Get the free PERSONAL FINANCIAL INFORMATION

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial information

Edit your personal financial information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial information online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal financial information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial information

How to fill out personal financial information:

01

Start by gathering all relevant financial documents, such as bank statements, investment statements, tax returns, and pay stubs.

02

Organize these documents in a systematic manner, ensuring that all information is readily accessible when needed.

03

Begin by filling out basic personal information, such as your name, address, contact details, and social security number. This information is crucial for identification purposes.

04

Move on to documenting your income sources, including your salary, wages, bonuses, commissions, and any other sources of income you may have.

05

List all your assets, such as properties, vehicles, investments, and valuable possessions. Be sure to include details such as their estimated value and any outstanding loans or mortgages.

06

Provide a comprehensive breakdown of your liabilities, including credit card debts, student loans, mortgages, and any other outstanding loans.

07

Disclose your monthly expenses, including rent/mortgage payments, utilities, insurance, groceries, transportation costs, and any other necessary expenditures.

08

Consider including information about your financial goals, such as saving for retirement, purchasing a home, or paying off debts. This gives a more holistic view of your financial situation.

09

Double-check all the information provided to ensure accuracy and completeness. Any inaccuracies can lead to issues later on.

10

Finally, sign and date the document, confirming that all the information provided is true and accurate.

Who needs personal financial information:

01

Individuals applying for loans or credit: Lenders require personal financial information to assess an individual's creditworthiness and determine whether to approve or deny a loan application.

02

Financial advisors and planners: Professionals in the financial industry use personal financial information to provide tailored advice and create customized financial plans for their clients.

03

Employers and human resources departments: Some employers may request personal financial information, particularly for positions that involve handling company funds or sensitive financial information.

04

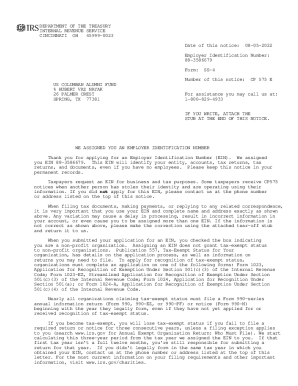

Government agencies: Government entities, such as the Internal Revenue Service (IRS), may require individuals to provide personal financial information for tax reporting purposes or when applying for certain benefits or assistance programs.

05

Insurance companies: When applying for insurance coverage, such as life or health insurance, individuals may need to disclose personal financial information to determine premium rates and eligibility.

Remember, it is crucial to exercise caution and protect your personal financial information. Only share it with trusted entities or individuals who have a legitimate need for the information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal financial information to be eSigned by others?

Once your personal financial information is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I edit personal financial information on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing personal financial information.

Can I edit personal financial information on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as personal financial information. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is personal financial information?

Personal financial information includes details about an individual's assets, liabilities, income, expenses, investments, and other financial activities.

Who is required to file personal financial information?

Public officials, government employees, and certain individuals in positions of authority are typically required to file personal financial information.

How to fill out personal financial information?

Personal financial information can be filled out on specific forms provided by the relevant authority, detailing all relevant financial activities and holdings.

What is the purpose of personal financial information?

The purpose of personal financial information is to increase transparency, prevent conflicts of interest, and ensure accountability among public officials and individuals in positions of authority.

What information must be reported on personal financial information?

Information such as assets, liabilities, income sources, investments, real estate holdings, and other financial interests must typically be reported on personal financial information.

Fill out your personal financial information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.