Get the free Objection to an Assessment or Decision. Objection to an Assessment or Decision Other...

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign objection to an assessment

Edit your objection to an assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your objection to an assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing objection to an assessment online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit objection to an assessment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out objection to an assessment

How to fill out objection to an assessment:

01

Start by reviewing the assessment: Carefully read through the assessment report or notice provided by the assessing authority. Take note of any errors, inconsistencies, or reasons that you believe warrant an objection.

02

Gather supporting documents: Collect any relevant documents or evidence that support your objection. This might include receipts, invoices, financial statements, or any other documentation that contradicts the assessment.

03

Prepare your objection letter: Write a clear and concise letter stating your objection to the assessment. Include your contact information, the date of the assessment, the assessment number, and any other relevant details. Clearly explain the basis for your objection and provide supporting evidence where appropriate.

04

Submit the objection letter: Send your objection letter to the relevant assessing authority by mail or electronically, following their specified submission process. Make sure to retain a copy of the letter and any supporting documents for your records.

05

Follow up: After submitting your objection, it is important to follow up with the assessing authority to ensure that your objection has been received and is being processed. This may involve making phone calls, sending emails, or requesting a confirmation of receipt.

Who needs objection to an assessment?

01

Individuals: Any individual who believes that their assessment is incorrect, unfair, or inconsistent with their circumstances may need to file an objection. This could include taxpayers who feel that their income, deductions, or tax liabilities have been inaccurately assessed.

02

Businesses: Businesses that disagree with their assessed tax liabilities, deductions, or any other aspect of the assessment may also need to file an objection. This can include corporations, partnerships, self-employed individuals, and other entities subject to taxation.

03

Property owners: Property owners who believe that their property has been overvalued or wrongly assessed for property taxes may need to file an objection. This could include residential homeowners, landlords, commercial property owners, or anyone affected by property tax assessments.

Remember, specific rules, procedures, and timelines for lodging objections to assessments may vary depending on your jurisdiction and the type of assessment. It is advisable to consult with a tax professional or seek guidance from the relevant assessing authority to ensure compliance with the correct procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send objection to an assessment for eSignature?

To distribute your objection to an assessment, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the objection to an assessment electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your objection to an assessment in minutes.

How do I edit objection to an assessment straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing objection to an assessment.

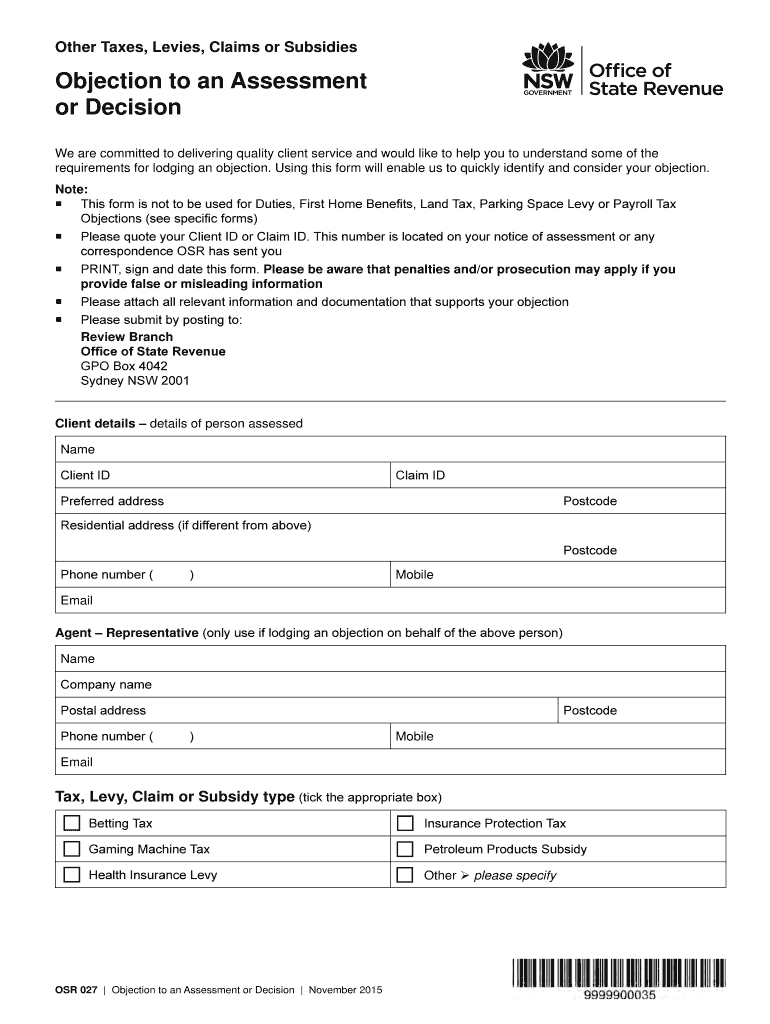

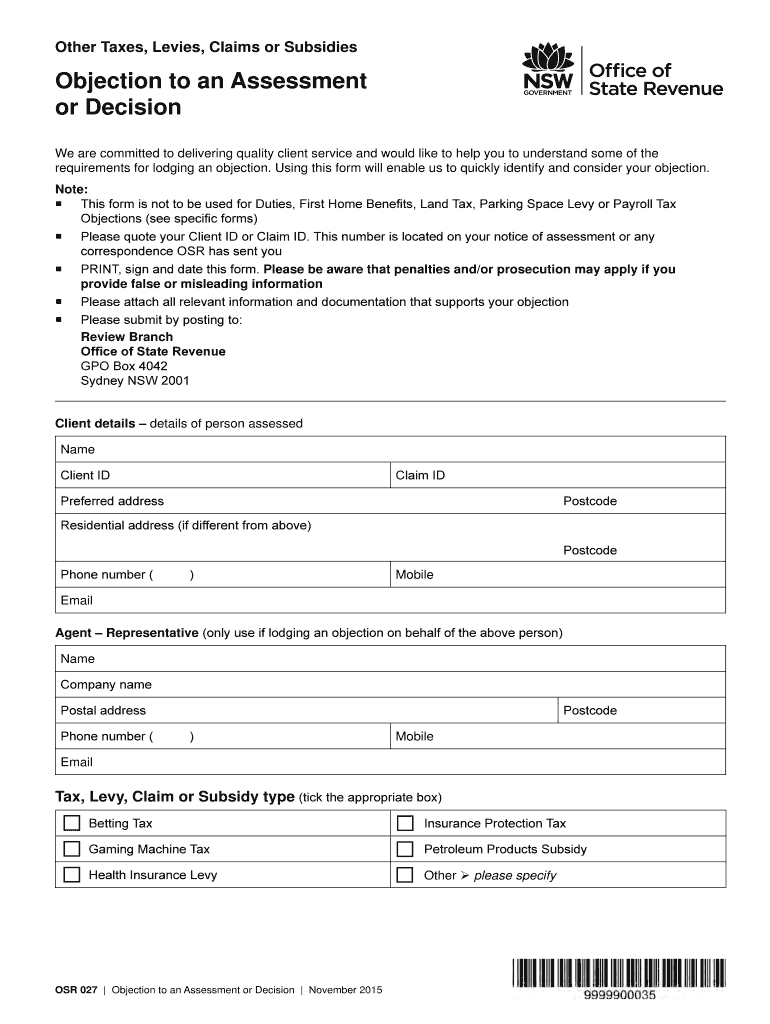

What is objection to an assessment?

An objection to an assessment is a formal complaint or protest against a decision or judgment made by an assessor regarding the value of a property or the amount of tax owed.

Who is required to file objection to an assessment?

Any property owner who disagrees with the assessment made by the assessor is required to file an objection to the assessment.

How to fill out objection to an assessment?

To fill out an objection to an assessment, the property owner must typically submit a written statement detailing the reasons for the objection and any supporting documentation.

What is the purpose of objection to an assessment?

The purpose of an objection to an assessment is to challenge the assessment made by the assessor and potentially have the value of the property reassessed.

What information must be reported on objection to an assessment?

The objection to an assessment must include the property owner's name, address, the property details, reasons for the objection, and any supporting evidence.

Fill out your objection to an assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Objection To An Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.