KY Form QCC1 2015-2026 free printable template

Show details

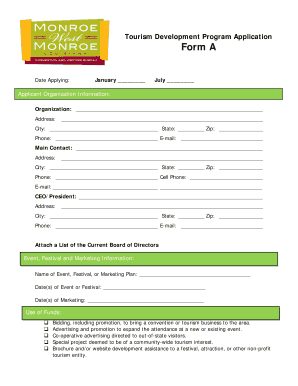

OFFICE USE ONLY DO NOT WRITE IN THIS SPACE EMPLOYER NOT PREPARER IS RESPONSIBLE FOR ALL INFORMATION AND PAYMENTS. SEE BACK FOR FILING INSTRUCTIONS QUESTIONS OR ASSISTANCE CALL 859 392-1440 DO NOT STAPLE THIS FORM OR ATTACHMENTS Remit to KENTON COUNTY FISCAL COURT PO BOX 706237 CINCINNATI OH 45270 KENTON COUNTY CITIES KENTUCKY EMPLOYEE S QUARTERLY WITHHOLDING FORM QCC1 - REV 11/2012 ADJ AM CT1A EL PI RAE TERM UND ACCOUNT NUMBER Print Form YEAR ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ky form qcc1 form print

Edit your KY Form QCC1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY Form QCC1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY Form QCC1 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KY Form QCC1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY Form QCC1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY Form QCC1

How to fill out KY Form QCC1

01

Start by downloading the KY Form QCC1 from the Kentucky Department of Revenue website.

02

Fill in your personal information at the top, including your name, address, and contact information.

03

Indicate the type of organization or business you are filing for in the designated section.

04

Provide the necessary financial information as requested, including income and expenses.

05

Review any specific instructions related to your type of organization or the purpose of the form.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate department by mail or electronically, as outlined in the instructions.

Who needs KY Form QCC1?

01

Businesses or organizations operating in Kentucky.

02

Organizations seeking tax exemptions or special status.

03

Tax professionals assisting clients with filings in Kentucky.

Fill

form

: Try Risk Free

People Also Ask about

What is Kenton County KY known for?

Kenton County has been home to noted politicians, world-renowned artists, and breathtaking architecture throughout its rich history.

What are the demographics of Kenton County Kentucky?

The racial makeup of the county was 93.99% White, 3.84% Black or African American, 0.15% Native American, 0.59% Asian, 0.03% Pacific Islander, 0.41% from other races, and 1.00% from two or more races. 1.10% of the population were Hispanics or Latinos of any race.

What is the poverty rate in Kenton County?

Median Income In 2021, the median household income of Kenton County households was $68,503. Kenton County households made slightly more than Campbell County households ($65,580) and Bullitt County households ($67,892) . However, 8.2% of Kenton County families live in poverty.

What is the poverty rate in Floyd County Kentucky?

Table PopulationIncome & PovertyMedian household income (in 2021 dollars), 2017-2021$37,360Per capita income in past 12 months (in 2021 dollars), 2017-2021$20,160Persons in poverty, percent 28.0%57 more rows

In what County is Covington KY?

Covington, city, one of the seats of Kenton county (the other being Independence), north-central Kentucky, U.S. It is situated at the confluence of the Ohio and Licking rivers, adjoining Newport (east) and opposite Cincinnati, Ohio.

How much do Kenton County substitute teachers make?

$18. The estimated total pay for a Substitute Teacher at Kenton County School District is $18 per hour.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the KY Form QCC1 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign KY Form QCC1 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out KY Form QCC1 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your KY Form QCC1. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete KY Form QCC1 on an Android device?

Use the pdfFiller mobile app and complete your KY Form QCC1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is KY Form QCC1?

KY Form QCC1 is a tax form used in the state of Kentucky for reporting certain tax credits, specifically aimed at taxpayers claiming the Kentucky personal income tax credit.

Who is required to file KY Form QCC1?

Any individual or entity who is claiming tax credits provided under Kentucky state law and is eligible under the guidelines set forth by the Kentucky Department of Revenue is required to file KY Form QCC1.

How to fill out KY Form QCC1?

To fill out KY Form QCC1, you need to provide personal information such as your name, Social Security number, and the tax year for which you are filing. Then, complete the sections regarding the specific credits you are claiming, including any necessary calculations or supporting documentation.

What is the purpose of KY Form QCC1?

The purpose of KY Form QCC1 is to facilitate the reporting of claims for tax credits that help reduce the overall tax liability for individuals and businesses in Kentucky.

What information must be reported on KY Form QCC1?

The information that must be reported on KY Form QCC1 includes the taxpayer's name and identification number, details of the credits being claimed, supporting documentation for the credits, and any other relevant information required by the Kentucky Department of Revenue.

Fill out your KY Form QCC1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY Form qcc1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.