Get the free Research Accounting - Expense Claim Form (Initiating Group) - ucalgary

Show details

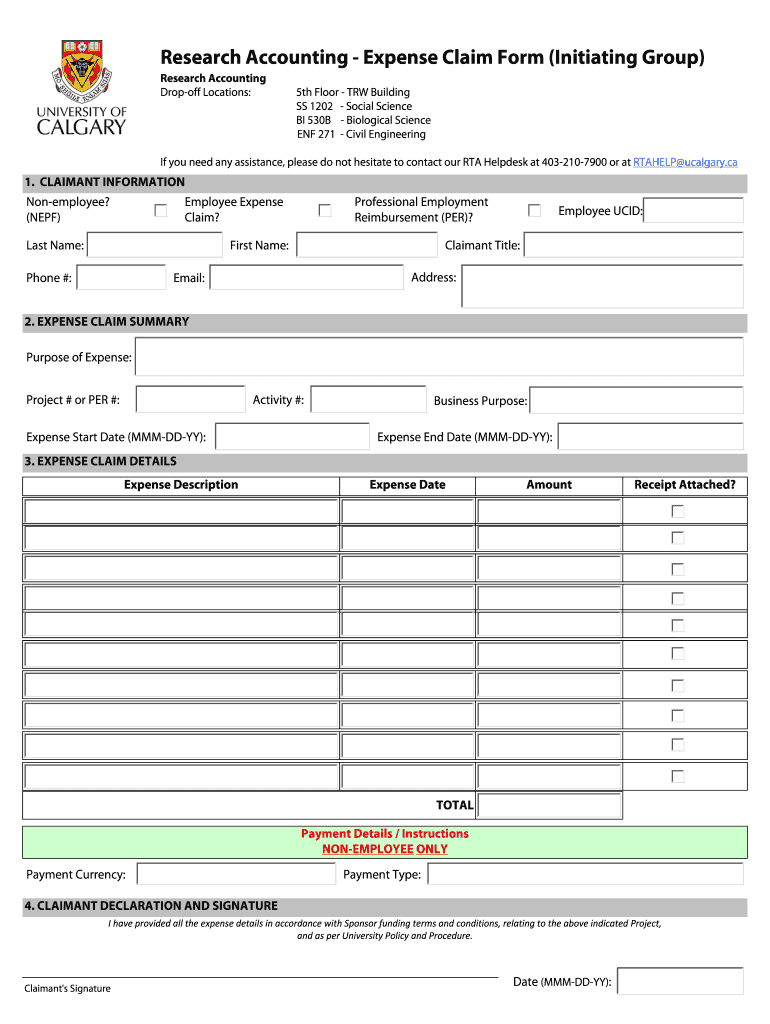

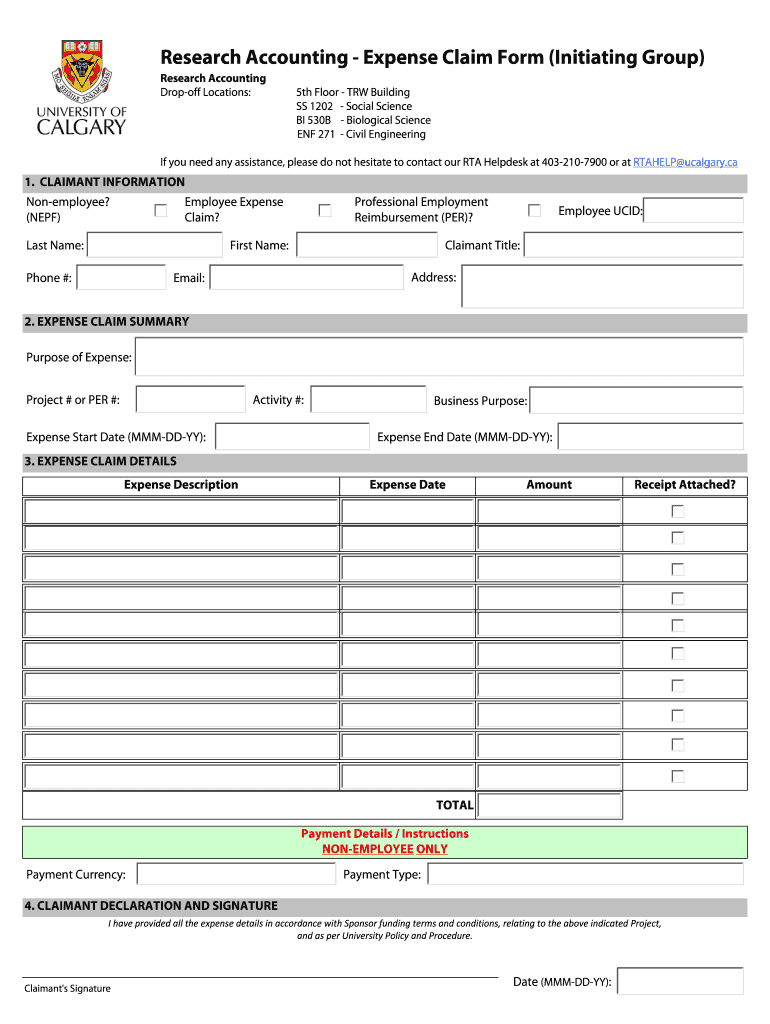

Research Accounting Expense Claim Form (Initiating Group) Research Accounting Drop-off Locations: 5th Floor TRY Building SS 1202 — Social Science BI 530B Biological Science ENF 271 — Civil Engineering

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign research accounting - expense

Edit your research accounting - expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your research accounting - expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing research accounting - expense online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit research accounting - expense. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out research accounting - expense

How to fill out research accounting - expense:

01

Begin by gathering all relevant financial documents related to the research project, including receipts, invoices, and payment records.

02

Familiarize yourself with the specific guidelines and requirements of your institution or funding agency regarding research accounting - expense. This may involve understanding which expenses are eligible for reimbursement and any necessary documentation or approvals that may be required.

03

Create a spreadsheet or use accounting software to track and categorize expenses. It is important to accurately record the date, description, and amount of each expense, as well as the appropriate account code or category.

04

Review each expense item and ensure that it complies with the guidelines set forth by your institution or funding agency. Exclude any personal or unauthorized expenses.

05

Attach copies of relevant documents, such as receipts or invoices, to support each expense entry. These documents should be organized and easily accessible for future reference or audits.

06

Calculate the total expenses for the research project based on the information recorded in your accounting system. This will provide an accurate overview of the project's financial status.

Who needs research accounting - expense?

01

Researchers and scientists conducting research projects funded by institutions or external agencies often require research accounting - expense to accurately track and manage project expenses.

02

Academic institutions and research organizations need research accounting - expense to ensure compliance with funding guidelines and regulations, as well as to maintain transparency and accountability in financial reporting.

03

Funding agencies or sponsors may also require researchers to submit detailed research accounting - expense reports to evaluate project progress and ensure that funds are being used appropriately.

Overall, research accounting - expense is a crucial process for all stakeholders involved in research projects, helping to ensure accurate financial tracking, compliance, and accountability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute research accounting - expense online?

pdfFiller has made filling out and eSigning research accounting - expense easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete research accounting - expense on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your research accounting - expense. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit research accounting - expense on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as research accounting - expense. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is research accounting - expense?

Research accounting - expense refers to the financial tracking and reporting of expenses related to research activities conducted by an organization or individual.

Who is required to file research accounting - expense?

Organizations or individuals that conduct research activities and incur expenses related to those activities are required to file research accounting - expense.

How to fill out research accounting - expense?

Research accounting - expense can be filled out by documenting all expenses incurred during research activities, categorizing them appropriately, and reporting them in a financial statement.

What is the purpose of research accounting - expense?

The purpose of research accounting - expense is to accurately track and report all expenses related to research activities, allowing for proper financial management and accountability.

What information must be reported on research accounting - expense?

Information that must be reported on research accounting - expense includes details of all expenses incurred during research activities, such as supplies, equipment, salaries, and other related costs.

Fill out your research accounting - expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Research Accounting - Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.