Get the free AR Invoice Requisition Form NEW.doc - ryerson

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ar invoice requisition form

Edit your ar invoice requisition form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar invoice requisition form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ar invoice requisition form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ar invoice requisition form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

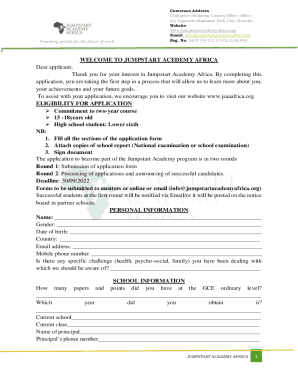

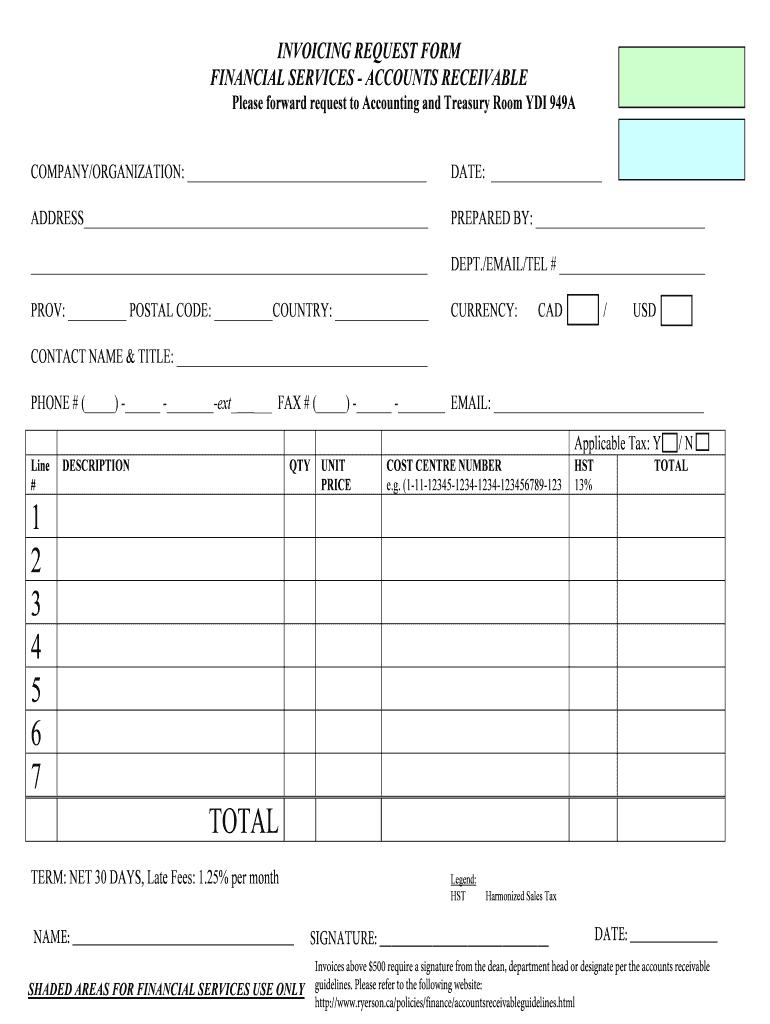

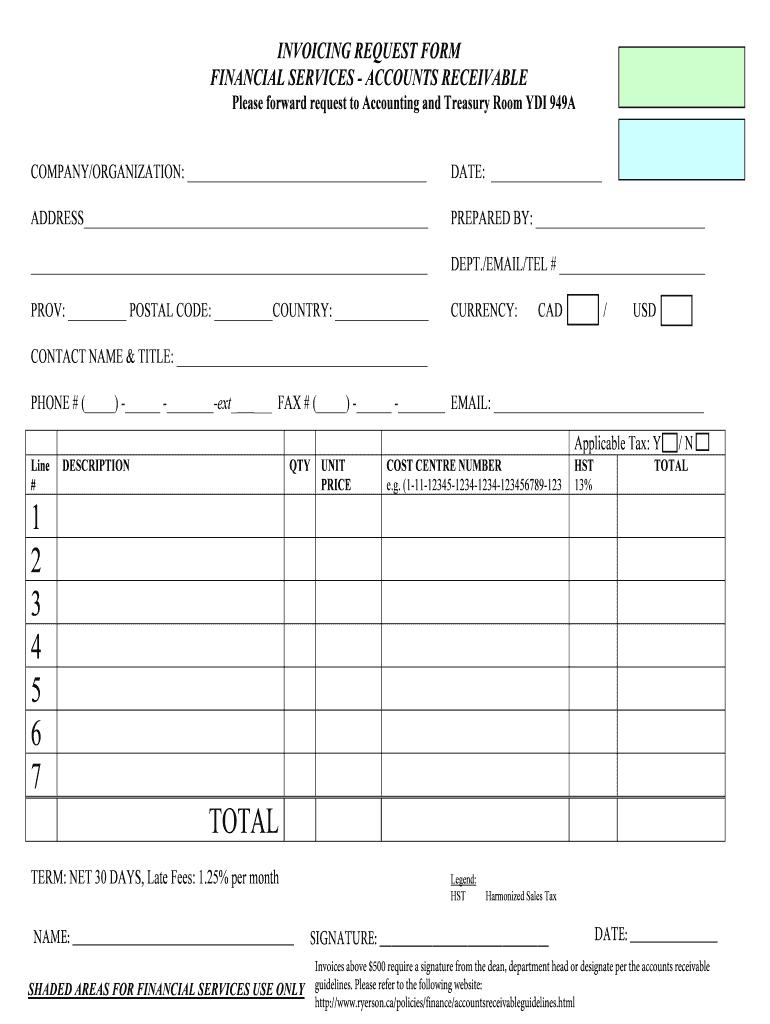

How to fill out ar invoice requisition form

How to fill out an AR invoice requisition form:

01

Begin by entering your company's name, address, and contact information at the top of the form. This information is crucial for identification purposes.

02

Next, input the date of the invoice requisition. Make sure to include the month, day, and year accurately to ensure proper record keeping.

03

Specify the customer or client's details, such as their name, address, and contact information. This information helps in correctly identifying who the invoice is being issued to.

04

Provide a unique invoice number in the designated field. These invoice numbers are important for organizing and tracking invoices in your accounting system.

05

Clearly state the products or services being invoiced. Include the quantity, item description, unit price, and any applicable taxes or discounts. List each item separately if multiple products or services are being billed.

06

Calculate and enter the total amount due. This should be the sum of all the products or services with taxes and discounts applied, if applicable.

07

If the client or customer has any special payment terms or instructions, include them in the relevant section of the form.

08

Include a payment due date. This acts as a reminder for the customer to settle the invoice by a specific date.

09

If necessary, provide a section for additional notes or comments. This area can be used to provide any relevant information that doesn't fit elsewhere on the form.

Who needs an AR invoice requisition form?

01

Any business or organization that provides products or services on credit and needs to document and track the invoices sent to customers or clients.

02

Companies that want to maintain proper financial records and have a streamlined invoicing process often utilize AR invoice requisition forms.

03

Small businesses, freelancers, and independent contractors who need to bill clients and customers for their work can benefit from using an AR invoice requisition form to ensure timely payments and accurate record-keeping.

Remember, accurately filling out the AR invoice requisition form is crucial for maintaining proper financial records, ensuring timely payments, and establishing a professional business relationship with customers or clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ar invoice requisition form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ar invoice requisition form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send ar invoice requisition form for eSignature?

Once your ar invoice requisition form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit ar invoice requisition form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ar invoice requisition form.

Fill out your ar invoice requisition form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ar Invoice Requisition Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.