Get the free MANDATORY PROVIDENT FUND SCHEMES AUTHORITY VI.1

Show details

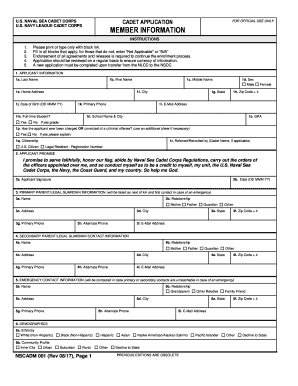

Guidelines VI.1 MANDATORY PROVIDENT FUND SCHEMES AUTHORITY VI.1 Guidelines on MPH Intermediary Registration and Notification of Changes INTRODUCTION Application for Registration as Principal Intermediary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mandatory provident fund schemes

Edit your mandatory provident fund schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mandatory provident fund schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mandatory provident fund schemes online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mandatory provident fund schemes. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mandatory provident fund schemes

How to fill out mandatory provident fund schemes:

01

Research the requirements: Start by familiarizing yourself with the mandatory provident fund (MPF) scheme and understanding the relevant regulations and guidelines. This will help you navigate the process more efficiently.

02

Choose a provider: Select an MPF provider that suits your needs. Consider factors such as fees, investment options, customer service, and reputation. You can compare different providers and their offerings to make an informed decision.

03

Complete the application form: Obtain the necessary application form from your chosen MPF provider. Fill out the form accurately and provide all required information, including personal details, employment information, and nominee details.

04

Submit required documents: Along with the application form, submit any necessary supporting documents, such as proof of identity, proof of address, and employment documents. Ensure that you provide valid and current documentation.

05

Nominate beneficiaries: Consider nominating beneficiaries to receive your MPF benefits in case of your death. Review the nominated beneficiaries regularly and update them if necessary. Consult with your MPF provider to understand the specific procedures and requirements for nominating beneficiaries.

06

Monitor your MPF account: Once your application is processed and approved, regularly monitor your MPF account. Keep track of contributions, investment performance, fees, and any changes in your employment status to ensure your MPF scheme remains up to date.

Who needs mandatory provident fund schemes:

01

Employees: In many jurisdictions, mandatory provident fund schemes are designed for employees. Employers are typically required to contribute a percentage of the employee's salary to the MPF scheme. Thus, individuals who work for employers covered by the legislation usually need to have an MPF scheme.

02

Self-employed individuals: In some cases, self-employed individuals may also need to participate in an MPF scheme. This can vary depending on the jurisdiction and specific regulations. It's important to consult with relevant authorities or seek professional advice to determine whether self-employed individuals are obligated to have an MPF scheme.

03

Residents in jurisdictions with mandated MPF: Mandatory provident fund schemes are compulsory in certain jurisdictions like Hong Kong. If you reside in a jurisdiction where MPF is mandated, you are likely required to have an MPF scheme.

04

Individuals planning for retirement: Even if not mandatory, individuals who want to secure their retirement savings can voluntarily participate in an MPF scheme. It offers a structured and regulated way to save and invest for retirement, ensuring financial security in the future. It's recommended to assess your financial goals and requirements to determine whether having an MPF scheme is beneficial for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mandatory provident fund schemes in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your mandatory provident fund schemes and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find mandatory provident fund schemes?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the mandatory provident fund schemes in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the mandatory provident fund schemes in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your mandatory provident fund schemes in seconds.

What is mandatory provident fund schemes?

Mandatory Provident Fund (MPF) schemes are retirement savings plans in Hong Kong that require both employers and employees to make regular contributions.

Who is required to file mandatory provident fund schemes?

Employers in Hong Kong are required to file mandatory provident fund schemes for their employees.

How to fill out mandatory provident fund schemes?

Employers can fill out mandatory provident fund schemes either manually or online through the MPF authority's designated platform.

What is the purpose of mandatory provident fund schemes?

The purpose of mandatory provident fund schemes is to ensure that employees have retirement savings and financial security when they reach retirement age.

What information must be reported on mandatory provident fund schemes?

The mandatory provident fund schemes must include information such as employee salaries, contributions made by both employer and employee, and investment choices.

Fill out your mandatory provident fund schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mandatory Provident Fund Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.