Get the free Debt Collection Guide - NYC.gov

Show details

Dial 311

(212NEWYORK)

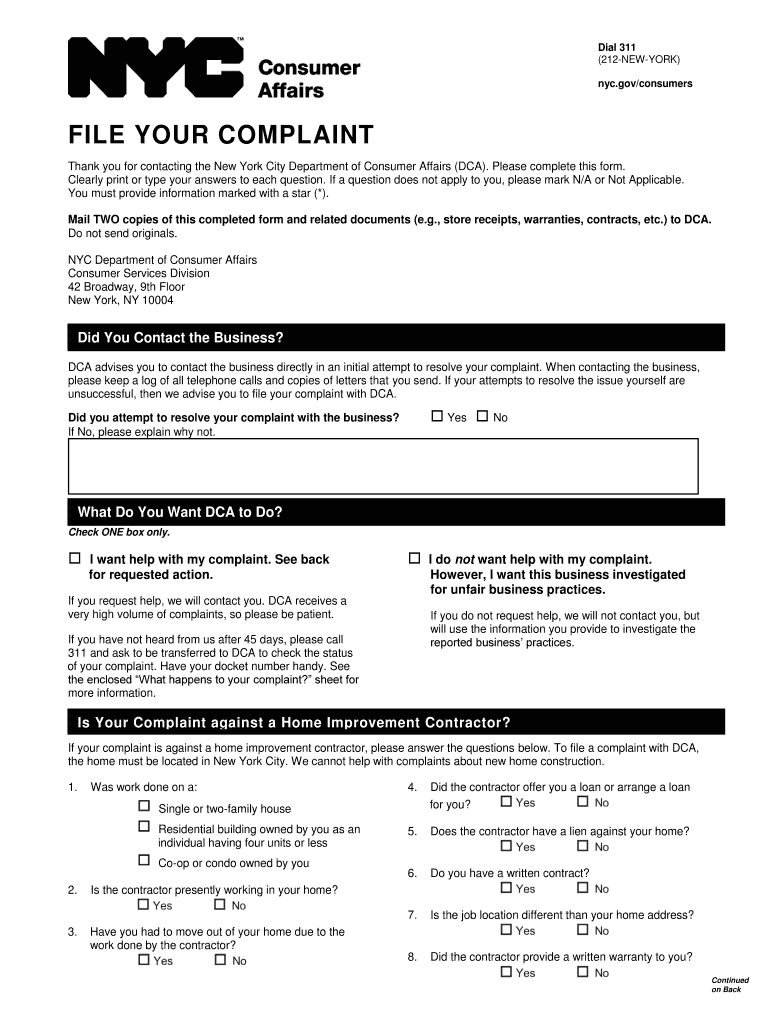

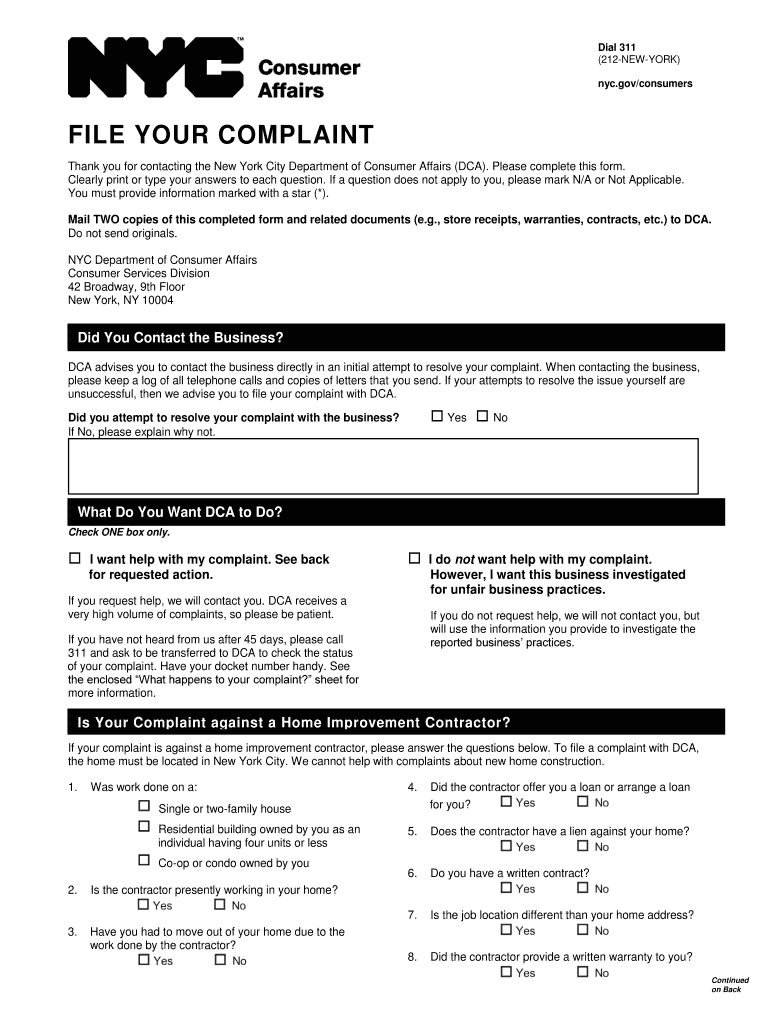

nyc.gov/consumersFILE YOUR COMPLAINT

Thank you for contacting the New York City Department of Consumer Affairs (DCA). Please complete this form.

Clearly print or type your answers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt collection guide

Edit your debt collection guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt collection guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt collection guide online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit debt collection guide. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt collection guide

How to fill out a debt collection guide:

01

Start by gathering all relevant information, including the debtor's name, contact information, and details of the debt owed. This may include outstanding invoices, account statements, or any relevant legal documentation.

02

Clearly outline the steps you will take to collect the debt. This may include sending reminder letters or emails, making phone calls, or engaging the services of a collection agency.

03

Provide a detailed explanation of the legal processes involved in debt collection. This may include information on how to file a lawsuit, obtain a judgment, or enforce a judgment through wage garnishment or asset seizure.

04

Include any necessary documentation or forms that need to be filled out throughout the debt collection process. This could include demand letters, payment plans, or court forms.

05

Make sure to include any relevant laws or regulations that govern the debt collection process. This will help ensure that you are following all legal requirements and avoid any potential legal pitfalls.

06

Provide tips or strategies for effective debt collection. This may include advice on negotiating with debtors, setting realistic expectations, or seeking professional help when necessary.

07

Clearly state the consequences of non-payment or non-compliance with the debt collection process. This may include information on potential legal action, credit reporting, or other measures to exert pressure on the debtor.

08

Finally, review and proofread the guide to ensure clarity and accuracy. It is important to present the information in a clear, concise, and easy-to-understand manner.

Who needs a debt collection guide?

01

Individuals or businesses that have outstanding debts and need guidance on the proper steps to take to collect what they are owed.

02

Creditors or lenders who want to ensure that they are following legal and ethical debt collection practices.

03

Legal professionals or debt collection agencies who need a resource or reference guide on the debt collection process.

04

Debtors who want to understand their rights and obligations during debt collection and how to respond to collection efforts.

Overall, a debt collection guide serves as a valuable resource for anyone involved in the debt collection process, providing step-by-step instructions, legal information, and practical tips to help streamline the collection process and increase the chances of successful debt recovery.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in debt collection guide?

With pdfFiller, the editing process is straightforward. Open your debt collection guide in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my debt collection guide in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your debt collection guide right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit debt collection guide on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign debt collection guide. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is debt collection guide?

Debt collection guide is a set of rules and procedures that outlines how to collect overdue debts from individuals or businesses.

Who is required to file debt collection guide?

Creditors and debt collection agencies are required to file debt collection guide.

How to fill out debt collection guide?

Debt collection guide can be filled out by providing information about the debt, debtor, collection methods, and legal requirements.

What is the purpose of debt collection guide?

The purpose of debt collection guide is to provide a standardized process for collecting debts while complying with legal regulations.

What information must be reported on debt collection guide?

Debt collection guide must include details about the debt amount, debtor's contact information, collection methods used, and any legal actions taken.

Fill out your debt collection guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Collection Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.