lot loan application.

Fill out your lot loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lot Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.