Get the free Levy of interest under Section 234B(1) and Section 234B(3) of the Income-tax Act is ...

Show details

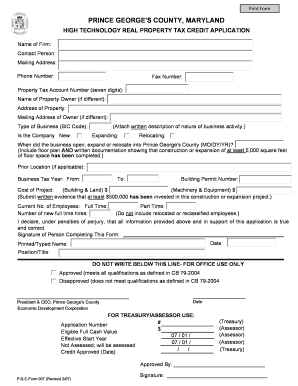

27 July 2016 Levy of interest under Section 234B(1) and Section 234B(3) of the Income tax Act is complimentary and not exclusive Background Recently, the Hyderabad Bench of the Income tax Appellate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign levy of interest under

Edit your levy of interest under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your levy of interest under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing levy of interest under online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit levy of interest under. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out levy of interest under

How to fill out levy of interest under:

01

Obtain the necessary forms: Start by obtaining the levy of interest under forms from the relevant government department or agency. These can usually be found online or by visiting the department in person.

02

Fill in personal information: Begin by providing your personal information, such as your name, address, and contact details. Make sure to fill in all the required fields accurately and clearly.

03

Specify the type of levy: Indicate the specific type of levy of interest under that you are applying for. This could include levies related to property, assets, income, or any other relevant category. Be sure to select the appropriate checkbox or fill in the corresponding information.

04

Provide supporting documentation: Attach any supporting documents as required by the levy of interest under application. These may include copies of relevant contracts, financial statements, or other evidence to support your claim or request.

05

Calculate and declare the interest amount: If applicable, calculate and declare the amount of interest that you are requesting to be levied. You may need to provide supporting documentation or explanations for how this interest amount was determined.

06

Sign and date the form: Once you have completed all the necessary sections of the levy of interest under form, sign and date it in the designated spaces. By doing so, you acknowledge that the information provided is true and accurate to the best of your knowledge.

Who needs levy of interest under?

01

Individuals owed unpaid debts: Individuals who are owed unpaid debts can benefit from filing a levy of interest under. This allows them to seek additional interest on the outstanding amount, ensuring that they receive fair compensation for their losses.

02

Businesses or organizations owed outstanding payments: Businesses or organizations that are owed outstanding payments for goods or services can also utilize the levy of interest under. This legal tool helps them recover not just the principal amount but also the additional interest owed to them.

03

Creditors seeking financial restitution: Creditors who have successfully obtained a judgment or court order against debtors may use the levy of interest under as a means of collecting the debt with the added interest. It provides them with a legal mechanism to enforce payment and hold the debtor accountable.

In conclusion, filling out a levy of interest under requires obtaining the necessary forms, providing personal information, specifying the type of levy, attaching supporting documentation, calculating and declaring the interest amount, and signing the form. This tool is beneficial for individuals, businesses, organizations, and creditors who are seeking to recover unpaid debts and receive fair compensation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my levy of interest under directly from Gmail?

levy of interest under and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute levy of interest under online?

pdfFiller has made it simple to fill out and eSign levy of interest under. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the levy of interest under in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your levy of interest under directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is levy of interest under?

The levy of interest under is a tax imposed on overdue payments.

Who is required to file levy of interest under?

Any individual or business entity that has outstanding payments that are past due may be required to file a levy of interest under.

How to fill out levy of interest under?

To fill out a levy of interest under, the individual or business entity must provide details of the overdue payment amount, the interest rate, and the reason for the past due payment.

What is the purpose of levy of interest under?

The purpose of levy of interest under is to incentivize timely payments and compensate the creditor for the delayed payment.

What information must be reported on levy of interest under?

The levy of interest under typically requires information such as the amount of the overdue payment, the interest rate applied, and any relevant payment history.

Fill out your levy of interest under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Levy Of Interest Under is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.