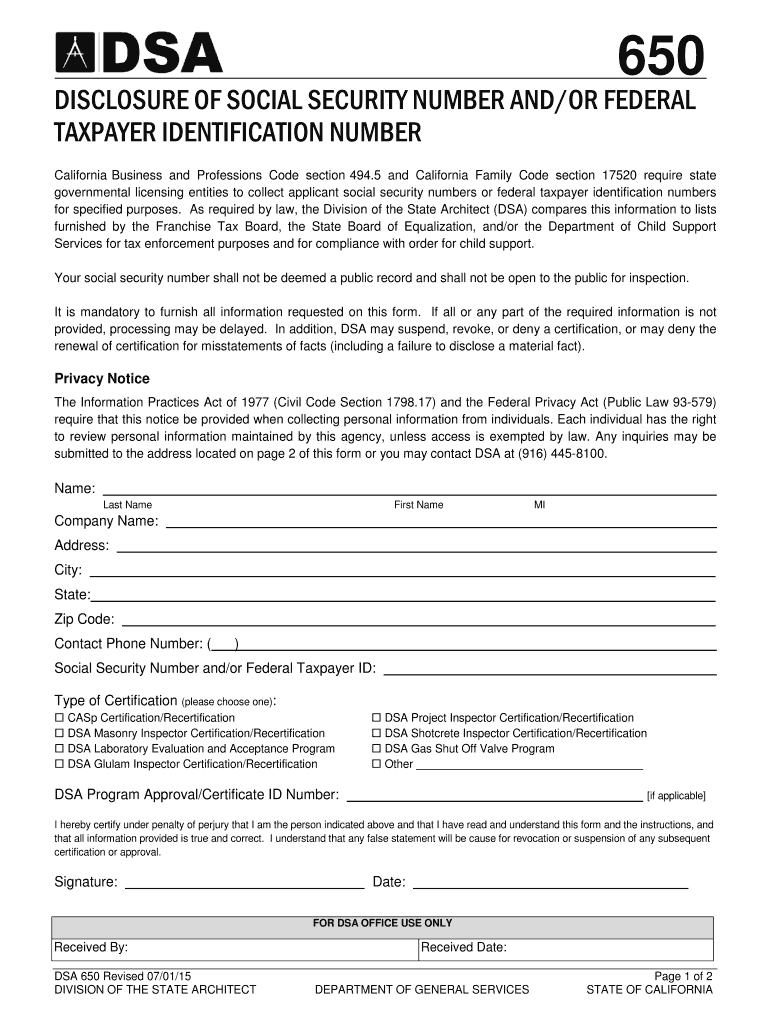

CA DSA 650 2014 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign disclosure of social security

Edit your disclosure of social security form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure of social security form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing disclosure of social security online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit disclosure of social security. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DSA 650 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out disclosure of social security

How to fill out disclosure of social security:

01

Obtain the disclosure form from the appropriate government agency or online source.

02

Read the instructions carefully to understand the information required and the purpose of the disclosure.

03

Provide your personal details, such as your full name, date of birth, and social security number.

04

Include any relevant employment information, such as your current employer and past employers.

05

Disclose any income received from sources such as retirement accounts, investments, or rental properties.

06

Declare any public assistance or government benefits received, such as social security or disability payments.

07

Provide information about your marital status, including any spouse or dependent children.

08

Review the form for accuracy and completeness before signing and dating it.

09

Submit the completed disclosure form to the appropriate government agency or follow any additional instructions provided.

Who needs disclosure of social security:

01

Individuals who are required by law to disclose their social security information for various purposes.

02

Applicants for government benefits, such as social security benefits or disability benefits, often need to submit a disclosure form.

03

Employees may need to disclose their social security information to their employers for payroll and tax purposes.

04

Individuals applying for certain financial services, such as loans or credit cards, may be asked to provide a social security disclosure.

05

Students applying for financial aid or scholarships may need to disclose their social security information.

06

Some governmental or legal processes may require individuals to disclose their social security information, such as during a legal investigation or immigration application.

07

Other situations or organizations may require a disclosure of social security information based on their specific requirements or regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is IRS Form 8821 used for?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

Who needs to fill out a w8ben form?

Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

What is the difference between IRS form 8821 and 2848?

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

What is form 2848 used for?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Do I need both 2848 and 8821?

The key difference between the two is that Form 8821 will only allow someone to view your tax information, while Form 2848 will allow them to act on your behalf with this information. If you are experiencing any financial issues with the IRS, it's important to know the distinction between the two.

What is form 8821 used for?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify disclosure of social security without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including disclosure of social security. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit disclosure of social security in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing disclosure of social security and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my disclosure of social security in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your disclosure of social security and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is disclosure of social security?

The disclosure of social security refers to the requirement for individuals and entities to report specific information regarding social security numbers and benefits to ensure transparency and prevent fraud.

Who is required to file disclosure of social security?

Individuals who receive social security benefits, employers who report wages to the Social Security Administration, and organizations handling personal data are typically required to file disclosures related to social security.

How to fill out disclosure of social security?

To fill out a disclosure of social security, gather necessary personal information, such as social security number, relevant earnings details, and complete the required forms accurately, ensuring all mandatory fields are filled.

What is the purpose of disclosure of social security?

The purpose of disclosure of social security is to ensure accurate reporting of benefits and earnings, mitigate identity theft, and maintain the integrity of the social security system.

What information must be reported on disclosure of social security?

Information that must be reported includes the individual's social security number, details of income or wages, the type of benefits received, and any changes in status or eligibility.

Fill out your disclosure of social security online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure Of Social Security is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.