Get the free PERSONAL FINANCIAL RISK ASSESSMENT - levelfa.com

Show details

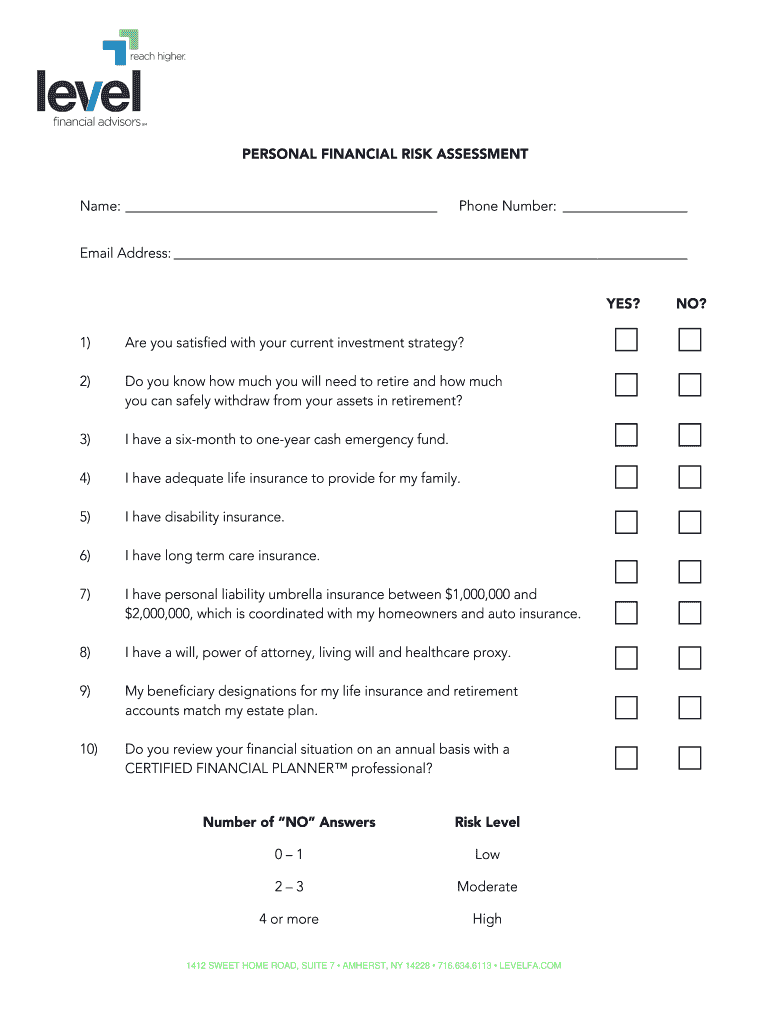

PERSONAL FINANCIAL RISK ASSESSMENT Name: Phone Number: Email Address: YES? NO? 1) Are you satisfied with ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial risk assessment

Edit your personal financial risk assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial risk assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial risk assessment online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal financial risk assessment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial risk assessment

How to fill out a personal financial risk assessment:

01

Start by gathering all relevant financial documents such as bank statements, investment statements, insurance policies, and loan documents. These will provide a comprehensive overview of your current financial situation.

02

Assess your income and expenses. Calculate your monthly income from various sources and list all your monthly expenses including bills, loans, and discretionary spending. This will give you an understanding of your cash flow and potential financial risks.

03

Evaluate your current assets and liabilities. List all your assets such as properties, vehicles, investments, and savings accounts. On the other hand, list all your liabilities, including mortgages, loans, credit card debts, and any other outstanding financial obligations.

04

Identify potential risks. Consider various factors that could negatively impact your financial well-being, such as job loss, disability, medical expenses, market downturns, or natural disasters. Assess the likelihood and potential severity of each risk.

05

Review your current insurance coverage. Evaluate your existing insurance policies, such as life insurance, health insurance, disability insurance, and property insurance. Determine whether the coverage is adequate to protect you and your family from potential risks.

06

Consider your long-term goals. Assess your financial goals, whether it's buying a house, saving for retirement, or funding your child's education. Evaluate the risks that could prevent you from achieving these goals and determine how to mitigate them.

07

Seek professional advice if needed. If you find it challenging to navigate through the assessment process or need expert guidance, consider consulting with a financial advisor who can provide personalized advice based on your specific circumstances.

Who needs a personal financial risk assessment:

01

Individuals with significant financial assets: If you have substantial savings, investments, or valuable properties, it's crucial to assess the potential risks associated with preserving and growing these assets.

02

Individuals with dependents: If you have a spouse, children, or other dependents who rely on your financial support, conducting a risk assessment ensures their well-being is protected in case of unforeseen events.

03

Individuals with variable income: If your income fluctuates or relies on commissions, bonuses, or self-employment, a financial risk assessment helps you anticipate and manage potential income volatility.

04

Individuals with debt or financial obligations: If you have outstanding loans, mortgages, or other financial obligations, evaluating potential risks can help you develop strategies to minimize the impact on your financial stability.

05

Individuals with specific financial goals: Whether you're saving for retirement, planning a big purchase, or aiming to start a business, a risk assessment ensures you consider potential threats and take appropriate measures to achieve your desired outcomes.

Remember, a financial risk assessment should be regularly reviewed and updated as your financial situation and goals evolve. It serves as a valuable tool in protecting your financial well-being and planning for a secure future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal financial risk assessment to be eSigned by others?

When your personal financial risk assessment is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute personal financial risk assessment online?

Filling out and eSigning personal financial risk assessment is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit personal financial risk assessment in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing personal financial risk assessment and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is personal financial risk assessment?

Personal financial risk assessment is the process of evaluating an individual's financial situation to identify potential risks and vulnerabilities.

Who is required to file personal financial risk assessment?

Individuals who are deemed to be at risk of financial hardship or instability may be required to file a personal financial risk assessment.

How to fill out personal financial risk assessment?

Personal financial risk assessment forms can typically be filled out online or submitted in paper format. It usually requires detailed information about income, assets, debts, expenses, and financial goals.

What is the purpose of personal financial risk assessment?

The purpose of personal financial risk assessment is to help individuals identify potential financial risks and develop strategies to mitigate them.

What information must be reported on personal financial risk assessment?

Information such as income, assets, debts, expenses, financial goals, and risk factors should be reported on personal financial risk assessment forms.

Fill out your personal financial risk assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Risk Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.