Get the free Cash Management System Security Access Form

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash management system security

Edit your cash management system security form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash management system security form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash management system security online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash management system security. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

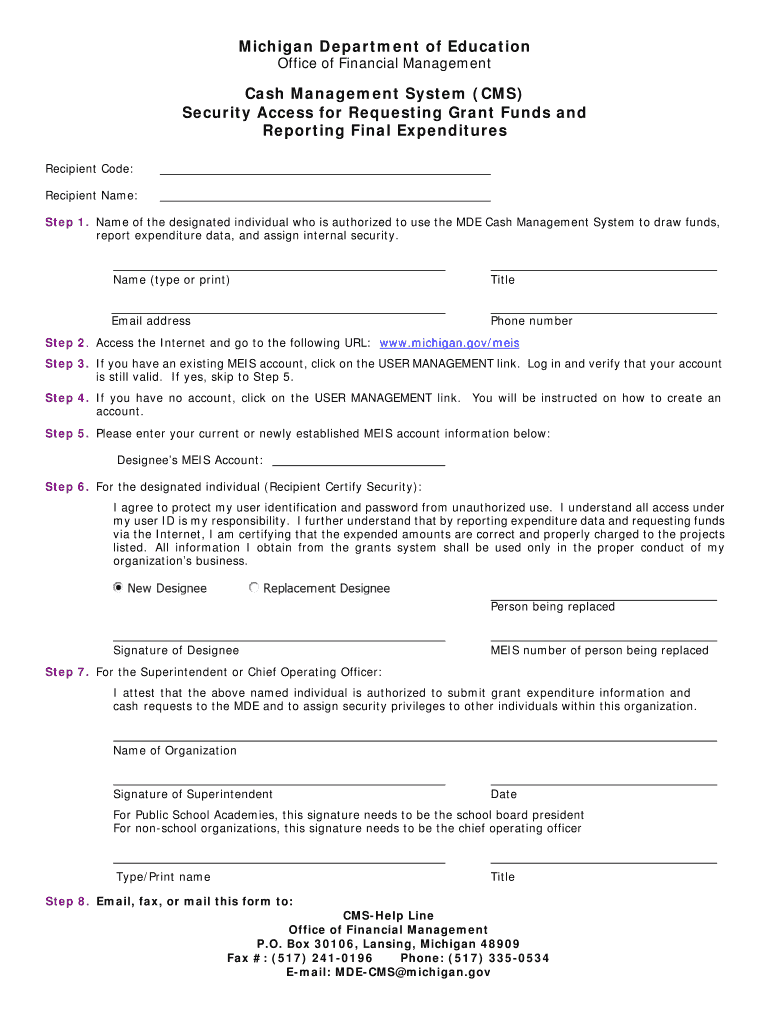

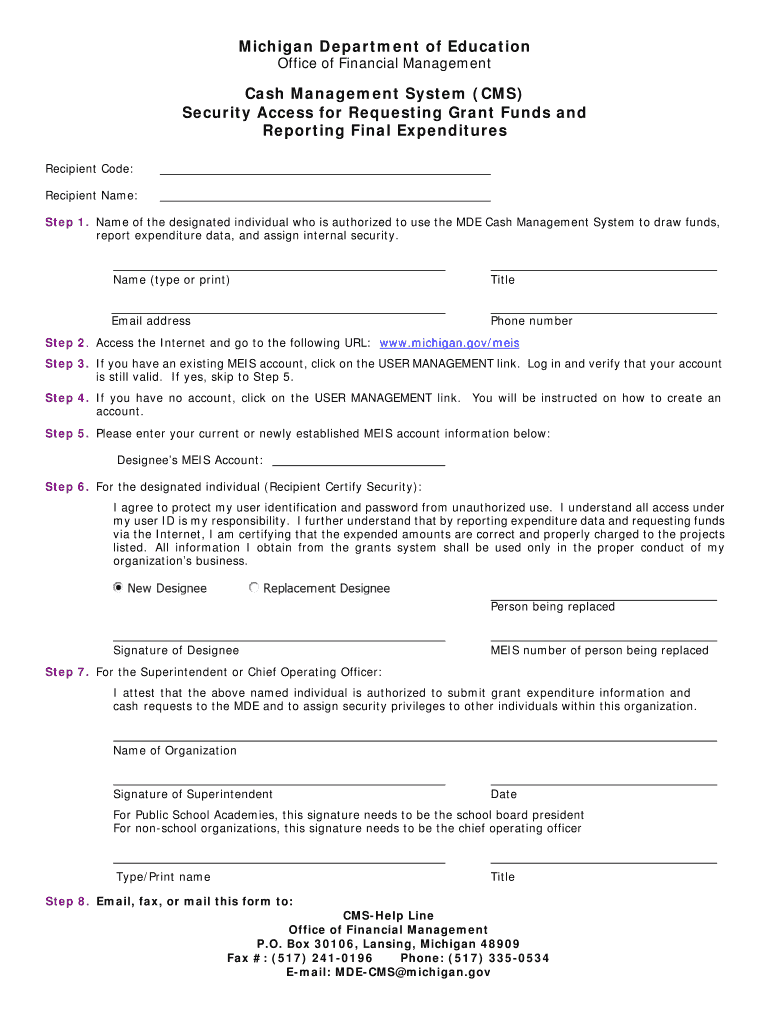

How to fill out cash management system security

How to fill out cash management system security:

01

Assess the current security measures in place. Evaluate the effectiveness of the existing security protocols and identify any vulnerabilities or gaps.

02

Conduct a risk assessment. Analyze the potential risks and threats that the cash management system may face, such as unauthorized access, data breaches, or fraud. Prioritize these risks based on their impact and likelihood.

03

Develop a comprehensive security policy. Create a clear and concise document that outlines the guidelines and procedures for maintaining the security of the cash management system. It should include guidelines for password management, user access controls, encryption methods, and incident response.

04

Implement physical security measures. Ensure that the physical environment where the cash management system is located is secure. This may involve using locks, security cameras, access control systems, and alarms.

05

Establish user access controls. Determine who should have access to the cash management system and what level of access they should have. Implement strong authentication methods, such as multi-factor authentication, to ensure that only authorized individuals can access the system.

06

Regularly update and patch the system. Keep the cash management system up to date with the latest security patches and software updates to protect against known vulnerabilities.

07

Train employees on security awareness. Educate all users of the cash management system about the importance of security and their role in maintaining it. Provide training on topics such as password hygiene, social engineering, and recognizing phishing attempts.

08

Monitor and review system activity. Implement monitoring tools to detect any suspicious behaviors or unauthorized access attempts. Regularly review the system logs to identify any potential security incidents and take appropriate action.

09

Continuously improve security measures. Stay informed about the latest security threats and best practices in cash management system security. Regularly review and update security policies and procedures to adapt to new risks and technologies.

Who needs cash management system security?

01

Businesses and organizations that handle cash transactions, such as retail stores, restaurants, banks, and financial institutions, need cash management system security to protect against theft, fraud, and unauthorized access.

02

Large corporations with multiple branches or locations often require cash management system security to ensure consistency and centralized control over cash handling.

03

Government agencies and departments that handle cash, such as taxation offices or treasury departments, need cash management system security to maintain the integrity of financial transactions and prevent misuse of public funds.

04

Non-profit organizations that handle cash donations or funds also need cash management system security to protect donor information and maintain transparency in financial operations.

05

Any individual or organization that handles large sums of cash, such as event organizers or cash-handling services, should prioritize cash management system security to prevent losses and ensure accurate tracking of funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the cash management system security in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cash management system security right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the cash management system security form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign cash management system security and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out cash management system security on an Android device?

On Android, use the pdfFiller mobile app to finish your cash management system security. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is cash management system security?

Cash management system security refers to the measures put in place to protect the financial assets and transactions of an organization.

Who is required to file cash management system security?

All organizations that handle cash or financial transactions are required to file cash management system security.

How to fill out cash management system security?

To fill out cash management system security, organizations must provide detailed information on their cash handling procedures, security protocols, and any incidents or breaches that have occurred.

What is the purpose of cash management system security?

The purpose of cash management system security is to safeguard financial assets, prevent fraud, and ensure the integrity of financial transactions.

What information must be reported on cash management system security?

Information to be reported on cash management system security includes cash handling procedures, security measures, incidents or breaches, and any updates or changes to the system.

Fill out your cash management system security online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Management System Security is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.