Get the free Penalty Invoice

Show details

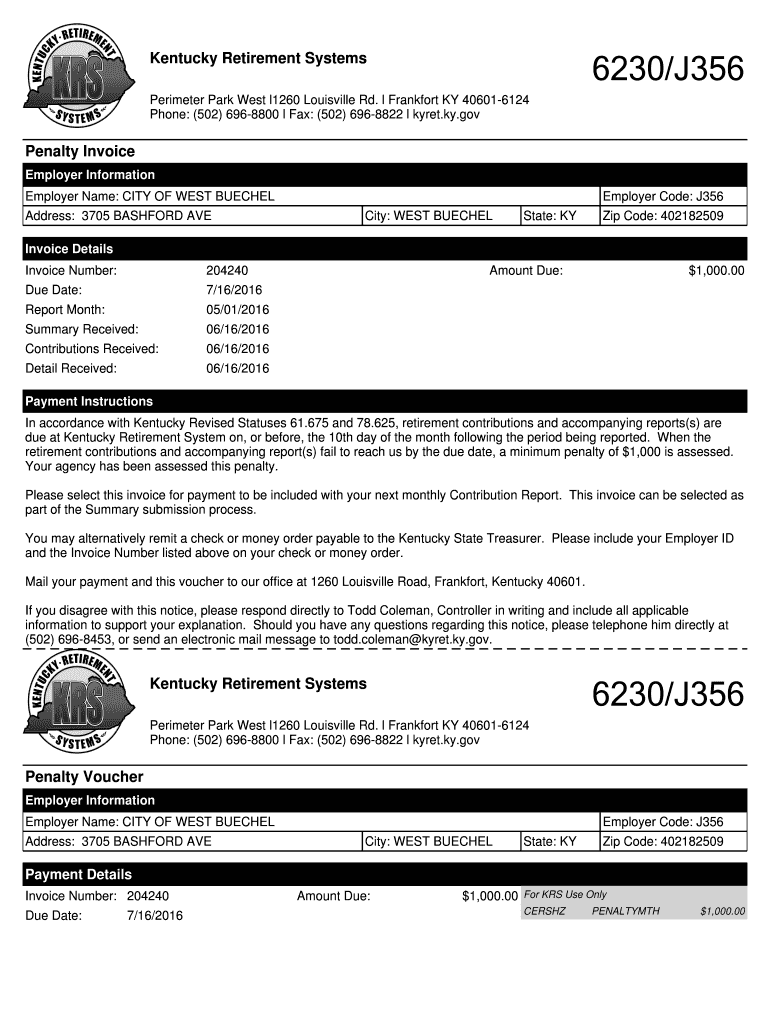

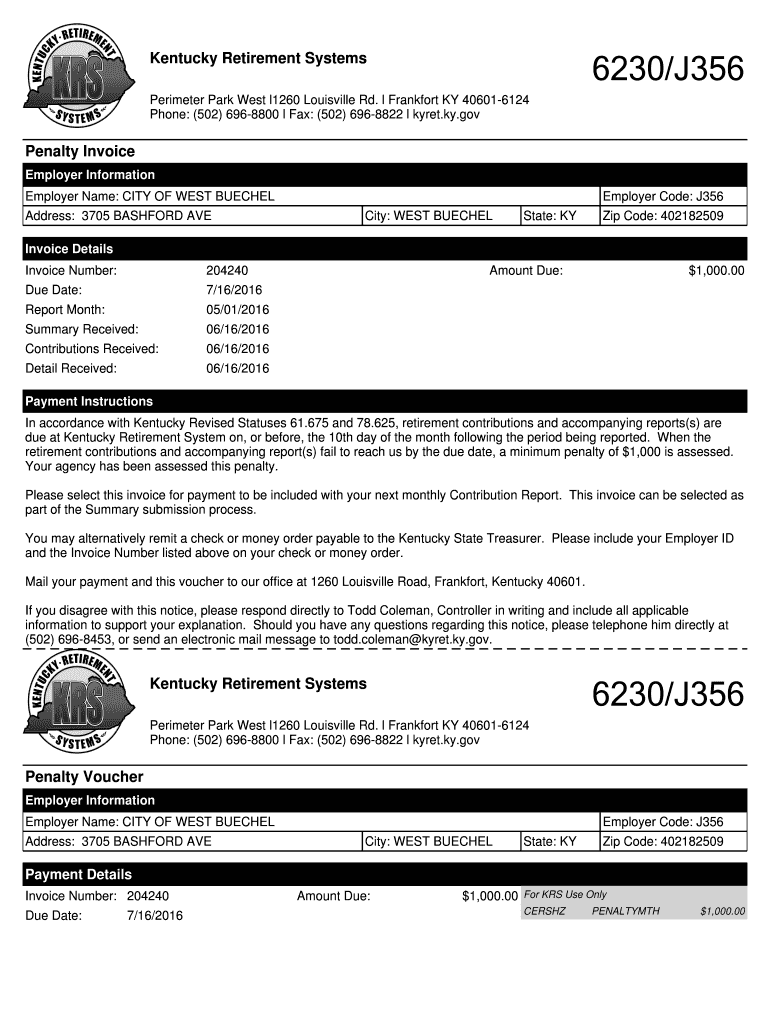

Kentucky Retirement Systems 6230/J356 Perimeter Park West l1260 Louisville Rd. l Frankfort KY 406016124 Phone: (502) 6968800 l Fax: (502) 6968822 l yet.KY.gov Penalty Invoice Employer Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign penalty invoice

Edit your penalty invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penalty invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing penalty invoice online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit penalty invoice. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out penalty invoice

How to fill out a penalty invoice:

01

Begin by gathering all the necessary information for the invoice, including the details of the person or company receiving the penalty, the date and location of the incident, and any relevant reference numbers or citations.

02

Clearly state the reason for the penalty and provide a detailed explanation of the violation or offense that led to it. Ensure that the description is concise and informative.

03

Include the amount of the penalty, making sure to specify the currency and whether any taxes or additional charges apply.

04

Provide clear instructions on how and when to make the payment. Include details about acceptable payment methods, such as bank transfer or online payment platforms, and specify any deadlines or late payment penalties.

05

Include your contact information, such as your name, title, phone number, and email address, to facilitate communication in case the recipient has any questions or concerns regarding the penalty invoice.

06

Attach any supporting documents or evidence that substantiate the violation or offense. This could include photographs, reports, or other relevant documentation that strengthens the case for the penalty.

07

Double-check all the information on the invoice for accuracy and completeness before sending it. Ensure that all the details are correct and that there are no spelling or grammatical errors.

08

Send the penalty invoice to the appropriate recipient via email, mail, or any other agreed-upon method. Make sure to keep a copy for your records.

Who needs a penalty invoice:

01

Individuals or companies who have committed a violation or offense that has resulted in a penalty or fine.

02

Organizations or agencies responsible for enforcing regulations, laws, or rules may issue penalty invoices to offenders as a means of imposing consequences or corrective measures.

03

Penalty invoices are typically required in situations where there is a need to document and communicate the details of the offense and the corresponding penalty to the responsible party.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit penalty invoice in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing penalty invoice and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out penalty invoice using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign penalty invoice and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit penalty invoice on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign penalty invoice. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is penalty invoice?

A penalty invoice is a document issued to notify a party of the penalty they owe for a violation or breach of contract.

Who is required to file penalty invoice?

The party responsible for the violation or breach is required to file the penalty invoice.

How to fill out penalty invoice?

To fill out a penalty invoice, include details of the violation or breach, the amount of the penalty, and any other relevant information.

What is the purpose of penalty invoice?

The purpose of a penalty invoice is to notify the party responsible for a violation or breach of the penalty they owe.

What information must be reported on penalty invoice?

The penalty invoice must include details of the violation or breach, the amount of the penalty, and any other relevant information.

Fill out your penalty invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Penalty Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.