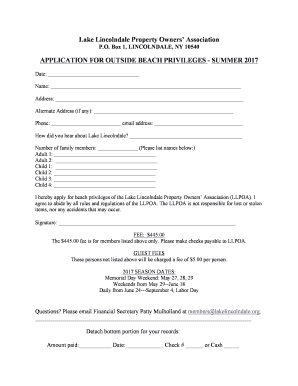

Get the free ANNUAL PROFESSIONAL INDEMNITY INSURANCE For...

Show details

A C and E PI & Liability Underwriting Managers (Pty) Ltd

7th Floor Office Tower, Bedford Center, Smith Street, Bedfordview

P O Box 752189, Garden view, 2047, Republic of South Africa

Company Registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual professional indemnity insurance

Edit your annual professional indemnity insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual professional indemnity insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual professional indemnity insurance online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual professional indemnity insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual professional indemnity insurance

How to fill out annual professional indemnity insurance?

01

Begin by gathering all necessary information and documents. This may include your personal and business details, financial records, and any relevant licenses or certifications.

02

Research different insurance providers and policies to find the best fit for your professional needs. Consider factors such as coverage limits, exclusions, and costs.

03

Contact the insurance provider or use their online platform to start the application process. Fill out the required fields accurately and thoroughly.

04

Provide details about your profession, including the type of services you offer and any specific risks associated with your work. This helps the insurance provider assess your individual needs.

05

Determine the desired coverage limit for your professional indemnity insurance. This should align with the potential risks and liability you may face in your profession.

06

Disclose any relevant claims or incidents from previous policies or any ongoing legal proceedings. Honesty is crucial during the application process to avoid potential issues later on.

07

Evaluate and add any additional coverage options to your policy, if necessary. Some insurance providers offer extensions such as cyber liability coverage or legal defense costs.

08

Review the application thoroughly before submitting it. Double-check all the entered information to ensure accuracy and completeness.

09

Pay the premium for your annual professional indemnity insurance. The cost will depend on various factors such as the coverage limit, your profession's risk level, and the insurance provider.

10

Keep a copy of your filled-out application and the insurance policy for future reference.

Who needs annual professional indemnity insurance?

01

Professionals who provide services to clients, such as consultants, advisors, architects, engineers, or accountants, may need annual professional indemnity insurance. It helps protect them against claims of professional negligence, errors, or omissions in their work.

02

Many regulated professions often require professional indemnity insurance as part of their licensing or accreditation process. This includes lawyers, doctors, financial advisors, or real estate agents.

03

Small business owners, especially those in service-based industries, should consider annual professional indemnity insurance to safeguard against costly legal actions that may arise from dissatisfied clients.

04

Freelancers or self-employed individuals who offer professional services can benefit from this insurance coverage to protect their personal assets if a claim is made against them.

05

Any professional who handles confidential or sensitive client data should consider professional indemnity insurance coverage to mitigate risks associated with data breaches or cyber-related damages.

Please note that the specific requirements for annual professional indemnity insurance may vary depending on your jurisdiction, profession, and industry regulations. It is advisable to consult with an insurance professional or legal expert to ensure you meet all necessary obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the annual professional indemnity insurance in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your annual professional indemnity insurance and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit annual professional indemnity insurance on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign annual professional indemnity insurance on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit annual professional indemnity insurance on an Android device?

You can edit, sign, and distribute annual professional indemnity insurance on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is annual professional indemnity insurance?

Annual professional indemnity insurance is a type of insurance that protects professionals from liability claims arising from their work.

Who is required to file annual professional indemnity insurance?

Professionals who provide services or advice that could result in financial loss for their clients are typically required to file annual professional indemnity insurance.

How to fill out annual professional indemnity insurance?

To fill out annual professional indemnity insurance, professionals must provide details about their work, clients, coverage limits, and any past claims.

What is the purpose of annual professional indemnity insurance?

The purpose of annual professional indemnity insurance is to protect professionals from financial losses due to liability claims and to ensure that their clients are compensated for any damages.

What information must be reported on annual professional indemnity insurance?

On annual professional indemnity insurance, professionals must report details about their work, coverage limits, any past claims, and contact information.

Fill out your annual professional indemnity insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Professional Indemnity Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.