Get the free Nonprofit Unemployment

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit unemployment

Edit your nonprofit unemployment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit unemployment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit unemployment online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nonprofit unemployment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit unemployment

How to fill out nonprofit unemployment:

01

Gather all necessary documents: Before starting the application process for nonprofit unemployment, it is essential to collect all the required documents, such as tax forms, payroll records, and any other relevant financial information. Having these ready will make the process smoother and more efficient.

02

Research state-specific requirements: Different states have varying regulations and requirements when it comes to filing for nonprofit unemployment. It is crucial to research and understand the specific guidelines for your state to ensure accurate and complete filing.

03

Determine eligibility: Nonprofit organizations must meet certain criteria to qualify for unemployment benefits. Evaluate whether your organization meets the eligibility requirements set forth by your state's unemployment agency. This may include factors such as the number of employees, legal structure, and purpose of the nonprofit.

04

Complete the application: Once you have gathered the necessary information and confirmed eligibility, proceed with filling out the nonprofit unemployment application. Provide accurate and detailed information about your organization, its financial status, and the reason for filing for unemployment benefits.

05

Submit the application: After completing the application, submit it to the relevant state unemployment agency. Take note of any deadlines or additional steps that may be required, such as providing supporting documents or attending an interview. Double-check that all information is accurate and complete before submission.

Who needs nonprofit unemployment?

01

Nonprofit organizations facing financial challenges: Nonprofit unemployment benefits are designed to assist organizations experiencing financial difficulties, such as a decrease in funding, closure of programs, or unexpected financial burdens. These benefits provide temporary relief and support during challenging times.

02

Nonprofit employees who have lost their jobs: Nonprofit unemployment benefits are primarily intended to aid individuals who are employed by nonprofit organizations and have become unemployed. Employees who have been laid off, had their hours reduced, or their positions eliminated may be eligible for these benefits.

03

Nonprofit organizations with eligible employees: To access nonprofit unemployment benefits, the organization must have employees who qualify for unemployment benefits according to the state's guidelines. This means that individuals must meet certain criteria related to wages earned and the reason for job separation.

Overall, nonprofit unemployment benefits are intended to assist both organizations and their employees during times of financial distress or job loss. By following the proper application process and meeting eligibility requirements, nonprofit organizations can access the necessary support to alleviate some of their challenges.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nonprofit unemployment?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific nonprofit unemployment and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete nonprofit unemployment online?

Easy online nonprofit unemployment completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my nonprofit unemployment in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your nonprofit unemployment and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

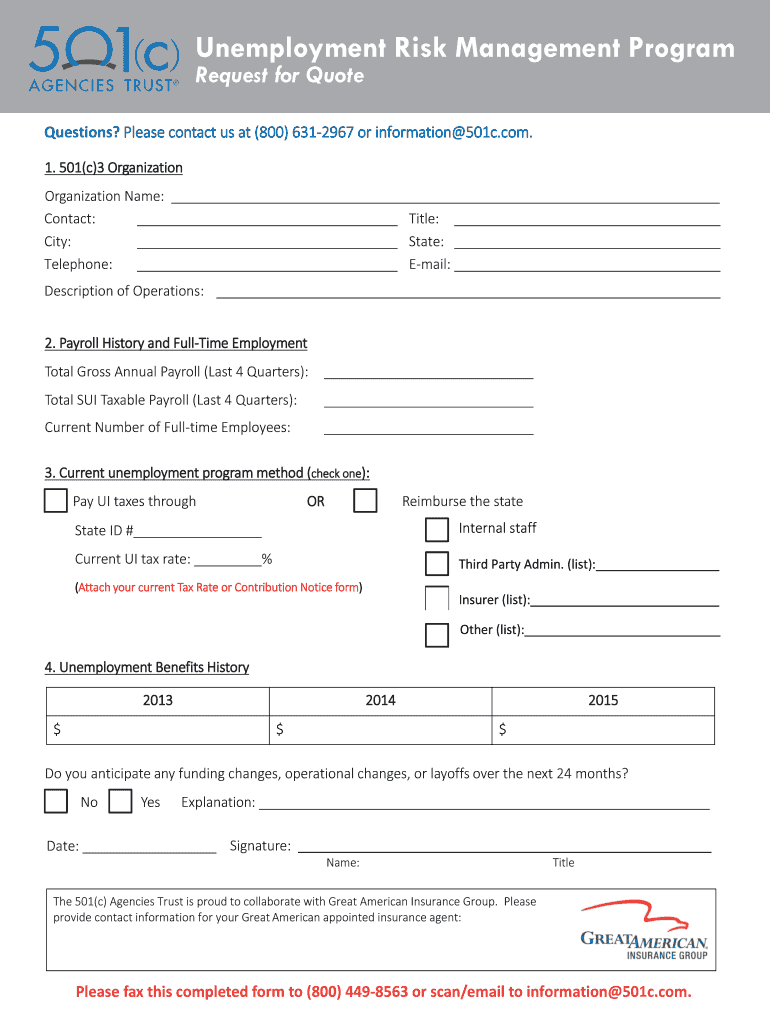

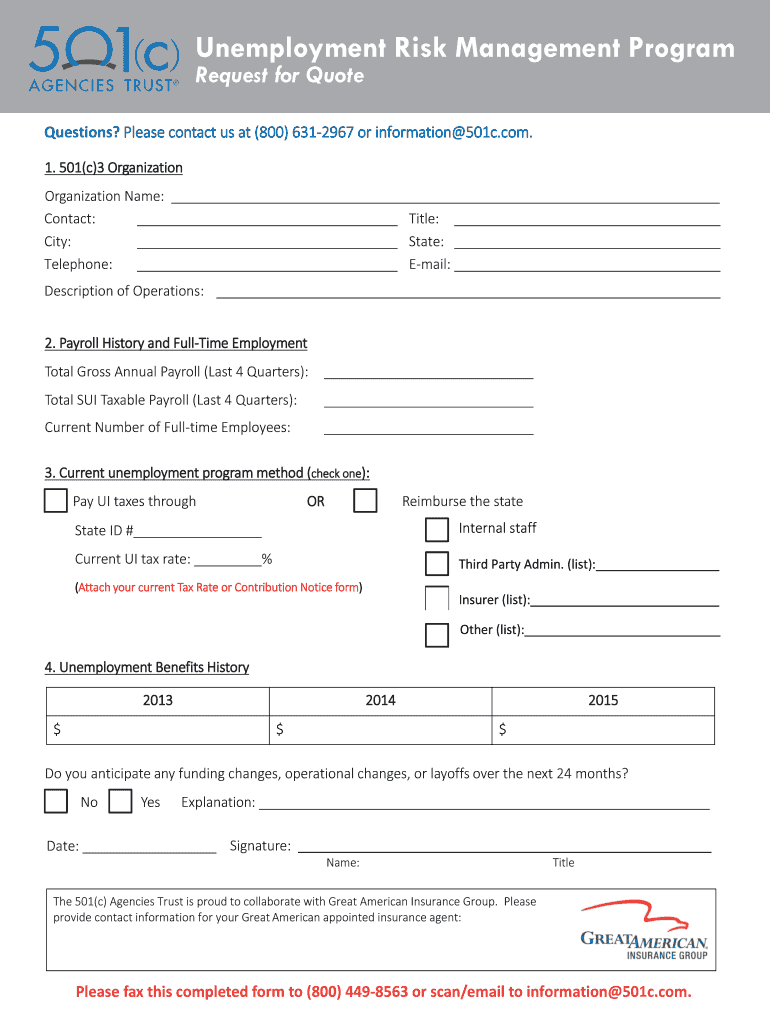

What is nonprofit unemployment?

Nonprofit unemployment is a state program that provides unemployment benefits to eligible employees of nonprofit organizations.

Who is required to file nonprofit unemployment?

Nonprofit organizations with employees are required to file nonprofit unemployment.

How to fill out nonprofit unemployment?

Nonprofit organizations can fill out nonprofit unemployment online or by submitting paper forms to the state employment agency.

What is the purpose of nonprofit unemployment?

The purpose of nonprofit unemployment is to provide financial assistance to eligible employees who have lost their jobs through no fault of their own.

What information must be reported on nonprofit unemployment?

Nonprofit organizations must report their employees' wages, hours worked, and reasons for separation.

Fill out your nonprofit unemployment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Unemployment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.