Get the free LATE CONT

Show details

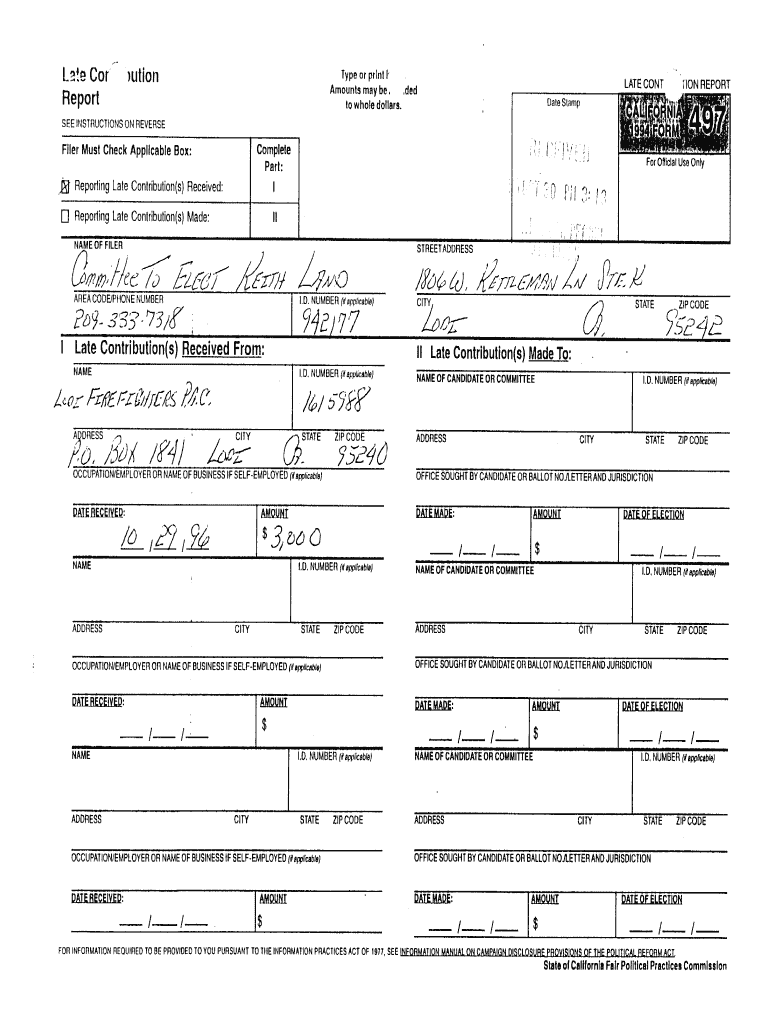

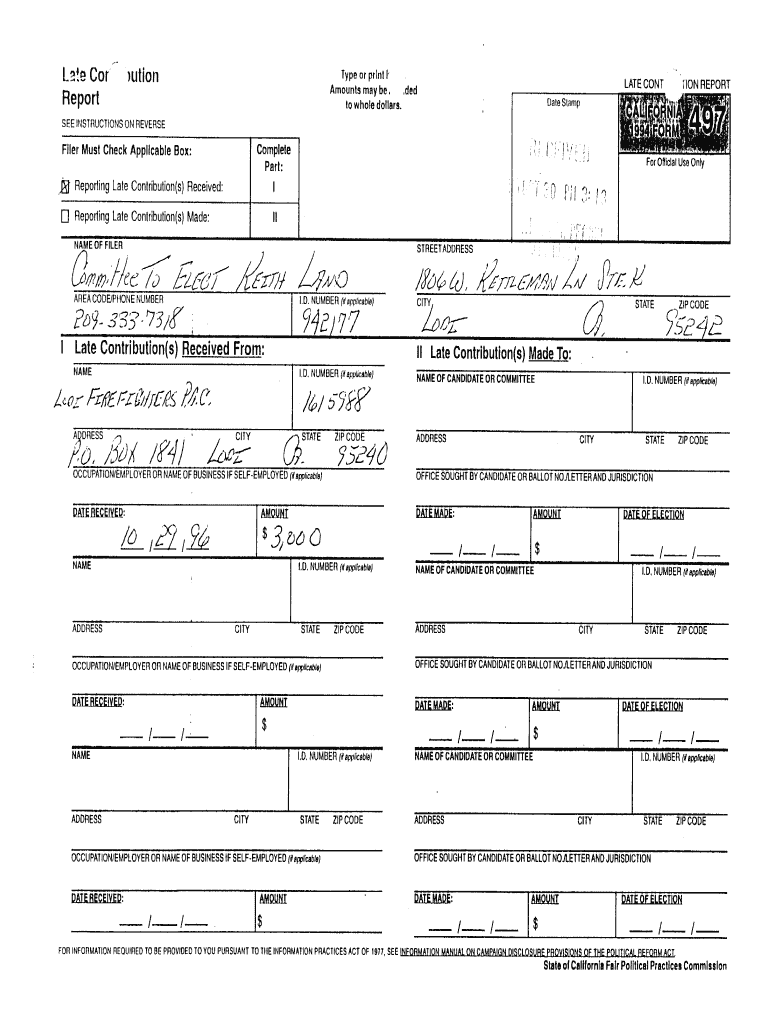

LATE CONT Complete Part: Filer Must Check Applicable Box: Reporting Late Contribution(s) Received: 0 ;ION REPORT I'm Reporting Late Contribution(s) Made: II NAME OF CANDIDATE OR Committee I CITY STATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign late cont

Edit your late cont form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your late cont form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing late cont online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit late cont. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out late cont

How to fill out late cont:

01

Make sure to gather all necessary information and documents related to the late contribution. This may include receipts, records of payments, and any other relevant financial information.

02

Begin by accurately completing the late contribution form. Provide the required personal information, such as your name, contact details, and social security number or tax identification number.

03

Indicate the specific tax year for which the late contribution is being made. This is important as it will impact the tax implications and ensure accurate record-keeping.

04

State the type of account to which the late contribution is being made. This can include traditional IRAs, Roth IRAs, or other retirement savings accounts. Ensure that you select the appropriate account to avoid issues during the filing process.

05

Specify the amount of the late contribution. It is essential to accurately state the exact dollar amount you wish to contribute to the account, as this will determine the impact on your taxes and retirement savings.

06

Provide any additional information or explanations required by the late contribution form. This may include details regarding the reason for the late contribution or any special circumstances that need to be taken into account.

Who needs late cont:

01

Individuals who have missed the deadline for making regular contributions to their retirement savings accounts, such as IRAs or 401(k)s, may need to consider making a late contribution.

02

It is also relevant for individuals who have experienced a change in their financial situation and want to catch up on their retirement savings by making additional contributions.

03

Self-employed individuals or small business owners who have missed the deadline for contributing to their retirement plans, such as SEP-IRAs or SIMPLE IRAs, may need to fill out a late contribution form.

04

Individuals who have discovered errors or discrepancies in their previous contributions and need to correct them may also benefit from filling out a late contribution form.

In summary, filling out a late contribution form involves gathering the necessary information, accurately completing the form, specifying the type and amount of the late contribution, and providing any additional required details. Late contributions are relevant for individuals who missed regular contribution deadlines, want to catch up on savings, need to correct errors, or have experienced changes in their financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get late cont?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific late cont and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit late cont online?

The editing procedure is simple with pdfFiller. Open your late cont in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit late cont on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing late cont right away.

What is late cont?

Late cont is the late filing of contributions or payments.

Who is required to file late cont?

Individuals or entities who have missed the deadline for contributions or payments are required to file late cont.

How to fill out late cont?

Late cont can be filled out by providing the necessary information related to the missed contributions or payments.

What is the purpose of late cont?

The purpose of late cont is to rectify missed contributions or payments and ensure compliance with regulations.

What information must be reported on late cont?

Late cont must include details of the missed contributions or payments, the reason for the delay, and any additional relevant information.

Fill out your late cont online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Late Cont is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.