Get the free Business & Industry Loan/Grant Application - scrantonpa

Show details

Business & Industry Loan/Grant Application I. City of Scranton, Office of Economic & Community Development GENERAL INFORMATION Name of Business: Type of Business: Federal Tax I.D.: DUNS#: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business amp industry loangrant

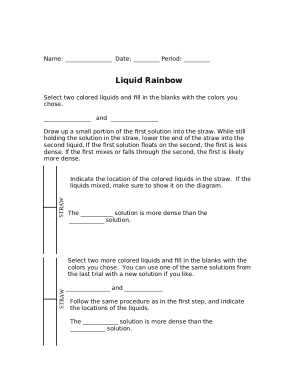

Edit your business amp industry loangrant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business amp industry loangrant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business amp industry loangrant online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business amp industry loangrant. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business amp industry loangrant

How to Fill Out Business Amp Industry Loan Grant:

01

Gather all necessary documents: Before starting the application process, make sure you have all the required documents ready. These may include financial statements, business plans, proof of collateral, tax returns, and any other relevant documents requested by the grantor.

02

Research eligibility criteria: Check the eligibility criteria set by the grantor to ensure that your business qualifies for the loan grant. This may include specific industry requirements, business size limitations, geographical constraints, or other factors.

03

Download the application form: Visit the grantor's website or contact their office to obtain the official application form for the business amp industry loan grant. Download the form and review it thoroughly to understand the information required.

04

Fill in personal and business details: Start by providing your personal information, such as name, address, contact details, and social security number. Then, proceed to enter your business information, including business name, address, industry type, and legal structure.

05

Complete financial information: Fill in the financial details requested on the application form. This may include providing information about your business's revenue, assets, liabilities, current debt, and cash flow. Use accurate and up-to-date financial statements for this section.

06

Provide business plans and projections: Many loan grants require applicants to submit a business plan and financial projections. Use this opportunity to showcase your business's goals, strategies, market analysis, and projected financial performance. Provide accurate and realistic information to strengthen your application.

07

Explain loan purpose and use of funds: Clearly state the purpose of the loan you are applying for and how the funds will be utilized to benefit your business. Whether it's for expansion, equipment purchase, working capital, or any other specific purpose, articulate your intentions in a compelling manner.

08

Compile supporting documents: Along with the application form, attach all the supporting documents requested by the grantor. These may include financial statements, tax returns, bank statements, legal documents, licenses, permits, or any other documentation required for evaluation.

09

Review and submit the application: After completing the application form, thoroughly review it for any errors or missing information. Ensure that all the required fields are filled out accurately and that all the supporting documents are attached. Once confirmed, submit the fully completed application either by mail or through the grantor's online portal, depending on their preferred submission method.

10

Follow up on the application: After submitting the application, it is essential to follow up with the grantor to inquire about the evaluation process and any additional steps that may be required. Be patient but proactive in checking the status of your application, as it may take some time for the grantor to review and make a decision.

Who needs business amp industry loan grants:

01

Startups and small businesses aiming to expand: Business amp industry loan grants are often designed to support startups and small businesses looking to grow their operations or expand into new markets. Such businesses can benefit from the financial assistance provided by these grants to fund their growth plans.

02

Entrepreneurs in specific industries: Some loan grants cater to entrepreneurs operating in specific industries such as agriculture, manufacturing, energy, or technology. These grants may offer specialized financial support, industry-specific resources, or incentive programs to promote growth and innovation within those sectors.

03

Businesses facing financial challenges: If your business is experiencing financial difficulties or needs additional capital to recover from setbacks, business amp industry loan grants can be a valuable resource. These grants can provide the necessary financial boost to overcome obstacles, stabilize operations, or improve business resilience.

04

Rural or underserved communities: Loan grants may specifically target businesses located in rural areas or underserved communities, aiming to stimulate economic development in those regions. If you operate in such a community, you may have a higher chance of eligibility for these specialized grants.

Note: The eligibility and availability of business amp industry loan grants vary depending on the grantor and the specific program. It is recommended to thoroughly research and verify the requirements of each grant before applying.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the business amp industry loangrant electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your business amp industry loangrant and you'll be done in minutes.

How do I fill out business amp industry loangrant using my mobile device?

Use the pdfFiller mobile app to fill out and sign business amp industry loangrant. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit business amp industry loangrant on an iOS device?

Use the pdfFiller mobile app to create, edit, and share business amp industry loangrant from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is business amp industry loangrant?

Business and Industry Loan Guarantee Program provides guarantees on loans made by commercial lenders to businesses in rural areas.

Who is required to file business amp industry loangrant?

Businesses in rural areas seeking loans from commercial lenders are required to file for the Business and Industry Loan Guarantee Program.

How to fill out business amp industry loangrant?

To fill out the Business and Industry Loan Guarantee Program application, businesses need to provide details about their operations, financial information, and loan requirements.

What is the purpose of business amp industry loangrant?

The purpose of the Business and Industry Loan Guarantee Program is to facilitate access to capital for businesses in rural areas, promoting economic development and job creation.

What information must be reported on business amp industry loangrant?

Businesses need to report details about their operations, financial statements, loan amount, loan purpose, and repayment plan.

Fill out your business amp industry loangrant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Amp Industry Loangrant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.