Get the free IFTA Quarterly Statement Blank

Show details

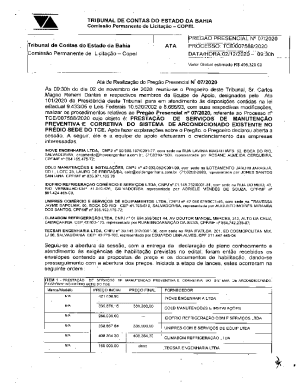

Maine Bureau of Motor Vehicles Fuel Type: Diesel 3Q/16 IFTA Quarterly Fuel Use Tax Schedule SSN/VEIN: Carrier Name: Return Due Date: October 31, 2016 IFTA101 (page 1) Use this form to report operations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifta quarterly statement blank

Edit your ifta quarterly statement blank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta quarterly statement blank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ifta quarterly statement blank online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ifta quarterly statement blank. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifta quarterly statement blank

01

Start by obtaining the ifta quarterly statement blank form from the official website of your state's department of revenue or transportation.

02

Fill in the necessary identifying information at the top of the form, such as your name, company name, address, and ifta account number.

03

Provide the reporting period for which the ifta quarterly statement relates. This typically includes the start and end dates of the quarter being reported.

04

Record the distance traveled in each jurisdiction during the reporting period. This should include the total number of miles or kilometers driven in each state or province.

05

Calculate the total taxable and nontaxable miles or kilometers for each jurisdiction based on the type of operation (interstate or intrastate) and the applicable tax rates for each jurisdiction.

06

Determine the total gallons or liters of fuel purchased in each jurisdiction during the reporting period. This information can usually be obtained from fuel purchase receipts or records.

07

Calculate the taxable and nontaxable gallons or liters of fuel consumed in each jurisdiction based on the type of operation and the applicable tax rates.

08

Use the provided formulas to calculate the fuel tax due or refundable for each jurisdiction. This is typically based on the taxable gallons or liters consumed and the tax rates for each jurisdiction.

09

Summarize the total distance traveled, total fuel consumed, and total fuel tax due or refundable for all jurisdictions combined.

10

Review the completed ifta quarterly statement blank for accuracy and ensure that all required information has been provided. Make any necessary corrections before submitting the form.

Who needs ifta quarterly statement blank?

01

Trucking companies or individual truck owners who operate vehicles that weigh 26,000 pounds or more and are used for transporting goods across state or provincial lines.

02

Companies or individuals that have ifta accounts and are required to report and pay fuel taxes for their qualified motor vehicles.

03

Motor carriers who operate vehicles in multiple jurisdictions and have registered with the International Fuel Tax Agreement (IFTA) to simplify their fuel tax reporting and payment obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ifta quarterly statement blank without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your ifta quarterly statement blank into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the ifta quarterly statement blank in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your ifta quarterly statement blank directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the ifta quarterly statement blank form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign ifta quarterly statement blank and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is ifta quarterly statement blank?

IFTA quarterly statement blank is a form used by interstate motor carriers to report and calculate fuel taxes.

Who is required to file ifta quarterly statement blank?

Interstate motor carriers who operate qualified motor vehicles are required to file IFTA quarterly statement blank.

How to fill out ifta quarterly statement blank?

To fill out IFTA quarterly statement blank, motor carriers need to record the miles traveled and fuel purchased in each jurisdiction.

What is the purpose of ifta quarterly statement blank?

The purpose of IFTA quarterly statement blank is to simplify the reporting and payment of fuel taxes for interstate motor carriers.

What information must be reported on ifta quarterly statement blank?

Information such as miles traveled, fuel purchased, and taxes owed must be reported on IFTA quarterly statement blank.

Fill out your ifta quarterly statement blank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Quarterly Statement Blank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.