Get the free kotak sensex etf - Kotak Mahindra Bank

Show details

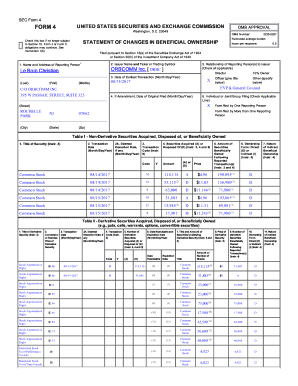

KEY INFORMATION MEMORANDUM (KIM) KODAK SENSE ETF An Open Ended Exchange Traded Fund Eligible Scheme under Rajiv Gandhi Equity Savings Scheme (LESS) Continuous Offer of units at applicable NAV Scheme

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kotak sensex etf

Edit your kotak sensex etf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kotak sensex etf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kotak sensex etf online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kotak sensex etf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kotak sensex etf

How to fill out kotak sensex etf:

01

Gather the required documents: Before filling out the kotak sensex etf form, ensure you have all the necessary documents such as your PAN card, KYC documents, and bank account details.

02

Visit the nearest Kotak Securities branch or log in to your Kotak Securities account online: You can either visit a physical branch of Kotak Securities or access your account through their online platform.

03

Obtain the kotak sensex etf application form: Request the kotak sensex etf application form from the representative at the branch or download it from the Kotak Securities website.

04

Fill in your personal details: Start by accurately providing your personal information such as name, address, contact details, and PAN number. Double-check the accuracy of the details entered.

05

Provide your bank account details: Enter your bank account number, bank name, branch, and IFSC code. This information is necessary for the transfer of funds and dividend payments.

06

Complete the KYC process: Fill in the KYC details such as your Aadhaar number, date of birth, occupation, and income details. Attach the necessary KYC documents, including a copy of your PAN card and address proof.

07

Choose investment options: Indicate the amount you wish to invest in the kotak sensex etf and select the mode of investment, i.e., lump sum or systematic investment plan (SIP).

08

Review and sign the application form: Carefully review all the details mentioned in the form. Ensure there are no errors or discrepancies. Put your signature in the designated area, confirming the accuracy of the information provided.

09

Submit the application form: Once you have completed the form and checked it thoroughly, submit it to the Kotak Securities representative at the branch or upload it online if submitting through their website.

10

Make the payment: If investing through a lump sum, make the payment for the desired amount through a check, demand draft, or online transfer. If opting for a SIP, provide the necessary bank account details for periodic deductions.

Who needs kotak sensex etf:

01

Investors looking for diversification: Kotak sensex etf allows investors to gain exposure to a diversified basket of stocks included in the sensex index. It helps spread the investment risk across multiple companies and sectors.

02

Individuals seeking passive investment: Kotak sensex etf is a passive investment instrument that aims to replicate the performance of the sensex index. Investors who prefer a low-cost, low-maintenance investment option may find it suitable.

03

Those seeking long-term wealth creation: The kotak sensex etf is designed for long-term investments as it offers potential capital appreciation over the years. Investors who have a long-term investment horizon and are willing to stay invested may consider it.

04

Investors with a bullish view on the Indian stock market: If an investor believes that the overall market will perform well and the sensex will rise, investing in kotak sensex etf can provide an opportunity to benefit from the potential upside.

05

Individuals looking for liquidity and transparency: Being listed on the stock exchange, kotak sensex etf provides liquidity as it can be bought or sold during market hours. Additionally, its transparent structure allows investors to track the performance and holdings easily.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit kotak sensex etf from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like kotak sensex etf, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete kotak sensex etf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your kotak sensex etf. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit kotak sensex etf on an Android device?

The pdfFiller app for Android allows you to edit PDF files like kotak sensex etf. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is kotak sensex etf?

Kotak Sensex ETF is an exchange-traded fund that aims to replicate the performance of the S&P BSE Sensex Index.

Who is required to file kotak sensex etf?

Investors who are interested in investing in stocks that mirror the S&P BSE Sensex Index can file Kotak Sensex ETF.

How to fill out kotak sensex etf?

To fill out Kotak Sensex ETF, investors can approach a registered stock broker or financial institution that offers the ETF and provide the necessary details and investment amount.

What is the purpose of kotak sensex etf?

The purpose of Kotak Sensex ETF is to provide investors with an opportunity to invest in a diversified portfolio that replicates the performance of the S&P BSE Sensex Index.

What information must be reported on kotak sensex etf?

Investors need to report their investment amount, personal information, and other details required by the stock broker or financial institution offering the Kotak Sensex ETF.

Fill out your kotak sensex etf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kotak Sensex Etf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.