Get the free Consumer Credit Report Alert Identity Verification Certification 01192010.doc

Show details

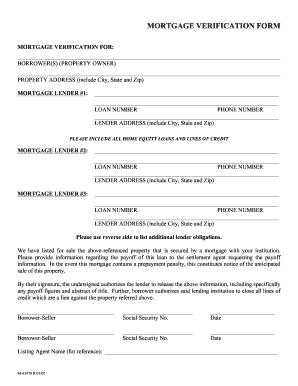

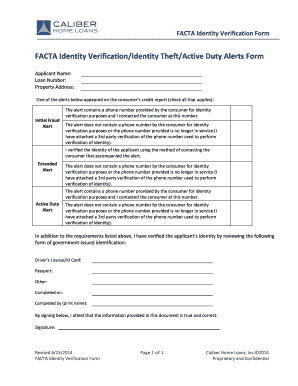

Consumer Credit Report Alert Identity Verification Certification The following Certification must be completed when a consumers credit report includes an Initial Fraud Alert, Extended Fraud Alert,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit report alert

Edit your consumer credit report alert form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit report alert form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit report alert online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit consumer credit report alert. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit report alert

To fill out a consumer credit report alert, follow these steps:

01

Start by accessing the website or platform where you can request a credit report alert. This can typically be done online through credit reporting agencies or credit monitoring services.

02

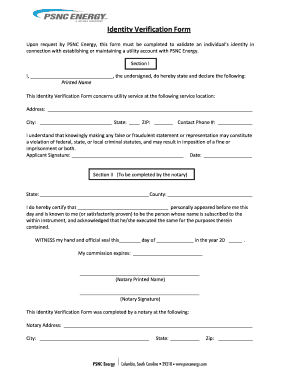

Provide your personal information, such as your full name, date of birth, social security number, and contact details. This information is necessary for the credit reporting agencies to properly identify and track your credit report.

03

Specify the type and duration of the credit report alert you want to set up. There are different options available, including an initial fraud alert, an extended fraud alert for identity theft victims, or an active duty alert for military personnel.

04

Carefully review and confirm the information you have provided before submitting the request. It's important to ensure that all the details are accurate to avoid any issues or delays in processing the credit report alert.

05

Finally, submit your request and wait for confirmation. The credit reporting agency will acknowledge your request and activate the credit report alert accordingly.

Who needs a consumer credit report alert?

01

Individuals who have experienced identity theft or suspect that they may be at risk for fraudulent activity on their credit accounts could benefit from a consumer credit report alert. It serves as an additional layer of protection against unauthorized access to their credit information.

02

People who want to actively monitor their credit reports for any potential signs of fraudulent activity can also choose to set up a consumer credit report alert. This helps them stay alert to any suspicious or unauthorized changes in their credit history.

03

Military personnel who wish to protect their credit information while on active duty can opt for an active duty alert. This alert ensures that credit reporting agencies take additional steps to verify any new credit applications made in the service member's name.

In conclusion, anyone who wants to safeguard their credit information or suspects any fraudulent activity on their credit accounts should consider setting up a consumer credit report alert. It provides an added layer of security and helps individuals monitor their credit reports for any unauthorized changes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer credit report alert for eSignature?

When your consumer credit report alert is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit consumer credit report alert online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your consumer credit report alert and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit consumer credit report alert in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your consumer credit report alert, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is consumer credit report alert?

A consumer credit report alert is a notification placed on a consumer's credit report to warn potential creditors that the consumer may be a victim of identity theft or fraud.

Who is required to file consumer credit report alert?

Any individual who believes they are a victim of identity theft or fraud is encouraged to file a consumer credit report alert.

How to fill out consumer credit report alert?

To fill out a consumer credit report alert, you typically need to contact one of the major credit reporting agencies (Equifax, Experian, TransUnion) and provide personal information such as your name, address, Social Security number, and details about the suspected fraud.

What is the purpose of consumer credit report alert?

The purpose of a consumer credit report alert is to protect consumers by notifying lenders to take extra steps in verifying identity before extending credit, thereby reducing the risk of identity theft.

What information must be reported on consumer credit report alert?

The information reported on a consumer credit report alert typically includes the consumer's name, address, Social Security number, and a statement indicating that the consumer is a victim of identity theft, along with any relevant details regarding the alert.

Fill out your consumer credit report alert online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit Report Alert is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.