Get the free 401k Services

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k services

Edit your 401k services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401k services online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 401k services. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

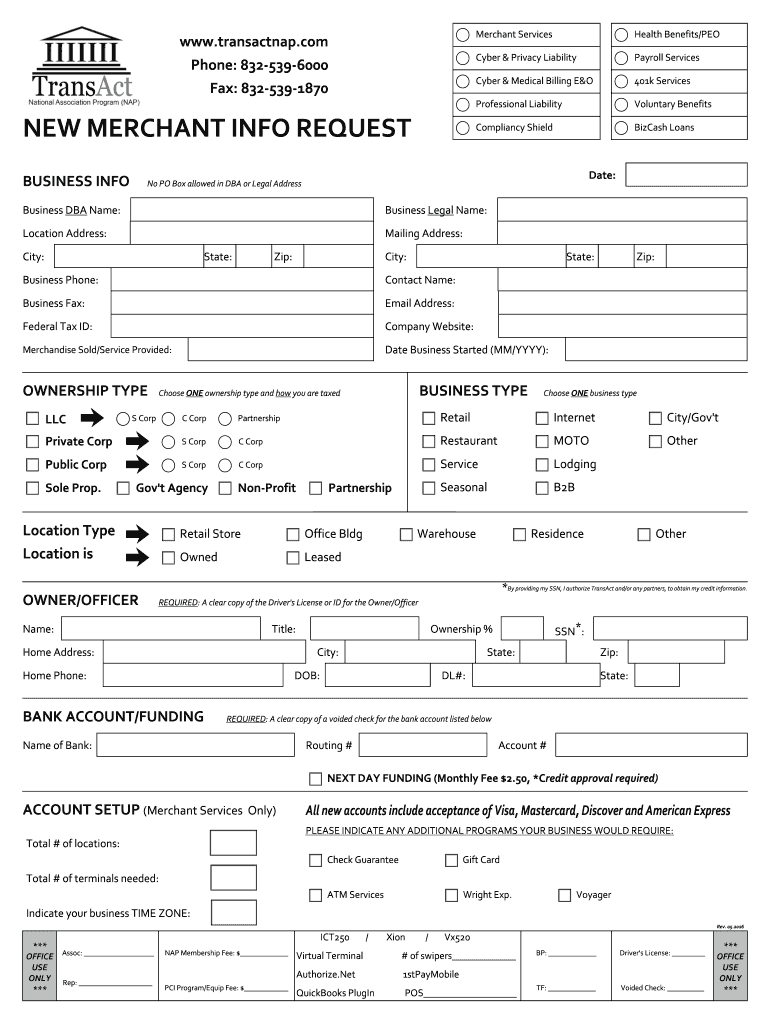

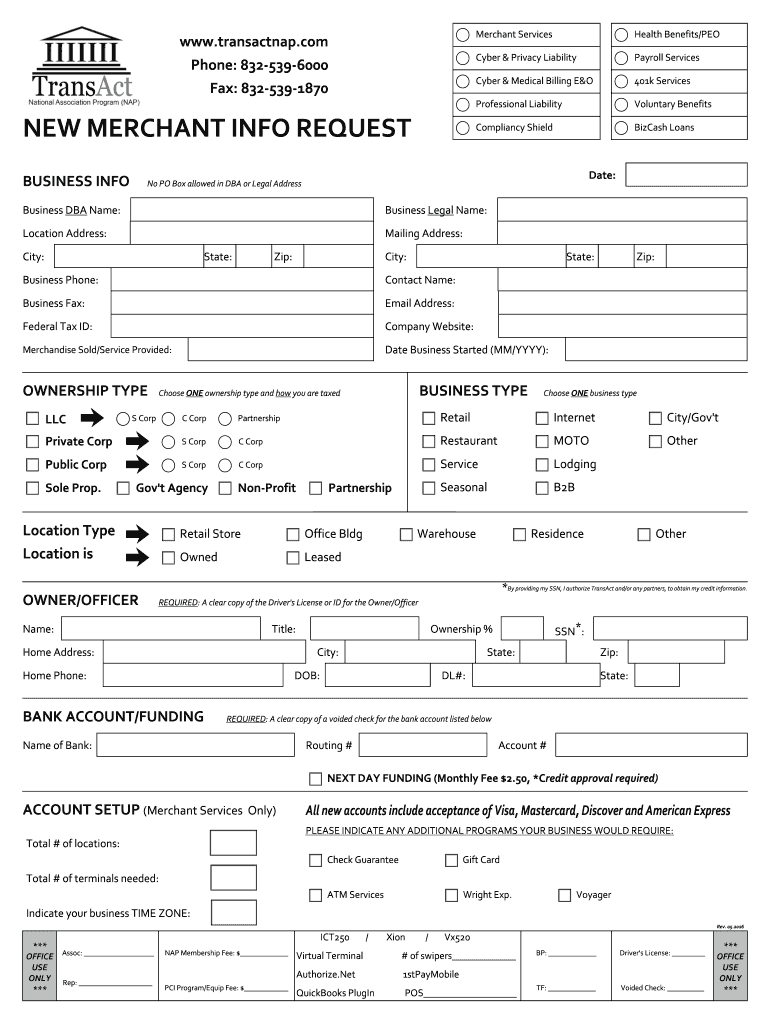

How to fill out 401k services

How to fill out 401k services:

01

Start by understanding the basics of a 401k plan. Educate yourself about contributions, investment options, and potential employer matching.

02

Contact your employer to inquire about their 401k program and obtain the necessary forms or online access.

03

Carefully review the enrollment materials and investment options. Take note of any fees and expenses associated with the plan.

04

Determine how much you want to contribute to your 401k and complete the contribution election form. Be aware of any contribution limits set by the IRS.

05

Consider taking advantage of employer matching contributions if available. Find out if there are any matching guidelines or vesting periods.

06

Designate your beneficiaries. Decide who will receive your 401k assets in the event of your death.

07

Choose your investment options. Review the available funds, such as stocks, bonds, and mutual funds, and select those that align with your financial goals and risk tolerance.

08

Monitor and manage your 401k account periodically. Regularly review your investment performance and consider making adjustments if necessary.

09

Stay informed about any changes to your employer's 401k plan or updates in tax laws that may impact your contributions or withdrawals.

Who needs 401k services:

01

Individuals employed by companies offering a 401k retirement plan.

02

People who want to save for retirement and take advantage of potential tax benefits.

03

Individuals who prefer having the ability to invest their retirement savings in a variety of investment options.

04

Employees who want to receive employer matching contributions to boost their retirement savings.

05

Self-employed individuals who have set up their own solo 401k plan.

06

Those who understand the importance of long-term retirement planning and want a vehicle to accumulate wealth over time.

07

Individuals who desire a convenient and automated way to save for retirement through regular salary deductions.

08

Anyone looking to secure their financial future and ensure a comfortable retirement.

09

Employees who want the flexibility to make pre-tax contributions that reduce their taxable income.

Note: It is important to consult with a financial advisor or tax professional for personalized advice regarding 401k services and retirement planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 401k services directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 401k services as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in 401k services?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 401k services to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit 401k services on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 401k services from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your 401k services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.