Get the free Bank credit card account

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank credit card account

Edit your bank credit card account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank credit card account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bank credit card account online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank credit card account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

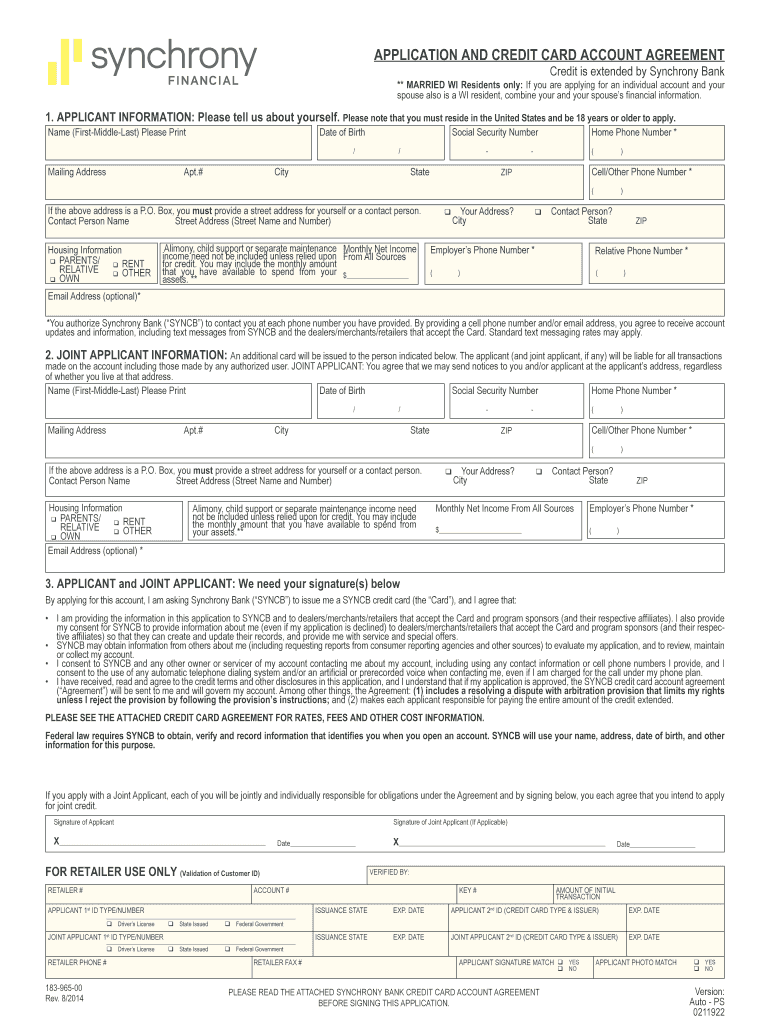

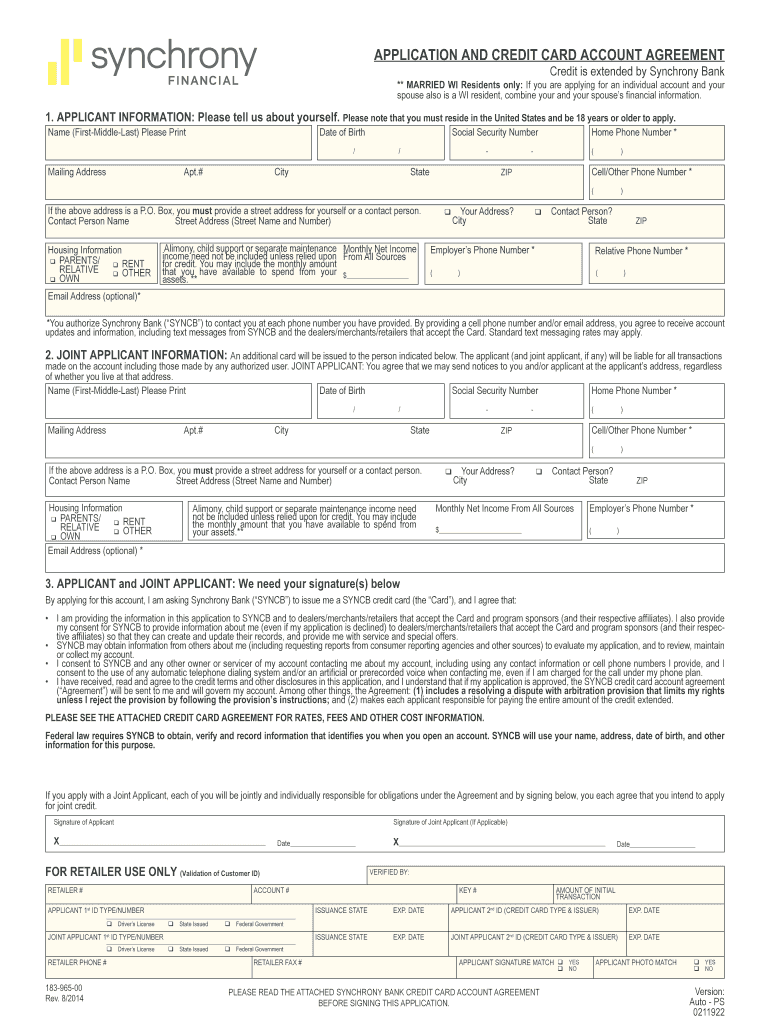

How to fill out bank credit card account

How to fill out a bank credit card account:

01

Start by gathering all the necessary documents and information. This may include your identification, proof of residence, and income details.

02

Research different banks and their credit card offers to find the best one that suits your needs and preferences. Take note of the interest rates, fees, and rewards programs.

03

Visit the bank's website or go to a local branch to begin the application process. Look for the option to apply for a credit card account.

04

Fill out the application form accurately and completely. Provide your personal information, such as your full name, contact details, and Social Security number.

05

Enter your income and employment details. Be honest and provide accurate information to increase your chances of approval.

06

Select the type of credit card you want. Banks usually offer different options based on your credit history, such as secured cards for those with no or bad credit, or rewards cards for those with good credit.

07

Read and understand the terms and conditions associated with the credit card. Take note of the annual fees, interest rates, grace periods, and payment terms.

08

Review your application before submitting it. Make sure all the information is correct and that you haven't missed any crucial details.

09

Submit the application either online or in-person at the bank. If applying online, ensure that all required documents are scanned and attached.

10

Wait for the bank's response. They will evaluate your application, perform a credit check, and verify your information.

Who needs a bank credit card account:

01

Individuals who want to establish or improve their credit history. Using a credit card responsibly and making timely payments can positively impact your credit score.

02

People who want to have a convenient payment method for online and in-store purchases. Credit cards are widely accepted and provide a secure way to shop.

03

Travelers who want to access benefits and perks associated with travel credit cards, such as airport lounge access, travel insurance, and rewards for flights and hotels.

04

Those who want to take advantage of rewards and cashback programs. Many credit cards offer incentives for spending, such as cashback, points, or miles that can be redeemed for various rewards.

05

Business owners who want to separate personal and business expenses. Having a dedicated credit card for business transactions helps with bookkeeping and provides a clear overview of expenses.

Remember, it's crucial to use a credit card responsibly and make timely payments to avoid high interest rates and debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bank credit card account to be eSigned by others?

Once your bank credit card account is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit bank credit card account straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit bank credit card account.

How do I edit bank credit card account on an iOS device?

Create, edit, and share bank credit card account from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is bank credit card account?

Bank credit card account refers to a financial account that is linked to a credit card issued by a bank. It is used for making purchases, receiving payments, and managing credit card transactions.

Who is required to file bank credit card account?

Individuals who hold a credit card issued by a bank are required to file bank credit card account.

How to fill out bank credit card account?

To fill out a bank credit card account, individuals need to provide information about the credit card transactions, payments, and balance. This information can usually be accessed through online banking or monthly statements.

What is the purpose of bank credit card account?

The purpose of bank credit card account is to track and manage credit card transactions, monitor spending, and ensure timely payments to avoid penalties and interest charges.

What information must be reported on bank credit card account?

The information that must be reported on bank credit card account includes details of transactions, payments, balance, interest charges, and fees.

Fill out your bank credit card account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Credit Card Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.