Get the free real estate tax relief for the elderly and/or totally disabled application

Show details

REAL ESTATE TAX RELIEF FOR THE ELDERLY AND/OR TOTALLY DISABLED APPLICATION DUE DATE: CITY OF STAUNTON, COMMISSIONER OF REVENUE 116 West Beverley Street, P. O. Box 4 Staunton, VA 244020004 (540) 3323829

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate tax relief

Edit your real estate tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

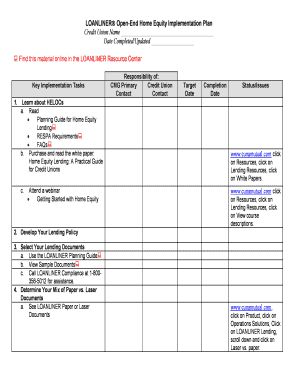

How to edit real estate tax relief online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit real estate tax relief. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

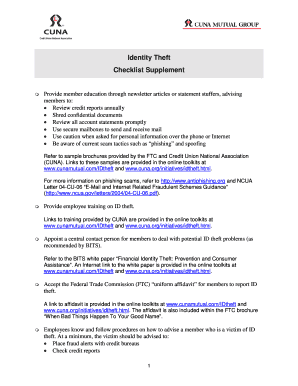

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate tax relief

01

Gather all necessary documents: Before filling out the real estate tax relief form, make sure you have all the required documents handy. This typically includes your property tax statement, income verification documents, and any other relevant financial statements.

02

Read and understand the instructions: Carefully go through the instructions provided with the real estate tax relief form. This will help you understand the requirements, eligibility criteria, and any specific information you need to provide.

03

Complete the personal information section: Start by filling out the personal information section of the form, which typically includes your name, address, contact details, and taxpayer identification number. Make sure to provide accurate and up-to-date information.

04

Provide details about the property: The form will require you to provide details about the property for which you are seeking tax relief. This may include the property's address, ownership information, and specific details related to its classification, size, and usage.

05

Include income information: Real estate tax relief programs often consider the applicant's income to determine eligibility. Provide accurate information about your household income, including any supporting documentation that may be required.

06

Specify the reason for requesting tax relief: Different jurisdictions may offer tax relief for various reasons, such as low income, age, disability, or other qualifying factors. Clearly state the reason for your tax relief request and provide any required documentation to support your claim.

07

Attach supporting documents: Along with the completed form, ensure that you attach all the necessary supporting documents as specified in the instructions. This may include income statements, property tax statements, proof of age or disability, and any other relevant paperwork.

08

Review and double-check: Before submitting the form, carefully review all the information you have provided. Check for any errors or omissions, ensuring that all details are accurate and up-to-date. Any mistakes could delay the processing of your application.

09

Submit the form: Once you are satisfied that all the information is correct, submit the completed form and any supporting documents as instructed. Make sure to keep a copy of the form for your records.

Who needs real estate tax relief?

01

Homeowners facing financial hardships: Real estate tax relief programs are often designed to assist homeowners who are experiencing financial difficulties. These individuals may have limited income, high medical expenses, or other circumstances that make it challenging to pay property taxes.

02

Seniors or retirees: Many jurisdictions offer real estate tax relief specifically for senior citizens or retirees. These programs take into account the reduced income often experienced during retirement and aim to alleviate the financial burden of property taxes for this demographic.

03

Individuals with disabilities: Some real estate tax relief programs cater to individuals with disabilities. These programs recognize the additional financial strain that disabilities may impose and provide assistance to help these individuals manage their property tax obligations.

04

Low-income households: Real estate tax relief is often available to individuals or families with low incomes. These programs aim to ensure that property taxes do not disproportionately burden those with limited financial resources.

05

Individuals affected by natural disasters: In the aftermath of a natural disaster, jurisdictions may offer temporary real estate tax relief to homeowners who have suffered property damage or loss. This provides some relief during the recovery period.

It's important to note that the availability and eligibility criteria for real estate tax relief programs vary depending on the jurisdiction. It's advisable to contact your local tax authority or consult a tax professional for specific information related to your circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete real estate tax relief online?

pdfFiller has made it easy to fill out and sign real estate tax relief. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the real estate tax relief in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your real estate tax relief in minutes.

How do I fill out the real estate tax relief form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign real estate tax relief and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is real estate tax relief?

Real estate tax relief is a program that provides financial assistance to property owners by reducing or eliminating the amount of property tax they owe.

Who is required to file real estate tax relief?

Property owners who meet certain criteria, such as income limits or age requirements, may be required to file for real estate tax relief.

How to fill out real estate tax relief?

To fill out real estate tax relief, property owners typically need to submit an application form along with supporting documentation, such as proof of income or age.

What is the purpose of real estate tax relief?

The purpose of real estate tax relief is to provide financial assistance to property owners who may be struggling to pay their property taxes.

What information must be reported on real estate tax relief?

Property owners may need to report information such as their income, age, and property value on real estate tax relief forms.

Fill out your real estate tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Tax Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.