Get the free For calendar plan year 2016 or fiscal plan year beginning - dol

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for calendar plan year

Edit your for calendar plan year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for calendar plan year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for calendar plan year online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit for calendar plan year. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for calendar plan year

How to fill out for calendar plan year?

01

Start by gathering all necessary information about your organization's financial activities and plans for the upcoming year.

02

Review the previous year's calendar plan and make any necessary updates or revisions.

03

Determine the specific goals and objectives you want to achieve during the calendar plan year.

04

Create a timeline or schedule for each major event or activity that will take place during the year.

05

Assign responsibilities to team members or departments for each task or activity.

06

Allocate resources such as budget, manpower, and equipment to support the plan.

07

Fill out the calendar plan year document or template, including all relevant details such as start and end dates, milestones, deadlines, and any other important information.

08

Review the completed calendar plan year document to ensure accuracy and consistency.

09

Seek approval from the appropriate authority or management before finalizing the plan.

10

Communicate the calendar plan year to all relevant stakeholders and team members to ensure everyone is aware of their roles and responsibilities.

Who needs for calendar plan year?

01

Organizations of all sizes and types can benefit from having a calendar plan year in place.

02

Businesses use it to outline their strategic objectives, financial targets, and important dates for various activities.

03

Non-profit organizations use it to plan fundraising events, community outreach programs, and other initiatives.

04

Educational institutions use it to schedule school terms, exams, holidays, and extra-curricular activities.

05

Government agencies use it to plan public programs, initiatives, and projects.

Overall, anyone who wants to have a clear roadmap of their upcoming year, whether it's for personal, professional, or organizational purposes, can benefit from creating and filling out a calendar plan year.

Fill

form

: Try Risk Free

People Also Ask about

What is the lookback year for HCE?

Generally, an employee is an HCE under the ownership test if he or she is a 5% owner at any time during the current plan year (also known as the determination year) or the 12-month period immediately preceding the determination year (also known as the lookback year).

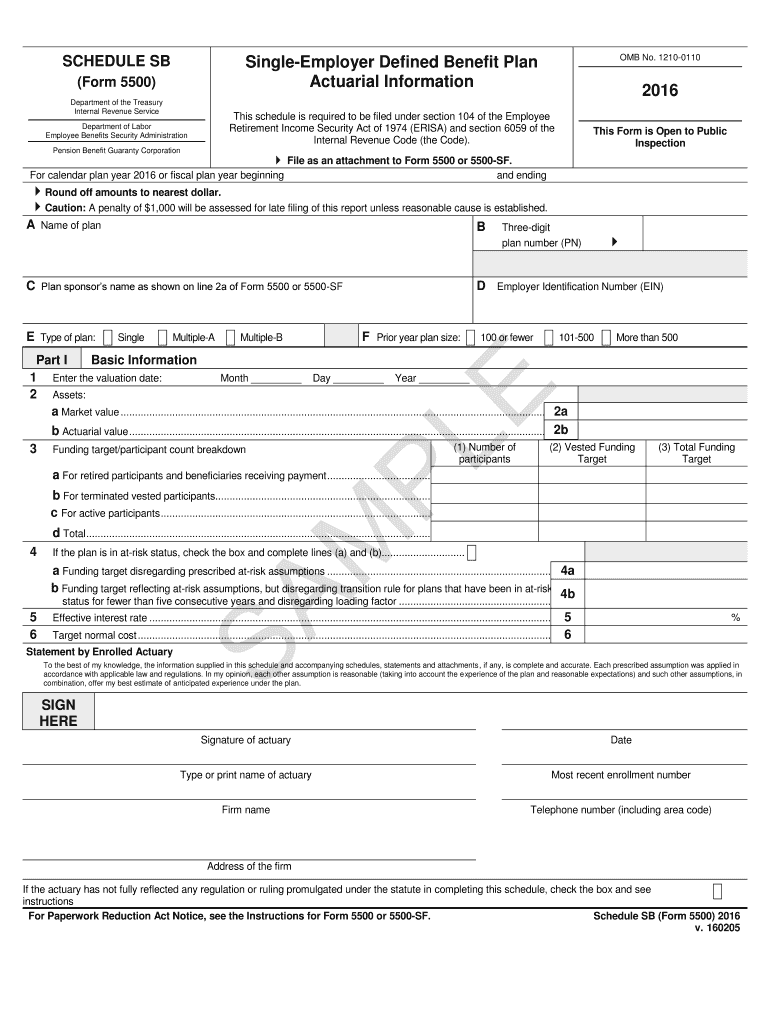

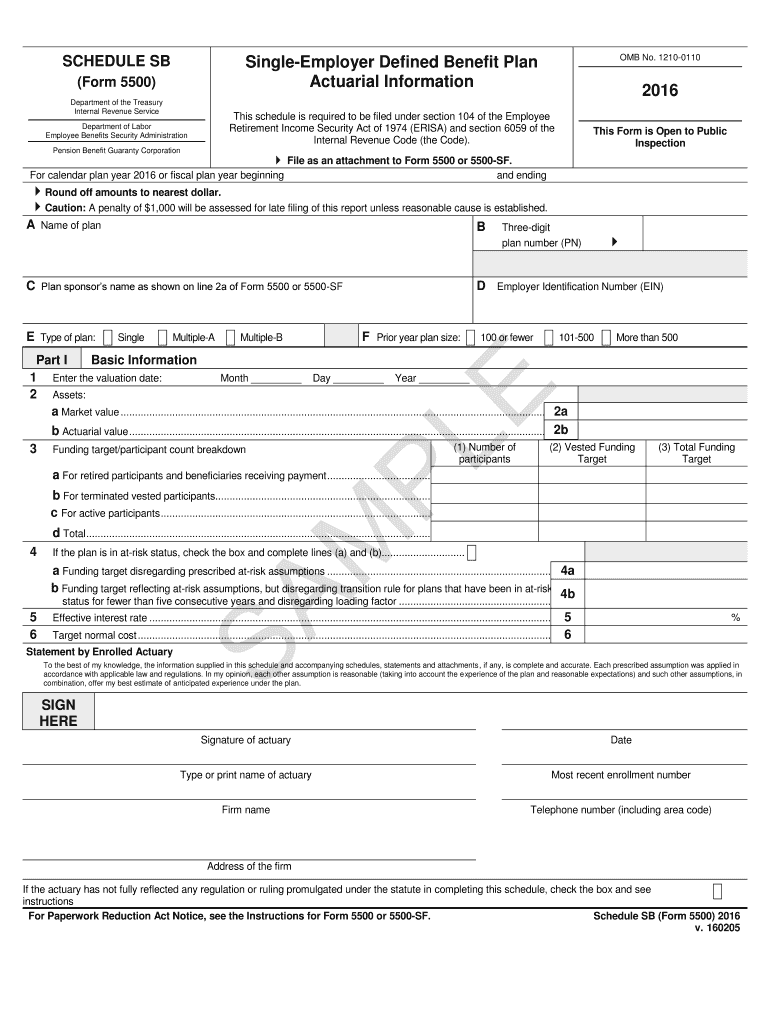

What is form 5500 Schedule C?

FORM 5500 SCHEDULE C GENERAL BACKGROUND The Schedule C of Form 5500 disclosure rules provide that each retirement plan required to file a Schedule C of Form 5500, review and potentially report, any “direct” and “indirect” compensation received by its service providers in connection with their services to the plan.

Can I contribute to a 401k and a SIMPLE IRA in the same year?

You can't contribute to a SIMPLE IRA plan for any calendar year in which an employee either: receives an allocation of contributions in a defined contribution plan, such as a 401(k), profit-sharing, money purchase, 403(b) or SARSEP plan; or.

Can I max out a SIMPLE IRA and a 401k in the same year?

Making non-deductible IRA or Roth IRA contributions You can make maximum contributions to both an employer plan such as a 401(k) and an IRA in the same year, assuming you have earned income and you otherwise qualify. But you may not be able to deduct your traditional IRA contribution, depending on your income.

How much can you contribute to a 401k and IRA in the same year?

401(k): You can contribute up to $22,500 in 2023 ($30,000 for those age 50 or older). IRA: You can contribute up to $6,500 in 2023 ($7,500 if age 50 and older). You can contribute that amount to a traditional IRA or a Roth IRA, or you can divvy up your money into each type of plan.

What is a Schedule R form 5500?

Purpose of Schedule Schedule R (Form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the adoption of amendments, as well as certain information on single employer and multiemployer defined benefit plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my for calendar plan year directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your for calendar plan year and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for signing my for calendar plan year in Gmail?

Create your eSignature using pdfFiller and then eSign your for calendar plan year immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit for calendar plan year on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing for calendar plan year.

What is for calendar plan year?

The calendar plan year typically runs from January 1st to December 31st.

Who is required to file for calendar plan year?

Employers and individuals who operate on a calendar year basis are required to file for calendar plan year.

How to fill out for calendar plan year?

To fill out for calendar plan year, individuals or employers must gather all relevant financial and operational information for the year and complete the necessary forms or documents.

What is the purpose of for calendar plan year?

The purpose of for calendar plan year is to track financial and operational activities over a specific twelve-month period.

What information must be reported on for calendar plan year?

Information that must be reported for calendar plan year includes income, expenses, assets, liabilities, and any other relevant financial data.

Fill out your for calendar plan year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Calendar Plan Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.