Get the free Consumer Small Loan Lender - mn

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer small loan lender

Edit your consumer small loan lender form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer small loan lender form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer small loan lender online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer small loan lender. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer small loan lender

How to fill out a consumer small loan lender?

01

Collect all necessary documents: Gather important documents such as identification proof, income statements, bank statements, and any other required paperwork.

02

Research lenders: Explore different consumer small loan lenders to find the best options available. Consider factors such as interest rates, repayment terms, and customer reviews.

03

Understand the loan terms: Read and comprehend the loan terms and conditions provided by the lender. Pay attention to interest rates, fees, penalties, and repayment schedules.

04

Complete the loan application: Fill out the loan application form provided by the lender. Provide accurate and complete information to ensure a smooth application process.

05

Submit required documents: Attach all the necessary documents requested by the lender along with your loan application. Ensure that all documents are properly filled out and signed.

06

Wait for approval and review: The lender will assess your application and documents before making a decision. It may take some time for them to review your application thoroughly.

07

Finalize the loan agreement: If your loan application gets approved, carefully review the loan agreement provided by the lender. Ensure that you understand all the terms and conditions before signing the agreement.

08

Receive the loan amount: Once the loan agreement is signed, the lender will transfer the approved loan amount to your designated bank account.

Who needs a consumer small loan lender?

01

Individuals facing unexpected financial emergencies: Consumer small loan lenders can be beneficial for individuals who encounter unforeseen expenses such as medical bills, car repairs, or home repairs. They provide quick access to funds in times of urgent need.

02

Small business owners: Entrepreneurs or small business owners who require immediate funds for their business activities can also benefit from consumer small loan lenders. These loans can help with inventory purchases, equipment upgrades, or covering operational expenses during lean periods.

03

Individuals with poor credit history: Traditional banks may reject loan applications from individuals with a poor credit history. However, consumer small loan lenders often consider other factors beyond credit scores, making them a potential option for individuals who have been turned down by traditional lenders.

04

Individuals looking to establish credit: Consumer small loan lenders may provide an opportunity for individuals with limited or no credit history to build their credit. Successfully repaying a small loan can help establish a positive credit history, making it easier to access larger loans in the future.

Remember to always evaluate your financial situation and repayment abilities before applying for any loan. It's essential to borrow responsibly and only take out loans that can be comfortably repaid.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the consumer small loan lender in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your consumer small loan lender in seconds.

How do I fill out consumer small loan lender using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign consumer small loan lender. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out consumer small loan lender on an Android device?

Use the pdfFiller Android app to finish your consumer small loan lender and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

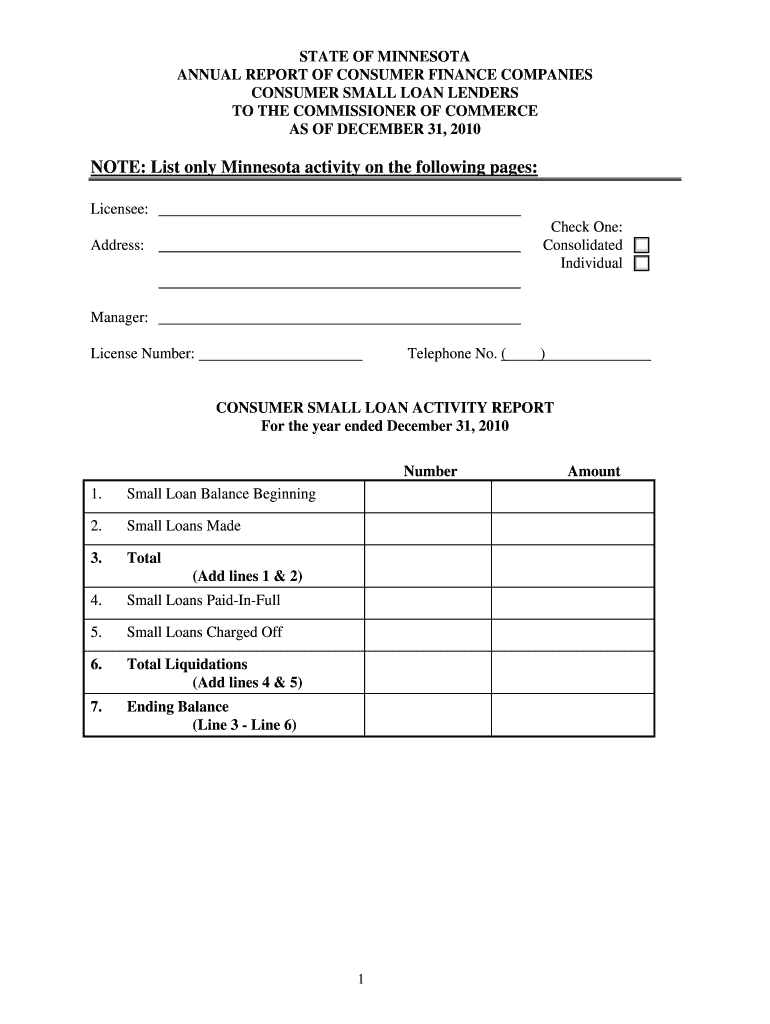

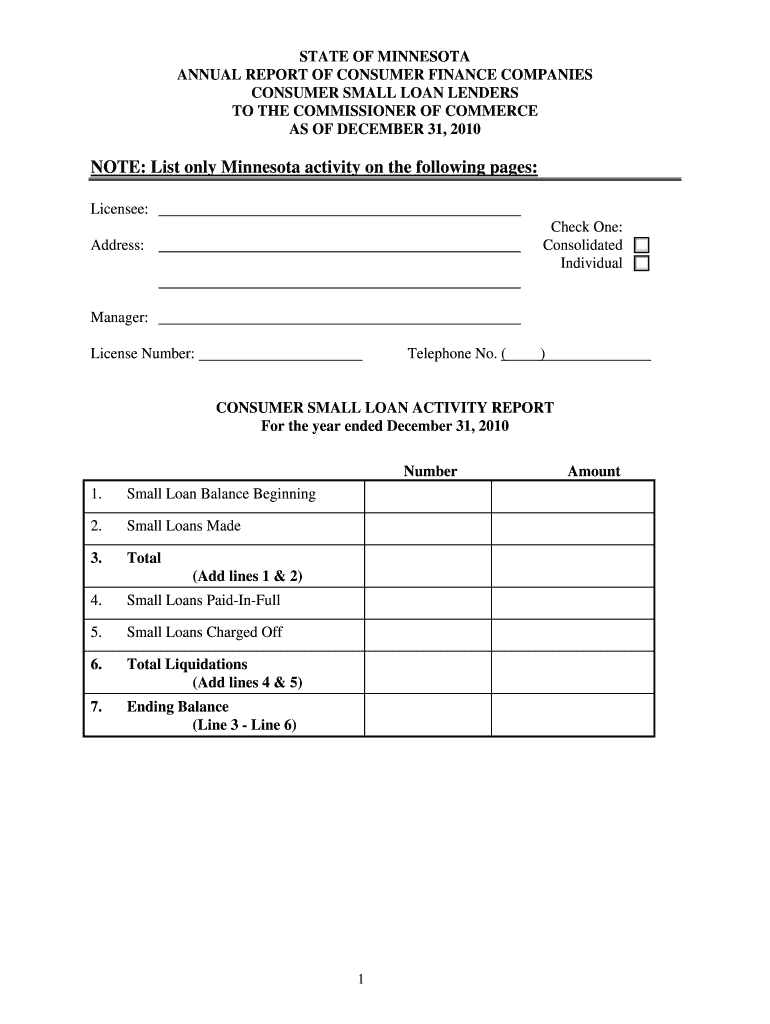

What is consumer small loan lender?

A consumer small loan lender is a financial institution that provides small loans to individual consumers.

Who is required to file consumer small loan lender?

Any financial institution that offers small loans to individual consumers is required to file as a consumer small loan lender.

How to fill out consumer small loan lender?

To fill out consumer small loan lender, the financial institution must provide details of the small loans offered to individual consumers and submit the necessary documentation to the regulatory authorities.

What is the purpose of consumer small loan lender?

The purpose of consumer small loan lender is to ensure that financial institutions offering small loans to individual consumers comply with regulations and protect consumers from predatory lending practices.

What information must be reported on consumer small loan lender?

The information that must be reported on consumer small loan lender includes details of the loans offered, interest rates, fees, and any other relevant terms and conditions.

Fill out your consumer small loan lender online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Small Loan Lender is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.