Get the free TOD (Beneficiary) Deed - saclaw

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tod beneficiary deed

Edit your tod beneficiary deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tod beneficiary deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tod beneficiary deed online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tod beneficiary deed. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tod beneficiary deed

How to Fill Out TOD Beneficiary Deed?

01

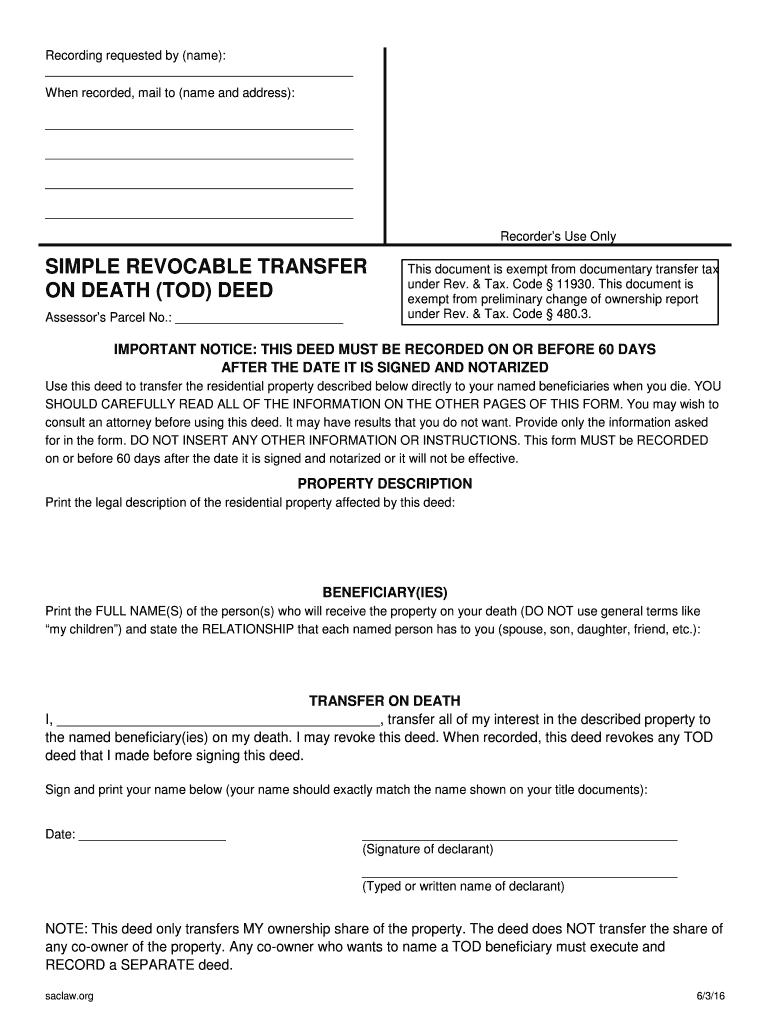

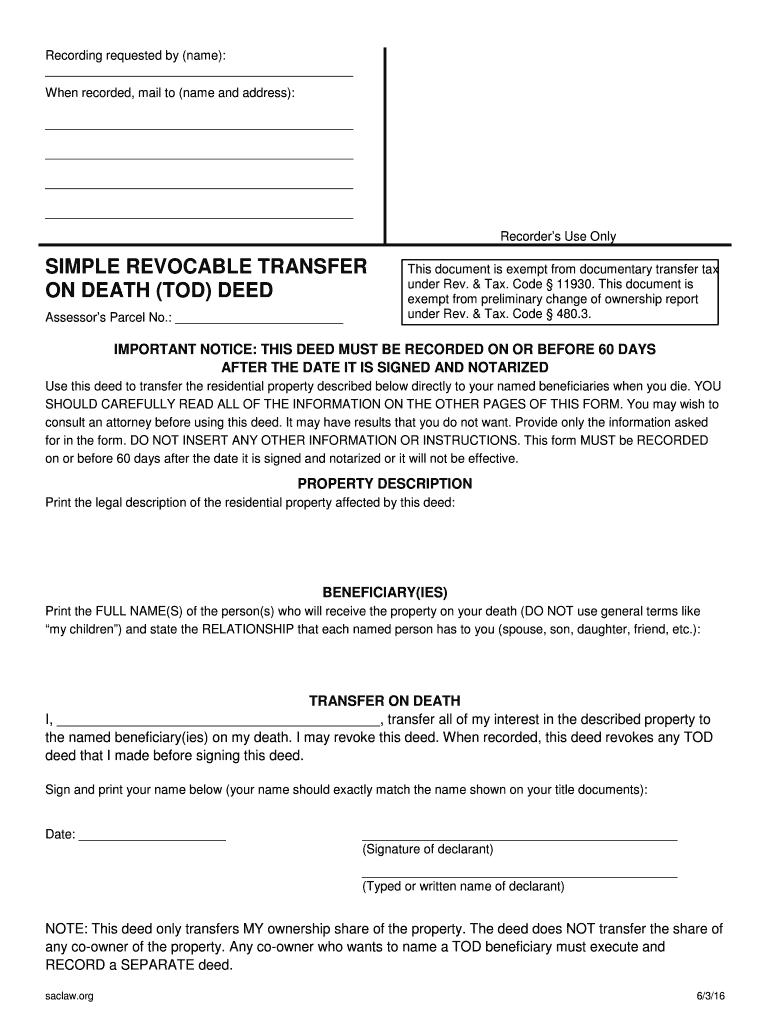

Begin by obtaining the necessary form: To fill out a TOD (Transfer on Death) beneficiary deed, you will need to acquire the specific form provided by your local county recorder's office or a legal document service. This form may also be available online on the official government website.

02

Gather all required information: Before starting to fill out the TOD beneficiary deed, gather all the essential information you will need, including the full legal names and addresses of the beneficiaries who will receive the property upon your passing. Additionally, you will need the legal description of the property, which can typically be found on the property deed or by requesting it from the county assessor's office.

03

Accurately complete the deed form: Using legible and precise handwriting, complete all sections of the TOD beneficiary deed form. Provide your own full legal name and address, as well as any other necessary personal details as required by the form. Fill in the legal description of the property accurately and double-check for any errors or omissions. Follow the instructions provided on the form carefully.

04

Indicate the beneficiaries: On the TOD beneficiary deed form, clearly identify the beneficiaries who will inherit the property upon your death. Include their full legal names and addresses. You may need to indicate the percentage of ownership each beneficiary will have, which should add up to 100%.

05

Notarize the deed: Once you have filled out the TOD beneficiary deed form completely, you must have it notarized. Sign the form in the presence of a notary public, who will verify your identity and witness your signature. The notary will then affix their official seal and signature to the deed, acknowledging its authenticity.

06

Record the deed with the county recorder: After notarization, submit the TOD beneficiary deed to the county recorder's office in the county where the property is located. There will likely be a recording fee to pay, but it ensures the deed is properly recorded and becomes part of the public record.

Who Needs TOD Beneficiary Deed?

01

Individuals with real property: Anyone who owns real property and wants to control who inherits it after their death could benefit from a TOD beneficiary deed. It is particularly relevant for individuals who want to bypass the potentially lengthy and costly process of probate.

02

Owners seeking flexibility: TOD beneficiary deeds provide flexibility, as they can be revoked or changed at any time during the owner's lifetime. If circumstances change, and the owner wishes to designate new beneficiaries or adjust their shares, they can easily update the TOD beneficiary deed.

03

Families looking to simplify estate planning: TOD beneficiary deeds offer a relatively straightforward way to transfer property outside of probate, reducing the complexity and costs associated with traditional estate planning methods. By utilizing a TOD beneficiary deed, families can plan for the future and ensure a smooth transfer of property to their chosen beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tod beneficiary deed directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tod beneficiary deed and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find tod beneficiary deed?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tod beneficiary deed in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the tod beneficiary deed electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tod beneficiary deed in seconds.

What is tod beneficiary deed?

A tod beneficiary deed, also known as a transfer-on-death deed, is a legal document used to transfer real estate to a named beneficiary upon the owner's death without the need for probate.

Who is required to file tod beneficiary deed?

The property owner is required to file a tod beneficiary deed in order to designate a beneficiary to inherit the property upon their death.

How to fill out tod beneficiary deed?

To fill out a tod beneficiary deed, the property owner must provide their personal information, details of the property, and the name of the designated beneficiary.

What is the purpose of tod beneficiary deed?

The purpose of a tod beneficiary deed is to allow the property owner to transfer real estate to a beneficiary without the need for probate, making the transfer process quicker and easier for the beneficiary.

What information must be reported on tod beneficiary deed?

The tod beneficiary deed must contain the property owner's information, details of the property being transferred, and the name of the designated beneficiary.

Fill out your tod beneficiary deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tod Beneficiary Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.