Get the free BUSINESS LOAN APPLICATION Complete in full and fax or mail to: First State Bank Attn...

Show details

BUSINESS LOAN APPLICATION Complete in full and fax or mail to: First State Bank Attn: Mark Taylor P. O. Box 160 One Commerce Park Shallower, Texas 79363 Phone 1-806-832-4525 Fax 1-806-832-5849 Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application complete

Edit your business loan application complete form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application complete form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loan application complete online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business loan application complete. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application complete

How to fill out a business loan application completely:

01

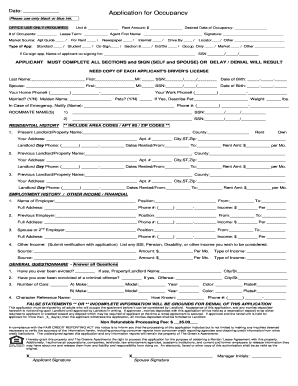

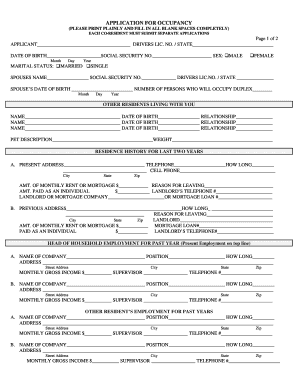

Gather all necessary documentation: Before starting the application, make sure you have all the required documents handy. This may include financial statements, tax returns, bank statements, and any other relevant paperwork.

02

Fill in basic details: Begin by providing basic information about your business, such as its legal name, address, phone number, and industry. This will help the lender identify your business accurately.

03

Provide financial information: Include details about your business's financial health, such as annual revenue, profit/loss statements, cash flow projections, and any outstanding debts. This information will help the lender assess your financial stability and determine your creditworthiness.

04

Describe the purpose of the loan: Clearly state why you need the loan and how it will be used to support and grow your business. Whether you require funds for equipment purchase, inventory, expansion, or working capital, be specific and provide a comprehensive explanation.

05

Detail business ownership: Specify the legal structure of your business (sole proprietorship, partnership, LLC, etc.) and provide information about each owner, including their names, ownership percentages, and personal financial information, if required.

06

Provide collateral information: If you're applying for a secured loan, mention the assets you're willing to pledge as collateral. Include descriptions, values, and any existing liens on these assets. Collateral provides security to the lender and increases your chances of loan approval.

07

Complete personal and business credit information: Give a thorough account of your personal and business credit history, including any loans, credit lines, or outstanding debts. Transparency is key, so ensure you provide accurate and up-to-date information.

Who needs a business loan application complete?

01

Entrepreneurs: Individuals starting their own businesses often require funding to get their ventures off the ground. A complete loan application is crucial for new business owners to secure the necessary funds and turn their dreams into reality.

02

Small business owners: Established small business owners frequently seek loans to fuel expansion, purchase new equipment, hire additional staff, or invest in marketing strategies. A complete loan application is vital for these owners to get the financial support they need.

03

Established companies: Even large companies with a strong financial standing may need loans for substantial investments or to weather unexpected challenges. These businesses must also submit a complete loan application to demonstrate their ability to repay the borrowed funds.

Note: The specific requirements and processes may vary depending on the lender and the type of loan. It's advisable to consult with a financial advisor or loan officer if you have any doubts or questions during the application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business loan application complete?

Business loan application complete refers to the submission of all required documents and information regarding a loan request for a business.

Who is required to file business loan application complete?

Business owners or individuals seeking a loan for their business are required to file a complete loan application.

How to fill out business loan application complete?

To fill out a business loan application complete, applicants must provide accurate and detailed information about their business, financials, and purpose of the loan.

What is the purpose of business loan application complete?

The purpose of a business loan application complete is to provide lenders with all necessary information to evaluate the loan request and make a decision.

What information must be reported on business loan application complete?

Information such as business financial statements, tax returns, business plan, credit history, and collateral details must be reported on a business loan application complete.

How can I send business loan application complete to be eSigned by others?

business loan application complete is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find business loan application complete?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific business loan application complete and other forms. Find the template you need and change it using powerful tools.

How do I edit business loan application complete on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share business loan application complete on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your business loan application complete online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application Complete is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.