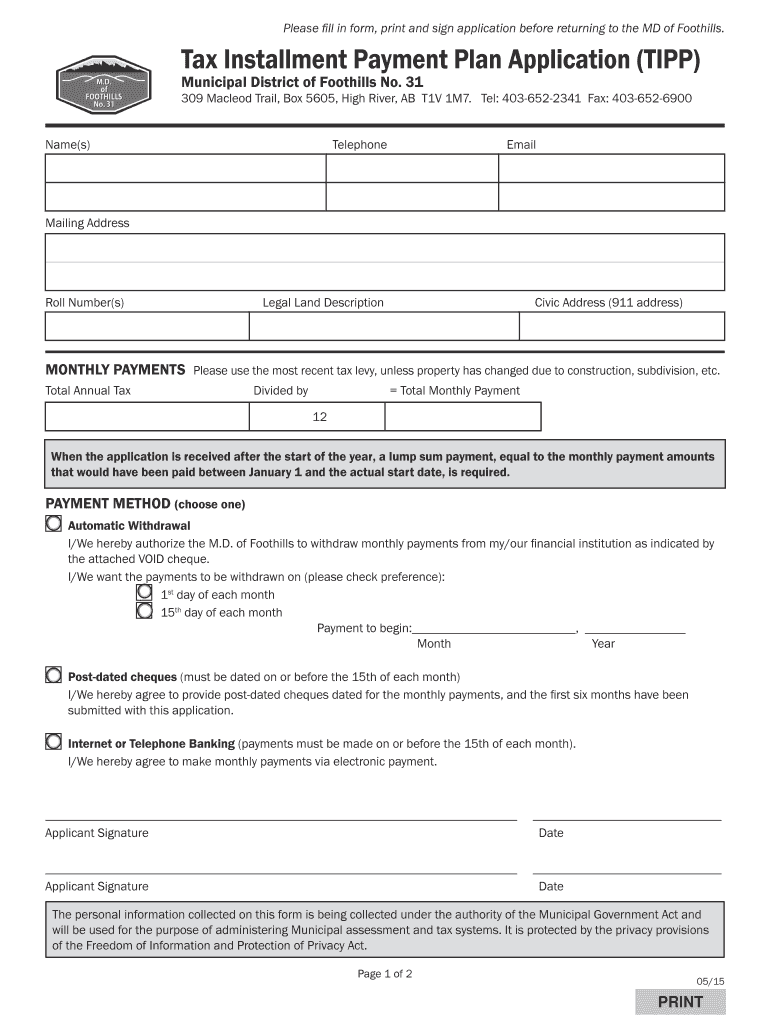

Get the free Tax Installment Payment Plan Application (TIPP) - MD Foothills

Show details

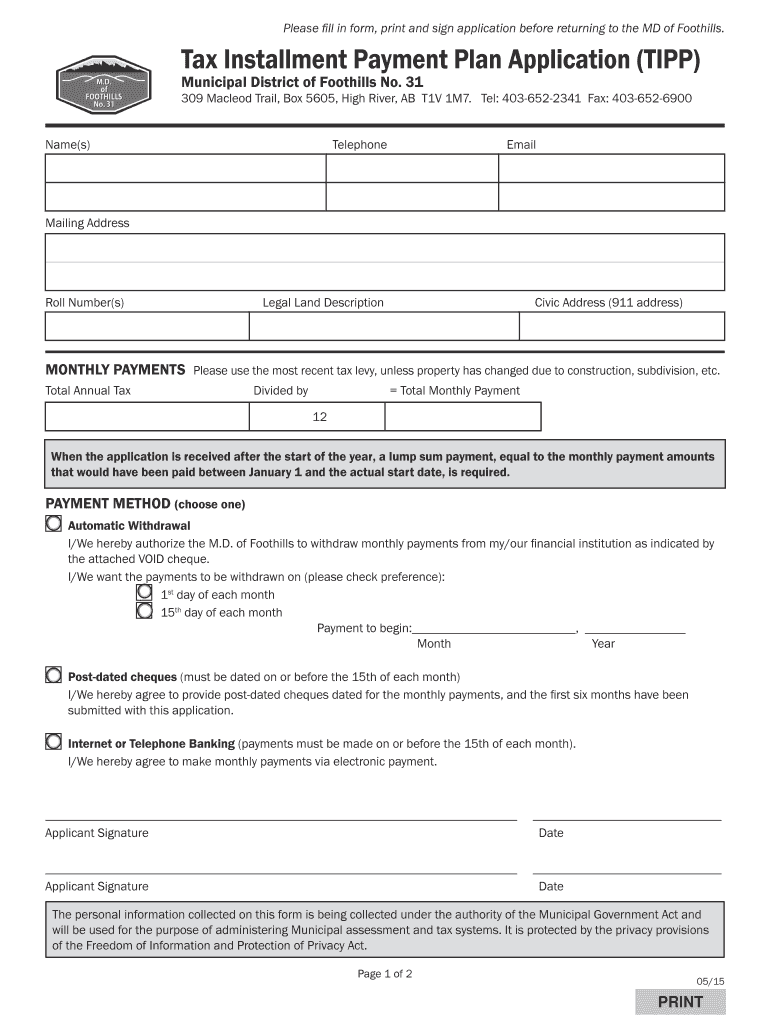

Tax Installment Payment Plan Application (TIPP) Municipal District of Foothills No. 31. 309 MacLeod Trail, Box 5605, High River, AB T1V 1M7. ... 5/29/2015 2:02:39 PM ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax installment payment plan

Edit your tax installment payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax installment payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax installment payment plan online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax installment payment plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax installment payment plan

How to fill out a tax installment payment plan:

01

Gather all relevant tax documents: Before filling out the tax installment payment plan, make sure you have all the necessary tax documents, such as your tax returns, W-2 forms, and any notices or letters from the IRS or state tax agency.

02

Review your financial situation: Take a close look at your finances to determine how much you can afford to pay each month towards your tax debt. Analyze your income, expenses, and other financial obligations to come up with a realistic payment plan.

03

Complete Form 9465: The IRS provides Form 9465, Installment Agreement Request, which is used to request a monthly payment plan for your tax debt. Fill out the form accurately and provide all the requested information, including your personal details, tax liability, proposed monthly payment, and bank account information.

04

Determine your proposed monthly payment: On Form 9465, you will need to specify the amount you can afford to pay each month towards your tax debt. It's essential to choose an amount that fits within your budget while still addressing your tax liability adequately. The IRS may require additional financial documentation or proof of income to support your proposed monthly payment.

05

Consider automatic payments: To simplify the payment process and ensure compliance, you may want to set up automatic payments through a direct debit from your bank account. This way, the monthly payments will be deducted automatically, reducing the risk of missed or late payments.

06

Submit the installment agreement request: Once you have completed Form 9465 and double-checked all the information, submit it to the appropriate tax authority. Make sure to keep a copy of the filled-out form for your records.

Who needs a tax installment payment plan:

01

Individuals with outstanding tax debts: If you owe money to the IRS or state tax agency and cannot pay the full amount upfront, a tax installment payment plan can provide a solution by allowing you to make monthly payments over time.

02

Self-employed individuals: Those who are self-employed may experience fluctuating income or unexpected tax liabilities. A tax installment payment plan can help manage these obligations more effectively.

03

Individuals facing financial hardships: If you are facing financial difficulties, such as job loss, medical expenses, or other significant financial burdens, a tax installment payment plan can help alleviate the immediate financial strain of paying your entire tax liability upfront.

04

Small business owners: Small business owners who find it challenging to pay their business tax debts in full can benefit from a tax installment payment plan to manage their tax obligations more effectively.

05

Those seeking to avoid penalties and interests: By setting up a tax installment payment plan, you can avoid or reduce penalties and interest charges that accrue on unpaid tax debts. This can provide financial relief and help you get back on track with your tax obligations.

Note: It is essential to consult with a tax professional or seek guidance from the IRS or state tax agency for specific advice tailored to your individual tax situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax installment payment plan?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the tax installment payment plan in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the tax installment payment plan in Gmail?

Create your eSignature using pdfFiller and then eSign your tax installment payment plan immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete tax installment payment plan on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your tax installment payment plan. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is tax installment payment plan?

A tax installment payment plan is a method for taxpayers to pay their taxes in installments over a period of time rather than in one lump sum.

Who is required to file tax installment payment plan?

Taxpayers who are unable to pay their taxes in full by the due date and meet certain criteria set by the tax authority may be required to file a tax installment payment plan.

How to fill out tax installment payment plan?

Taxpayers can fill out a tax installment payment plan by providing detailed financial information, including income, expenses, and assets, to the tax authority.

What is the purpose of tax installment payment plan?

The purpose of a tax installment payment plan is to provide taxpayers with a manageable way to pay their taxes over time and avoid penalties for late payment.

What information must be reported on tax installment payment plan?

Taxpayers must report detailed financial information, such as income, expenses, assets, and debts, on a tax installment payment plan.

Fill out your tax installment payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Installment Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.