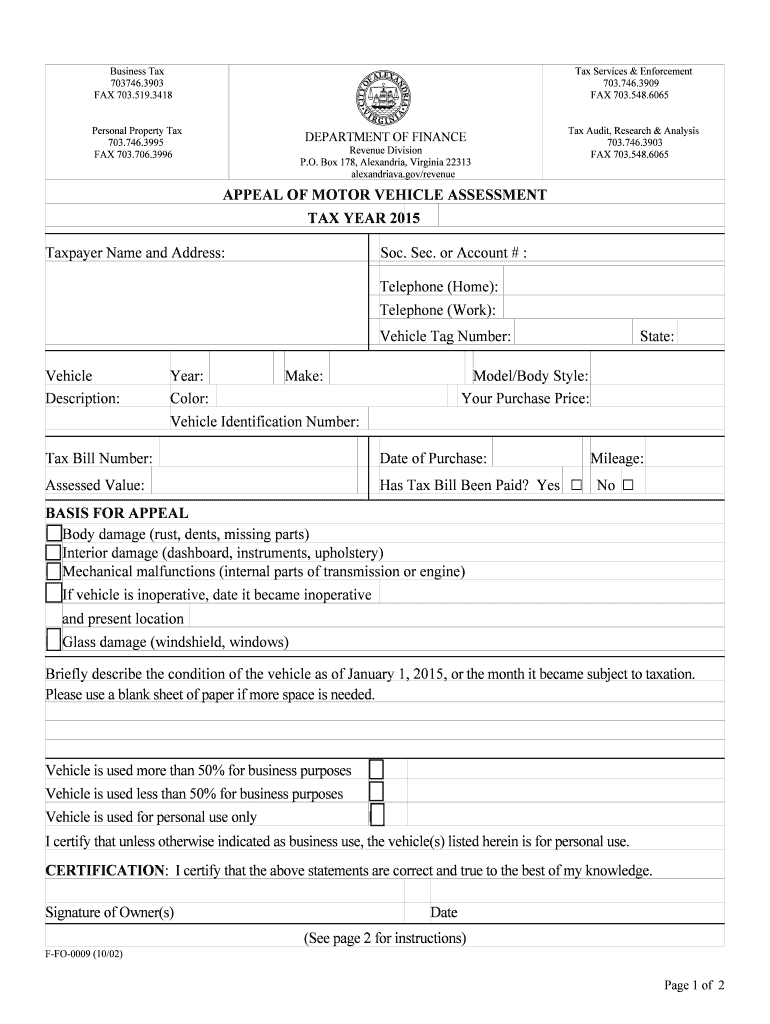

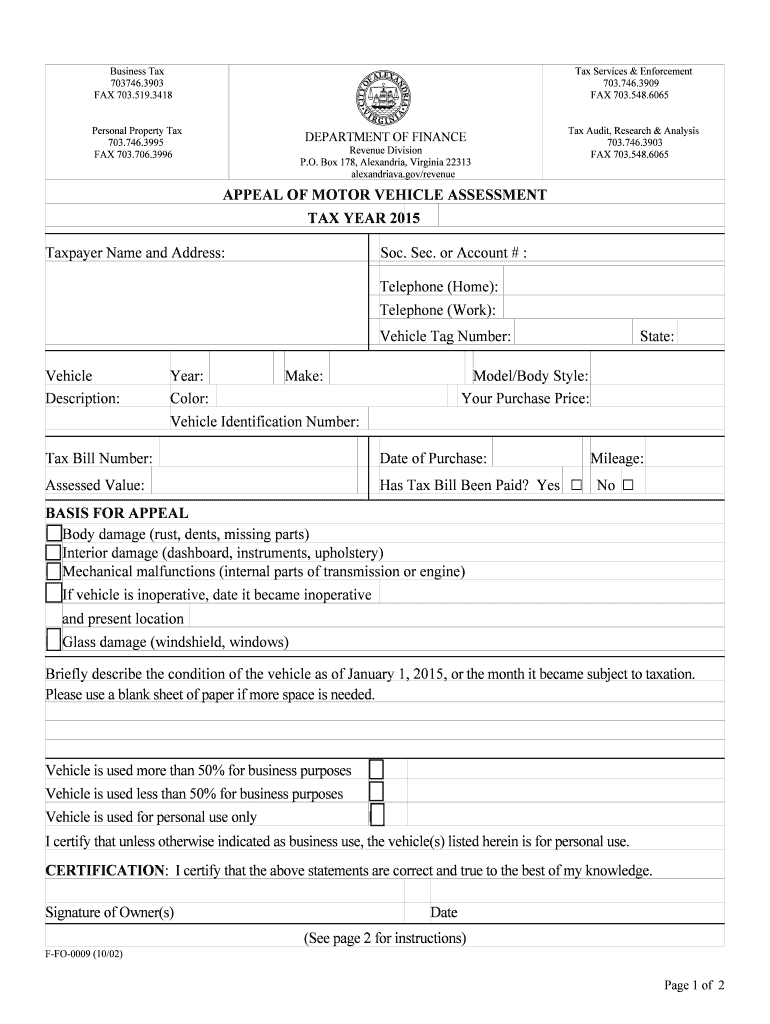

Get the free Tax Services & Enforcement - alexandriava

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax services amp enforcement

Edit your tax services amp enforcement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax services amp enforcement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax services amp enforcement online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax services amp enforcement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax services amp enforcement

How to fill out tax services amp enforcement:

01

Gather all necessary documents and information related to your income, expenses, and deductions. This includes W-2 forms, 1099 forms, receipts, and records of any other financial transactions.

02

Determine which tax forms you need to fill out based on your individual or business circumstances. This may include Form 1040, Schedule C, or other relevant forms and schedules.

03

Accurately report all income, deductions, and credits on the appropriate forms. Make sure to follow the instructions provided by the IRS or your tax software.

04

Calculate your tax liability based on the information provided. This may involve determining your taxable income, applying the correct tax rates, and taking into account any applicable deductions or credits.

05

Double-check all calculations and ensure that all figures are accurate before submitting your tax return.

06

Review your completed tax return for any errors or omissions. Correct any mistakes and make sure all required sections are complete.

07

Sign and date your tax return. If you are filing electronically, follow the instructions for submitting your digital signature.

08

Keep a copy of your completed tax return and all supporting documents for your records. This will be important if you need to provide additional information or in the event of an audit.

Who needs tax services amp enforcement?

01

Individuals: People who earn income, whether from employment, investments, or self-employment, may need tax services to help them accurately prepare and file their tax returns. Tax services can also benefit individuals who have complex financial situations or who are seeking to maximize their deductions or credits.

02

Small Businesses: Business owners need tax services to ensure compliance with tax laws and regulations. Professionals can help them accurately calculate and report their income, expenses, and deductions. They can also assist with payroll taxes, sales taxes, and other business-related tax obligations.

03

Nonprofit Organizations: Tax-exempt organizations have specific reporting requirements and must comply with tax laws to maintain their tax-exempt status. Tax services can help these organizations navigate the complex rules and regulations related to their financial activities and annual filings.

04

Corporations: Large companies often have complex financial structures and multiple tax obligations. Tax services can help these organizations with tax planning, compliance, and strategic decisions to minimize their tax liability and optimize their financial position.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax services amp enforcement for eSignature?

When your tax services amp enforcement is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit tax services amp enforcement in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tax services amp enforcement and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit tax services amp enforcement on an Android device?

You can make any changes to PDF files, like tax services amp enforcement, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is tax services amp enforcement?

Tax services amp enforcement refer to the activities conducted by government authorities to ensure compliance with tax laws and regulations. This includes collecting taxes, auditing tax returns, and taking enforcement actions against non-compliant taxpayers.

Who is required to file tax services amp enforcement?

All individuals and businesses that have taxable income or are subject to specific tax laws are required to file tax services amp enforcement. This includes filing tax returns, paying taxes owed, and providing any necessary documentation to the tax authorities.

How to fill out tax services amp enforcement?

To fill out tax services amp enforcement, individuals and businesses must gather all relevant financial information, complete the required forms accurately, and submit them to the tax authorities by the deadline. It is important to keep detailed records and seek professional assistance if needed.

What is the purpose of tax services amp enforcement?

The purpose of tax services amp enforcement is to ensure that individuals and businesses pay their fair share of taxes, promote compliance with tax laws, and maintain the integrity of the tax system. It also helps fund government programs and services.

What information must be reported on tax services amp enforcement?

Tax services amp enforcement forms typically require details such as income earned, deductions claimed, taxes withheld, credits applied, and any other relevant financial information. It is important to report accurate and complete information to avoid penalties.

Fill out your tax services amp enforcement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Services Amp Enforcement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.