Get the free MARYLAND FORM EL101 E-file DECLARATION FOR ELECTRONIC FILING 2016

Show details

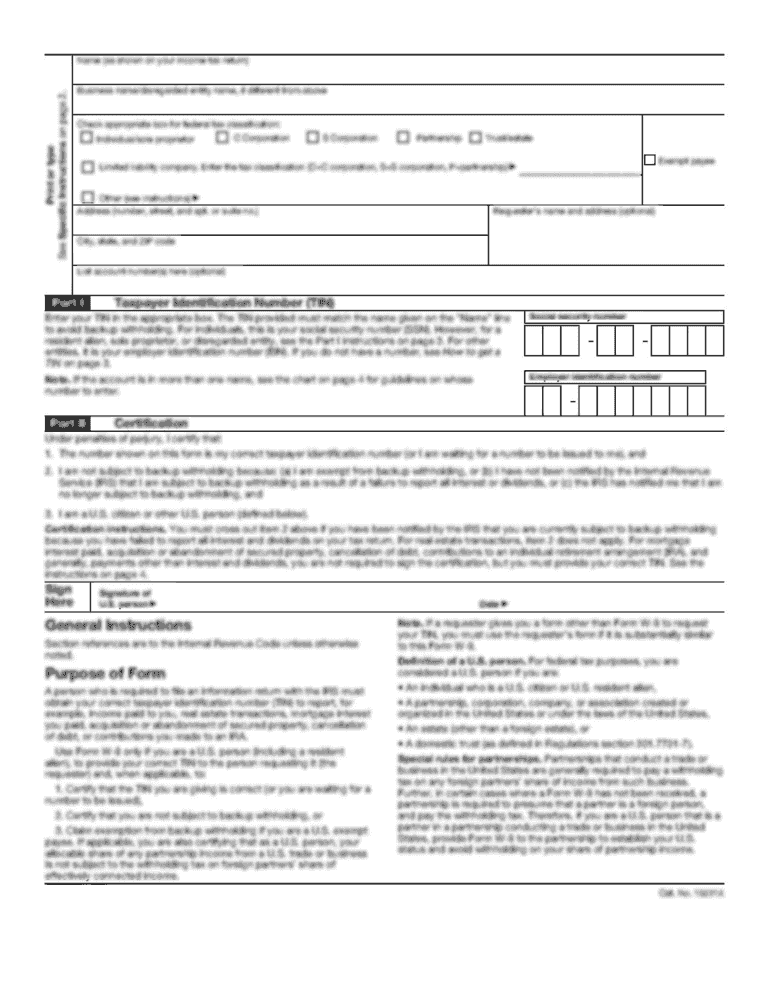

MARYLAND FORM EL101 2016 file DECLARATION FOR ELECTRONIC FILING Initial Last Name Spouse's First Name Initial Spouse's Last Name Part I SSN/Taxpayer Identification Number Tax Return Information (whole

We are not affiliated with any brand or entity on this form

Instructions and Help about maryland form el101 e-file

How to edit maryland form el101 e-file

How to fill out maryland form el101 e-file

Instructions and Help about maryland form el101 e-file

How to edit maryland form el101 e-file

To edit the maryland form el101 e-file, you can use pdfFiller, which provides user-friendly tools for modifying your document. Begin by uploading your existing form onto the pdfFiller platform. Utilize the editing tools to make necessary changes, such as updating personal information or adjusting financial figures. Once edited, save the modifications and prepare to either submit electronically or print the document for physical submission.

How to fill out maryland form el101 e-file

Filling out the maryland form el101 e-file involves several key steps to ensure accuracy and compliance. Start by gathering all relevant financial documents, including income statements and expenses records. Follow these steps:

01

Open the pdfFiller platform and upload the form.

02

Input your personal information in the designated sections.

03

Provide details on your income and any applicable deductions.

04

Review the information for accuracy before proceeding to submission.

Latest updates to maryland form el101 e-file

Latest updates to maryland form el101 e-file

Stay informed about the latest updates to the maryland form el101 e-file, as changes can affect filing procedures, deadlines, and eligibility criteria. Regularly check the Maryland State Comptroller's website or consult tax resources for any modifications affecting the current tax year.

All You Need to Know About maryland form el101 e-file

What is maryland form el101 e-file?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About maryland form el101 e-file

What is maryland form el101 e-file?

The maryland form el101 e-file is an electronic submission form used for filing certain tax returns in the state of Maryland. This form facilitates taxpayers in reporting their income and tax liabilities while ensuring compliance with state tax laws. It is specifically designed for individuals and businesses eligible to file electronically.

What is the purpose of this form?

The purpose of the maryland form el101 e-file is to streamline the tax filing process for Maryland taxpayers. By using this form, filers can report their earnings and pay any taxes due in a timely manner, ensuring they meet the state's tax obligations. Electronic filing enhances efficiency and reduces errors compared to paper filing.

Who needs the form?

Individuals and businesses that have taxable income in Maryland are required to use the maryland form el101 e-file. This includes employed individuals, self-employed persons, and corporations. Additionally, those who wish to take advantage of the benefits of electronic filing should use this form to ensure accurate and timely submissions.

When am I exempt from filling out this form?

You may be exempt from filing the maryland form el101 e-file if your income falls below the state's taxable threshold. Additionally, if you are not a Maryland resident or do not have any taxable income from Maryland sources, you do not need to file this form. Always confirm your eligibility by consulting the Maryland tax guidelines.

Components of the form

The maryland form el101 e-file includes several key components that must be completed accurately. These components typically encompass the taxpayer's name, address, Social Security number, income details, and any deductions or credits claimed. Ensuring that all parts are filled out correctly will help avoid delays in processing.

Due date

The due date for submitting the maryland form el101 e-file aligns with the federal tax deadline, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to verify the specific due date for the current tax year to ensure timely filing.

Form vs. Form

Comparing the maryland form el101 e-file to other forms, such as the federal tax return forms, highlights key differences. The el101 is specifically tailored for Maryland tax reporting, while federal forms address nationwide taxation. Understanding these distinctions is critical for accurate tax filings and compliance.

What payments and purchases are reported?

The maryland form el101 e-file requires reporting of various types of income, including wages, business income, and investment earnings. Additionally, taxpayers must accurately report any significant purchases that may qualify for tax deductions or credits, helping to ensure a comprehensive view of their financial situation.

How many copies of the form should I complete?

Typically, only one copy of the maryland form el101 e-file needs to be completed and submitted electronically. However, it is advisable to retain a copy for your records. Keeping records of submitted forms is essential for future reference and in case of audits or discrepancies.

What are the penalties for not issuing the form?

Failure to file the maryland form el101 e-file on time may result in penalties imposed by the state of Maryland. These penalties can include late filing fees and interest on any unpaid taxes. To avoid these penalties, ensure that you file your form by the due date and pay any taxes owed promptly.

What information do you need when you file the form?

When filing the maryland form el101 e-file, it is crucial to have accurate information readily available. This includes your identification details, income figures, amounts for any deductions and credits, and bank account information for direct deposit of any refunds. Having this information organized will facilitate smoother filing.

Is the form accompanied by other forms?

The maryland form el101 e-file may need to be accompanied by other related forms, depending on your specific tax situation. For example, if you claim certain deductions or credits, you may need to include additional schedules or forms to provide complete information to the state tax authority.

Where do I send the form?

For electronic submissions of the maryland form el101 e-file, you will typically send it through the Maryland Comptroller’s e-file system. Ensure that you follow the instructions provided on the form or the state tax website for directing your submission correctly. This ensures that your form reaches the appropriate tax authority without delays.

See what our users say