Get the free Regulations for Tax-Exempt Religious Organization Child ...

Show details

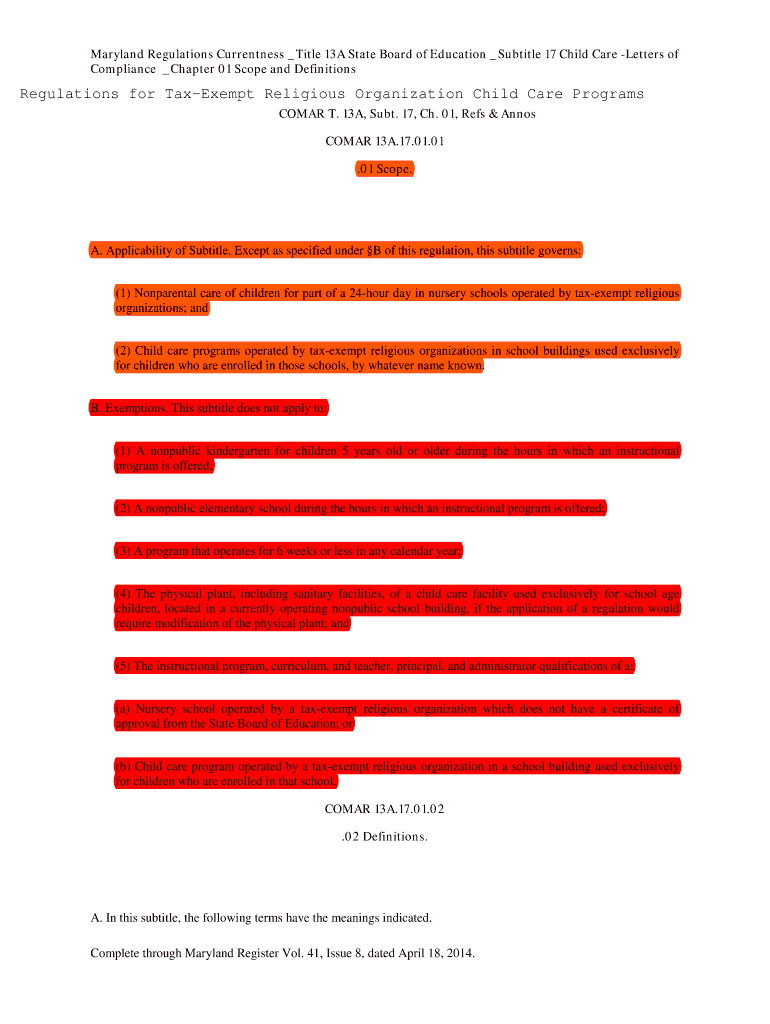

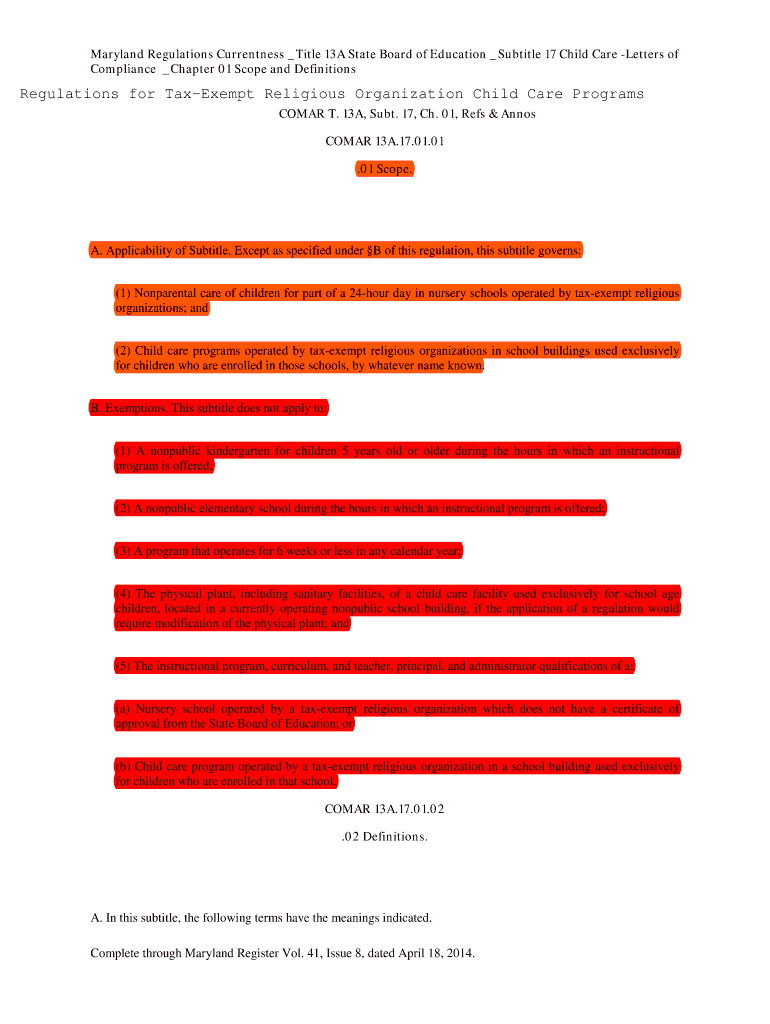

Maryland Regulations Correctness Title 13A State Board of Education Subtitle 17 Child Care Letters of Compliance Chapter 01 Scope and DefinitionsRegulations for Tax-exempt Religious Organization Child

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulations for tax-exempt religious

Edit your regulations for tax-exempt religious form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulations for tax-exempt religious form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing regulations for tax-exempt religious online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit regulations for tax-exempt religious. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulations for tax-exempt religious

How to fill out regulations for tax-exempt religious:

01

Understand the requirements: Familiarize yourself with the specific regulations and guidelines that apply to tax-exempt religious organizations. This may include provisions related to eligibility criteria, reporting and record-keeping requirements, fundraising activities, and more.

02

Gather necessary documentation: Gather all relevant documents, such as your organization's incorporation papers, bylaws, financial statements, and any other supporting documentation that may be required for the application or filing process.

03

Complete the application or forms: Fill out the necessary forms accurately and comprehensively. Provide all requested information, including details about the religious organization, its activities, its governing board or leadership, and the specific tax-exempt status sought (e.g., 501(c)(3)).

04

Review and double-check: Once the forms are completed, carefully review every detail to ensure accuracy and completeness. Mistakes or omissions could potentially lead to delays or complications in the application process.

05

Obtain necessary approvals or signatures: Ensure that any required approvals or signatures, such as those from the organization's board members or officers, are obtained before submitting the application.

06

Submit the application: Submit the completed application and any supporting documentation to the relevant government agency or authority responsible for overseeing tax-exempt status for religious organizations. Pay any required fees or dues, if applicable.

07

Follow up and maintain compliance: After submitting the application, it may take some time for the authorities to process and review it. Stay in contact with the agency or authority to check on the status of your application and address any questions or requests for additional information.

Who needs regulations for tax-exempt religious?

01

Religious organizations seeking tax-exempt status: Religious organizations that intend to operate as tax-exempt entities must comply with specific regulations set by the government or relevant authorities. These regulations ensure that the organization meets certain eligibility criteria and operates in a manner consistent with being tax-exempt.

02

Organizations engaging in religious activities: Non-profit organizations involved in religious activities, such as churches, synagogues, mosques, temples, or other religious institutions, may seek tax-exempt status to benefit from financial advantages and exemptions available to them.

03

Donors and supporters: Individuals or entities that donate or support tax-exempt religious organizations may need regulations to ensure that their contributions are used for religious, charitable, or educational purposes, as stipulated by the tax-exempt status. This can provide them with tax benefits and assurance that their donations are handled appropriately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in regulations for tax-exempt religious without leaving Chrome?

regulations for tax-exempt religious can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out regulations for tax-exempt religious using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign regulations for tax-exempt religious and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit regulations for tax-exempt religious on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign regulations for tax-exempt religious on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is regulations for tax-exempt religious?

Regulations for tax-exempt religious refer to the guidelines and requirements that religious organizations must follow in order to maintain their tax-exempt status.

Who is required to file regulations for tax-exempt religious?

Religious organizations that are recognized as tax-exempt by the IRS are required to file regulations for tax-exempt religious.

How to fill out regulations for tax-exempt religious?

To fill out regulations for tax-exempt religious, religious organizations must provide detailed information about their activities, finances, and compliance with tax laws.

What is the purpose of regulations for tax-exempt religious?

The purpose of regulations for tax-exempt religious is to ensure that religious organizations are operating in accordance with the tax laws and are using their tax-exempt status properly.

What information must be reported on regulations for tax-exempt religious?

Information such as financial statements, fundraising activities, executive compensation, and other relevant details must be reported on regulations for tax-exempt religious.

Fill out your regulations for tax-exempt religious online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulations For Tax-Exempt Religious is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.