Get the free 2016 Local Budget Law and Notice of Property Tax Forms and Instructions for Urban Re...

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016 local budget law

Edit your 2016 local budget law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 local budget law form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2016 local budget law online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2016 local budget law. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2016 local budget law

How to fill out 2016 local budget law:

01

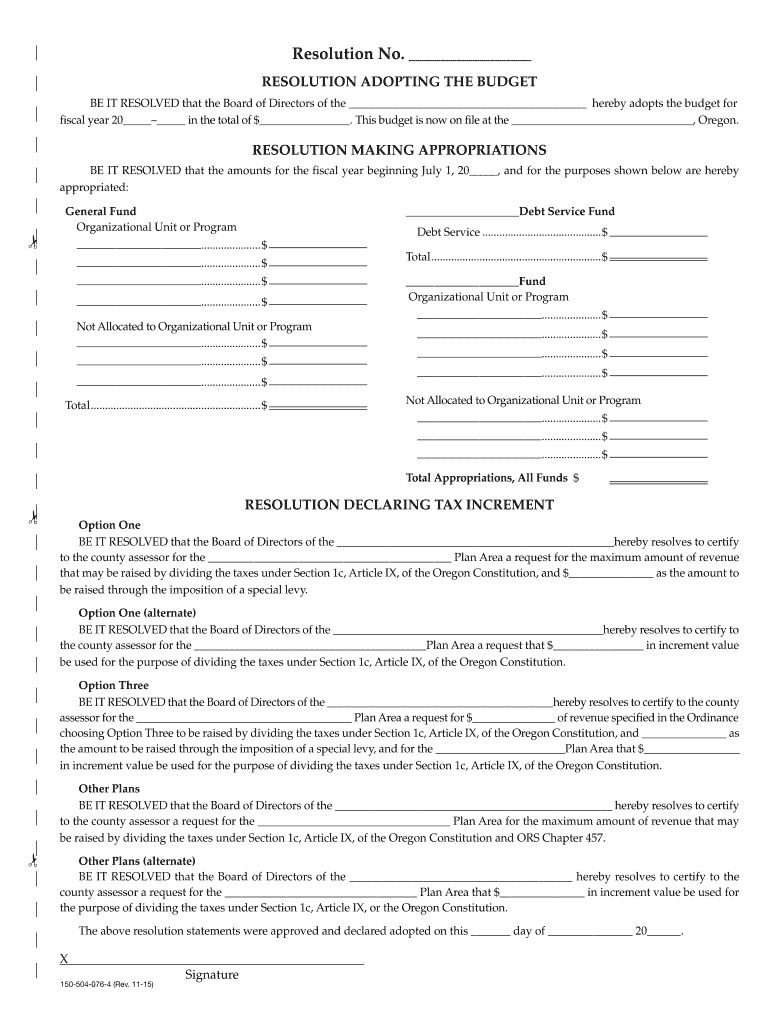

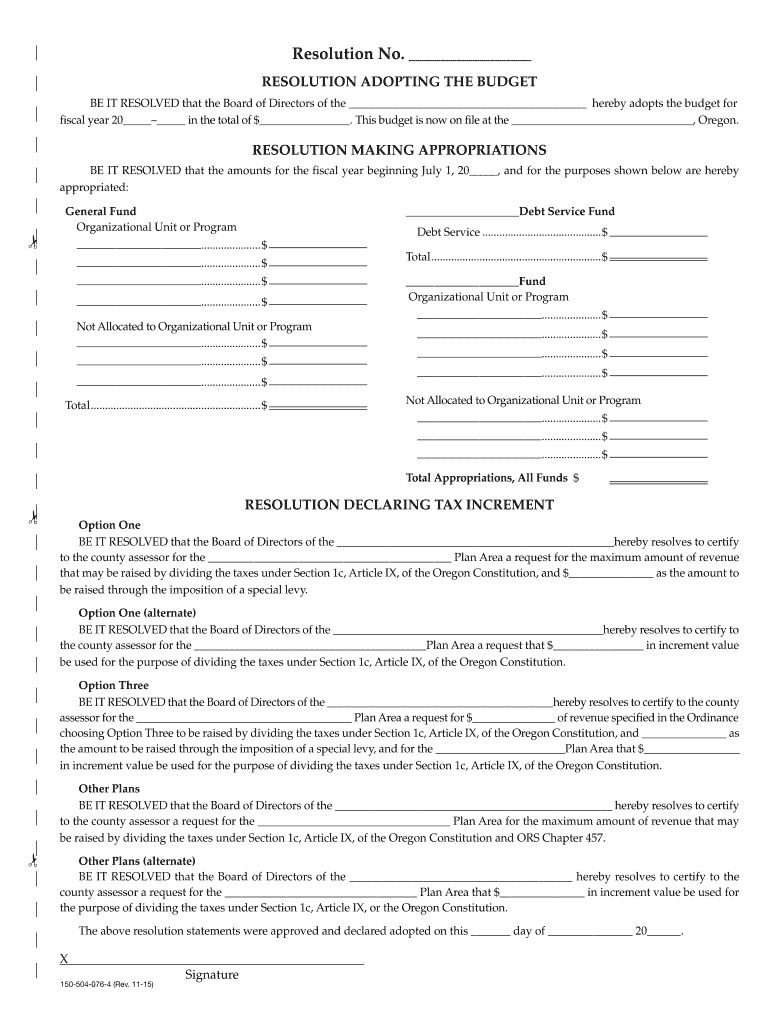

Identify the sources of revenue: Begin by determining the various sources of income for the local government, such as taxes, grants, fees, and other revenue streams. Make sure to include all relevant sources and estimate their expected amounts accurately.

02

Allocate funds to different sectors: Analyze the needs and priorities of your local community to determine how to distribute the budget. Allocate appropriate funds to different sectors such as education, healthcare, infrastructure, public safety, social welfare, and more. Prioritize areas that require immediate attention and ensure a fair distribution of resources.

03

Set financial goals and targets: Establish financial goals and targets for the upcoming year based on the needs and aspirations of your local community. Determine specific objectives for each sector and outline the steps required to achieve them within the allocated budget.

04

Create a detailed budget plan: Develop a comprehensive budget plan that clearly outlines the projected income, expenditures, and investments for each sector. Ensure transparency and accountability by providing detailed explanations for every budget item and justifying its necessity.

05

Consult with relevant stakeholders: Engage with key stakeholders such as local government officials, department heads, community leaders, and the public to gather input and feedback on the budget plan. Consider their suggestions, address concerns, and make necessary revisions to create a more inclusive and effective budget.

06

Implement and monitor the budget: Once the budget plan is finalized, start implementing it by allocating funds, approving expenditures, and closely monitoring financial activities. Regularly review the budget performance, track actual expenses, and compare them with the projected figures to identify any discrepancies and take necessary corrective actions.

Who needs 2016 local budget law?

01

Local government administrators: Local government administrators are responsible for managing public finances and ensuring the efficient allocation of resources. They need the 2016 local budget law to guide them in formulating and implementing the budget effectively.

02

Elected officials: Elected officials, such as mayors, governors, and council members, play a crucial role in budgetary decisions. They require the 2016 local budget law to understand their responsibilities, rights, and limitations when it comes to financial matters.

03

Government auditors: Government auditors are responsible for examining the financial records and practices of local governments to ensure compliance with the law. They need the 2016 local budget law to assess the budgetary processes and identify any irregularities or discrepancies.

04

Taxpayers and residents: Taxpayers and residents have the right to be informed about how their tax money is being utilized. They need the 2016 local budget law to understand how the budget is being allocated and to hold their local government accountable for its financial decisions.

05

Non-profit organizations and community groups: Non-profit organizations and community groups often rely on local government funding for their projects and initiatives. They need the 2016 local budget law to understand the available funding opportunities, eligibility criteria, and application procedures.

06

Researchers and academics: Researchers and academics studying local governance and public finance rely on the 2016 local budget law to analyze budgetary trends, evaluate the effectiveness of budget implementation, and propose improvements in financial management practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2016 local budget law from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 2016 local budget law, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the 2016 local budget law electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2016 local budget law in minutes.

How do I fill out the 2016 local budget law form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2016 local budget law. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is local budget law and?

Local budget law is a set of regulations and rules that govern the budgeting process for a specific locality.

Who is required to file local budget law and?

Local government officials and administrators are required to file local budget law.

How to fill out local budget law and?

Local budget law is filled out by providing detailed financial information and projections for the upcoming fiscal year.

What is the purpose of local budget law and?

The purpose of local budget law is to ensure transparency and accountability in the budgeting process of local governments.

What information must be reported on local budget law and?

Information such as revenue sources, expenditure forecasts, and budget allocations must be reported on local budget law.

Fill out your 2016 local budget law online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016 Local Budget Law is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.