Get the free ASC 606: Revenue from Contracts

Show details

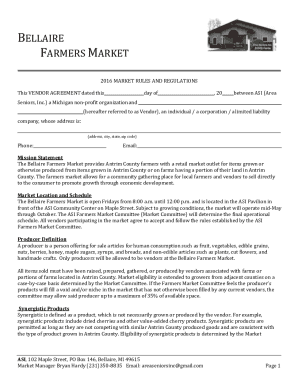

ASC 606: Revenue from Contracts with Customers Erin Roberts, Americas Leader of Engineering & Construction September, 2016Agenda Mandarin Oriental Las Vegas Tuesday, September 27, 2016, TimeMinutesSession

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asc 606 revenue from

Edit your asc 606 revenue from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asc 606 revenue from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit asc 606 revenue from online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit asc 606 revenue from. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out asc 606 revenue from

How to fill out ASC 606 revenue from?

01

Review the ASC 606 guidelines and requirements: Familiarize yourself with the ASC 606 standard and understand its principles and provisions. This will give you a comprehensive understanding of how to fill out the revenue forms correctly.

02

Gather necessary financial information: Collect all relevant financial data, including revenue streams, contracts, and customer agreements. Ensure that you have accurate and complete information to accurately report revenue.

03

Identify performance obligations: ASC 606 requires businesses to identify distinct performance obligations in their contracts. Determine the goods or services promised to the customer and separate them accordingly.

04

Allocate transaction price: ASC 606 mandates the allocation of the transaction price to each distinct performance obligation. Calculate the fair value of each obligation and allocate the revenue accordingly based on the relative standalone selling prices.

05

Recognize revenue over time or at a point in time: Determine whether the revenue is recognized over time or at a specific point in time. Consider factors like control of the goods or services, transfer of risks, and customer acceptance criteria to make this determination.

06

Document and disclose revenue information: Maintain detailed records of the calculations, assumptions, and judgments made during the revenue recognition process. Clearly disclose all significant judgments and changes in accounting policies in the financial statements.

Who needs ASC 606 revenue from?

01

Publicly traded companies: Companies that are publicly traded and subject to the rules and regulations of the Securities and Exchange Commission (SEC) in the United States need to comply with ASC 606. This standard ensures consistent revenue recognition practices and provides reliable financial information to investors.

02

Private companies: Private companies, especially those with significant contractual obligations and complex revenue streams, can benefit from implementing ASC 606. Adhering to this standard enhances transparency, comparability, and credibility of financial statements.

03

Non-profit organizations: Non-profit organizations that generate revenue from activities such as memberships, grants, and contributions also need to comply with ASC 606. Following this standard helps ensure proper recognition of revenue and enhances accountability in their financial reporting.

In summary, filling out ASC 606 revenue forms requires knowledge of the guidelines, gathering accurate financial information, identifying performance obligations, allocating transaction prices, and properly recognizing revenue over time or at a point in time. Companies across various sectors, including publicly traded companies, private companies, and non-profit organizations, need to comply with ASC 606 for consistent and transparent revenue recognition practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my asc 606 revenue from in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your asc 606 revenue from and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit asc 606 revenue from on an iOS device?

Create, modify, and share asc 606 revenue from using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit asc 606 revenue from on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share asc 606 revenue from on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is asc 606 revenue from?

asc 606 revenue is revenue recognized from contracts with customers in accordance with the guidelines outlined in ASC 606.

Who is required to file asc 606 revenue from?

Public companies are required to file asc 606 revenue from.

How to fill out asc 606 revenue from?

ASC 606 revenue should be filled out by following the guidelines and requirements set forth in the accounting standards.

What is the purpose of asc 606 revenue from?

The purpose of ASC 606 revenue is to provide a standardized way of recognizing revenue from customer contracts.

What information must be reported on asc 606 revenue from?

Information such as contract details, performance obligations, transaction price, and revenue recognition methods must be reported on ASC 606 revenue.

Fill out your asc 606 revenue from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asc 606 Revenue From is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.