Get the free Primary Beneficiary #1

Show details

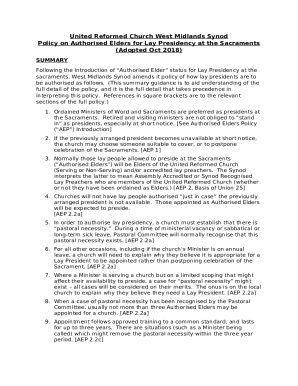

Clarity, Inc. 401(k) Profit Sharing Plan Beneficiary Designation #210487 Section 1 Participant Information Participant Name Home Address Marital Status Married Not Married Date of Birth Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign primary beneficiary 1

Edit your primary beneficiary 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your primary beneficiary 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit primary beneficiary 1 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit primary beneficiary 1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out primary beneficiary 1

01

To fill out primary beneficiary 1, you will need to gather certain information. Ensure that you have the full name, date of birth, and contact details of the primary beneficiary you wish to designate.

02

Begin by opening the relevant form or document where you need to provide the primary beneficiary information. This could be an insurance policy, retirement account, or will.

03

Locate the section or field labeled "Primary Beneficiary 1" on the form. It is usually identified as such, but if not, carefully read the instructions or refer to any guidelines provided.

04

Write or type the full name of the primary beneficiary in the designated space. Make sure to spell their name correctly and use their legal name.

05

Provide the date of birth of the primary beneficiary in the given format (e.g., dd/mm/yyyy or mm/dd/yyyy). Double-check that the information is accurate, as errors may lead to complications in the future.

06

Enter the contact details of the primary beneficiary, including their phone number and email address if required. This information will be crucial for communication purposes.

07

If applicable, indicate the percentage or share of the assets or benefits you wish to allocate to the primary beneficiary. For example, you could specify that they receive 50% of the proceeds or designate a specific monetary amount.

08

Review the entry for accuracy and completeness. Ensure that all required fields are filled out correctly and that you haven't missed any necessary information.

09

If required, sign and date the document, acknowledging that the information provided is accurate to the best of your knowledge.

Who needs primary beneficiary 1?

01

Primary beneficiary 1 is typically required in financial and legal documents where you need to designate who will receive the assets or benefits in the event of your death.

02

Various financial institutions, such as insurance companies, retirement plans, and investment accounts, may request primary beneficiary information to ensure that your desired beneficiary receives the intended benefits.

03

Additionally, individuals creating wills or trust documents may also require primary beneficiary information to outline the distribution of their assets after their passing.

Overall, anyone who wants to designate a specific person as the primary beneficiary of their financial or legal documents should include a primary beneficiary 1 designation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my primary beneficiary 1 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your primary beneficiary 1 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send primary beneficiary 1 for eSignature?

primary beneficiary 1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit primary beneficiary 1 on an Android device?

You can edit, sign, and distribute primary beneficiary 1 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is primary beneficiary 1?

Primary beneficiary 1 is the individual or entity that is first in line to receive the benefits from a particular asset or account.

Who is required to file primary beneficiary 1?

The owner of the asset or account is required to designate and file primary beneficiary 1.

How to fill out primary beneficiary 1?

Primary beneficiary 1 can be filled out by providing the full legal name, date of birth, and relationship to the owner of the asset or account.

What is the purpose of primary beneficiary 1?

The purpose of primary beneficiary 1 is to ensure that the designated individual or entity receives the benefits in the event of the owner's death.

What information must be reported on primary beneficiary 1?

The information that must be reported on primary beneficiary 1 includes the full legal name, date of birth, and relationship to the owner of the asset or account.

Fill out your primary beneficiary 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Primary Beneficiary 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.