Get the free Investment Plan/

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment plan

Edit your investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment plan online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit investment plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment plan

How to fill out an investment plan:

01

Start by determining your financial goals and objectives. What are you investing for? Is it for retirement, a down payment on a house, or funding your children's education? This will help you set a clear direction for your investment plan.

02

Assess your risk tolerance. Consider how much risk you are willing to take with your investments. Are you comfortable with higher-risk, higher-reward investments, or do you prefer a more conservative approach? Knowing your risk tolerance will guide your investment strategy.

03

Evaluate your current financial situation. Take stock of your income, expenses, assets, and liabilities. This will help you understand how much you can afford to invest and how much risk you can take.

04

Determine your time horizon. Decide how long you plan to invest for. If you have a long-term goal, such as retirement in 30 years, you can afford to take more risks. Short-term goals may require a more conservative approach.

05

Research different investment options. Familiarize yourself with various asset classes such as stocks, bonds, mutual funds, real estate, and commodities. Learn about their historical performance, risks, and potential returns. Consider diversifying your portfolio by investing in a mix of assets.

06

Define your investment strategy. Based on your financial goals, risk tolerance, time horizon, and research, develop a clear plan for allocating your investments. Determine how much you will invest in each asset class and how frequently you will review and rebalance your portfolio.

07

Set realistic expectations. Remember that investments carry some level of risk, and returns are not guaranteed. Be prepared for market fluctuations and consider seeking professional advice if needed. Make sure your expectations align with your risk tolerance and financial goals.

Who needs an investment plan:

01

Individuals who want to achieve specific financial goals, such as saving for retirement, buying a home, or funding their children's education, can greatly benefit from having an investment plan. It provides a structured approach to grow and protect their wealth.

02

People with varying risk tolerances can benefit from an investment plan. Whether you are comfortable with higher-risk investments or prefer a more conservative approach, having a plan helps you align your investments with your risk tolerance.

03

Anyone who wants to optimize their investment returns and minimize risks should have an investment plan. A well-thought-out plan helps identify suitable investment options, diversify portfolios, and make informed decisions based on personal financial circumstances.

04

Individuals who are unsure about investment strategies but want to make their money work for them can benefit from having a plan. An investment plan provides a roadmap for making investment decisions and guides individuals through the process.

Overall, an investment plan is beneficial for anyone who wants to take control of their financial future and make informed investment decisions based on their specific needs, goals, and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the investment plan in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your investment plan in seconds.

How do I fill out the investment plan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign investment plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit investment plan on an iOS device?

Use the pdfFiller mobile app to create, edit, and share investment plan from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

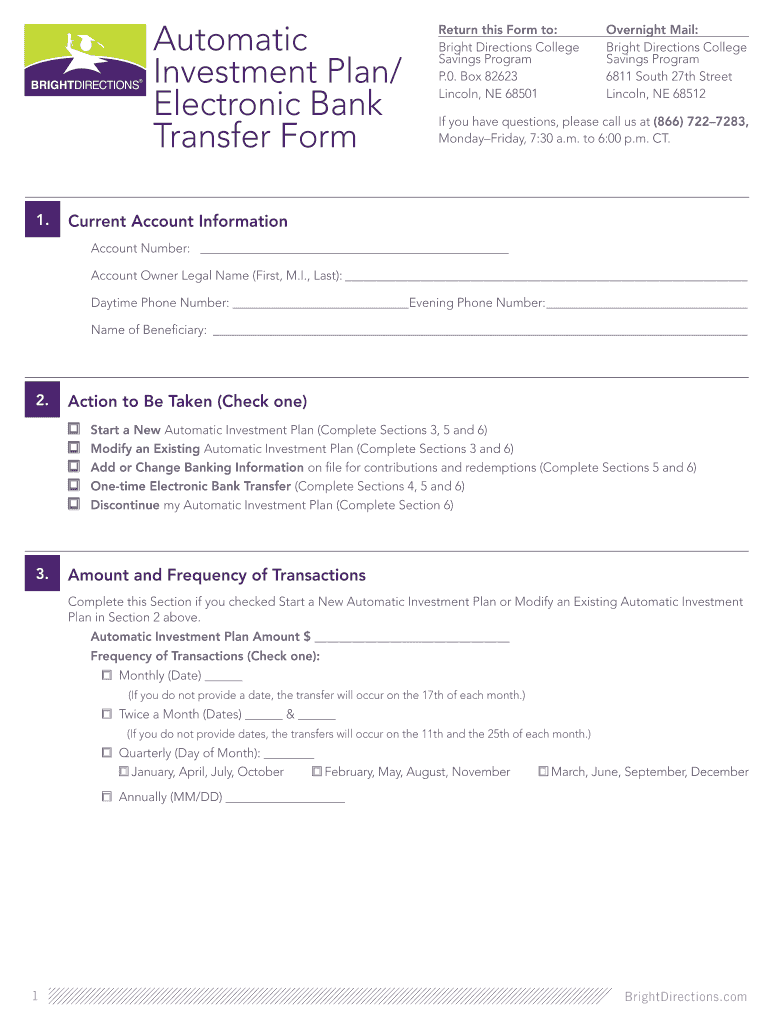

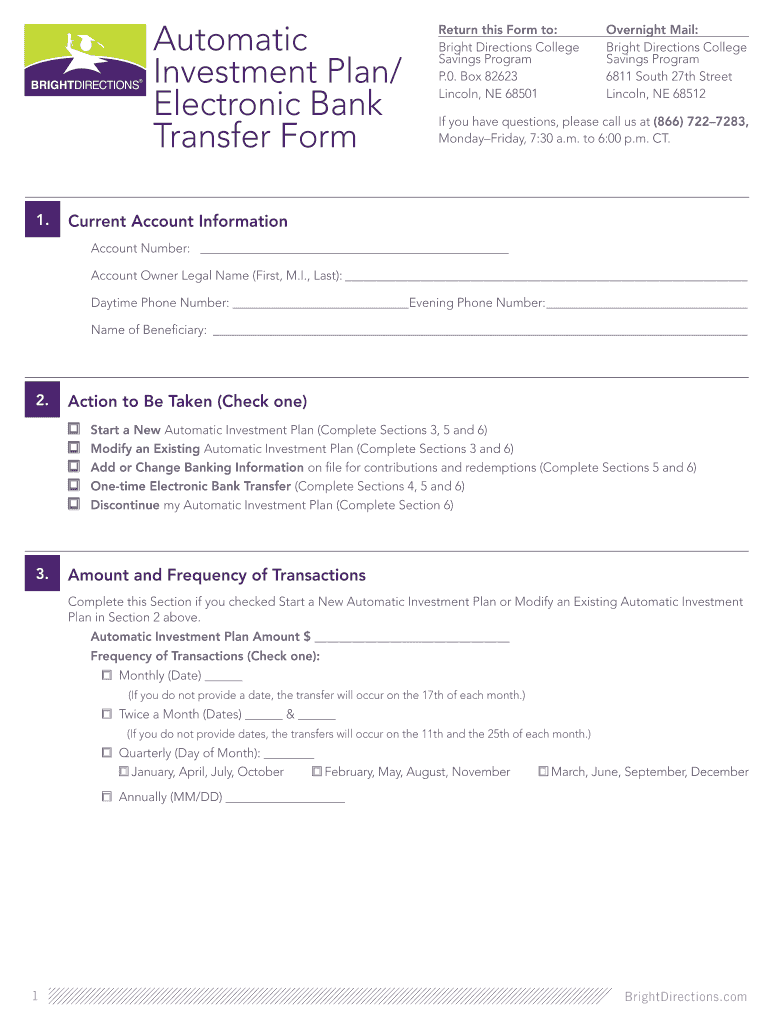

What is investment plan?

An investment plan is a detailed strategy for managing an individual's or organization's finances by determining investment goals, risk tolerance, and desired investment vehicles.

Who is required to file investment plan?

Individuals or organizations who have investments or assets that require strategic management are required to file an investment plan.

How to fill out investment plan?

To fill out an investment plan, one must first assess their financial goals, risk tolerance, and investment preferences. Then, they can outline a detailed plan for how they will allocate their assets to achieve those goals.

What is the purpose of investment plan?

The purpose of an investment plan is to provide a roadmap for achieving financial goals, managing risk, and maximizing returns on investments.

What information must be reported on investment plan?

An investment plan should include details on financial goals, risk tolerance, current investments, desired investment vehicles, and a timeline for achieving goals.

Fill out your investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.