Get the free Your Investments and Other Assets

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your investments and oformr

Edit your your investments and oformr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your investments and oformr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your investments and oformr online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit your investments and oformr. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your investments and oformr

How to fill out your investments and oformr:

01

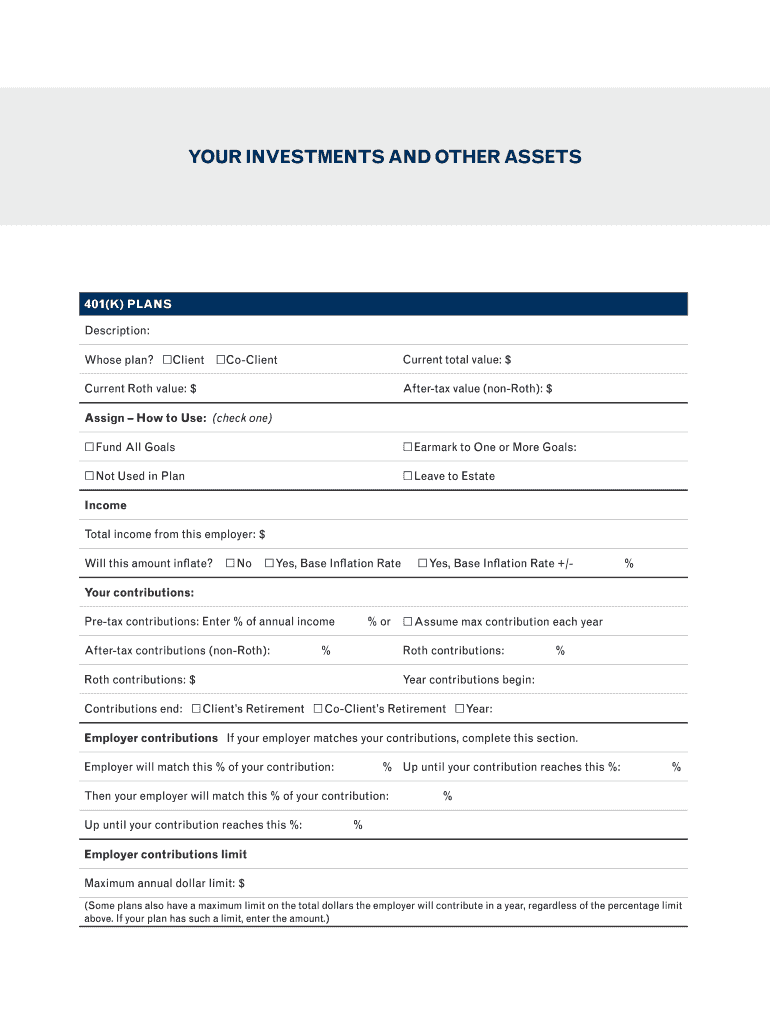

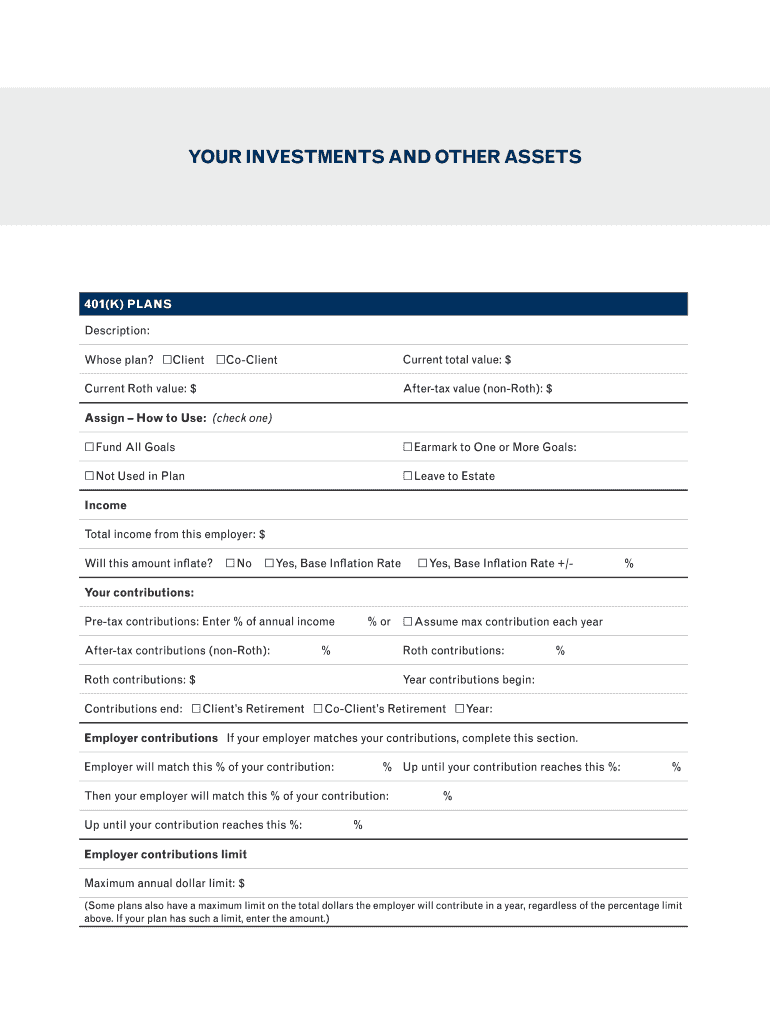

Start by gathering all the necessary information. Collect documents related to your investments, such as account statements, transaction records, and any relevant tax documents. Additionally, make sure you have the required forms, whether they are provided by your investment provider or the government.

02

Review the instructions provided with the forms and understand the required information. Familiarize yourself with the terminology used and any specific sections that need to be completed.

03

Begin filling out the forms by entering your personal information accurately. Provide your full name, address, social security number (or equivalent identification number), and any other requested details. It is crucial to double-check these details to avoid any errors or delays.

04

Proceed with documenting your investments. Declare the type of investments you hold, whether they are stocks, bonds, mutual funds, real estate, or any other financial assets. Include information such as the investment name, symbol or identifier code, and the current value or number of shares held.

05

Provide transaction details if applicable. Depending on the type of form, you may need to report any buying or selling of investments during the reporting period. Include dates, amounts, and any gains or losses associated with these transactions.

06

Declare any income earned from your investments. This could include interest, dividends, rental income, or capital gains. Carefully report the amounts and ensure you adhere to the appropriate tax laws or regulations.

07

If required, complete any additional sections related to your investments. Some forms may have sections dedicated to specific investment types or unique circumstances. Fill out these sections accordingly, providing accurate and detailed information.

08

Review the completed forms for any errors or omissions. It is crucial to verify that all the information provided is accurate and up-to-date. Take the time to double-check everything before finalizing the forms.

Who needs your investments and oformr:

01

Individual investors: Whether you are investing for your retirement, saving for a specific goal, or simply looking to grow your wealth, accurately filling out investment forms is crucial. This ensures the proper management and reporting of your investments, aiding you in making informed financial decisions.

02

Financial institutions and investment providers: Investment firms, banks, and other financial institutions require accurate information on your investments to provide you with the necessary services. This data also helps them comply with legal and regulatory requirements.

03

Tax authorities: Your investments and related forms play a significant role in your tax obligations. By accurately filling out your investment forms, you enable taxation authorities to assess your tax liability correctly and ensure compliance with tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in your investments and oformr without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your your investments and oformr, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I fill out your investments and oformr on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your your investments and oformr. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out your investments and oformr on an Android device?

Use the pdfFiller Android app to finish your your investments and oformr and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is your investments and oformr?

Investments and oformr refers to the document or form where an individual discloses their financial investments and holdings.

Who is required to file your investments and oformr?

Individuals who meet certain criteria set by the governing body are required to file their investments and oformr.

How to fill out your investments and oformr?

You can fill out your investments and oformr by providing accurate and detailed information about your financial investments and holdings.

What is the purpose of your investments and oformr?

The purpose of investments and oformr is to promote transparency and accountability in financial matters.

What information must be reported on your investments and oformr?

You must report detailed information about your financial investments, holdings, and any potential conflicts of interest.

Fill out your your investments and oformr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Investments And Oformr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.