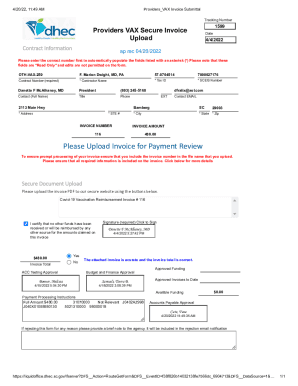

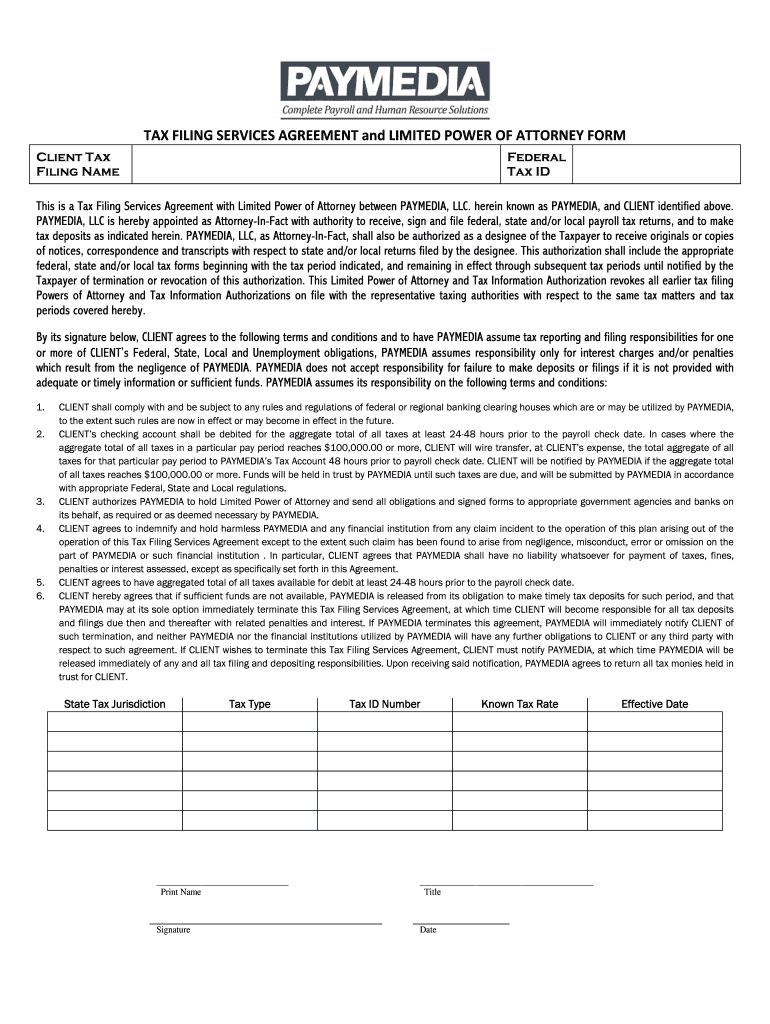

Get the free TAX FILING SERVICES AGREEMENT and LIMITED POWER OF ATTORNEY FORM

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax filing services agreement

Edit your tax filing services agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax filing services agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax filing services agreement online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax filing services agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax filing services agreement

To fill out a tax filing services agreement, follow these steps:

01

Start by reviewing the agreement: Carefully read through the entire agreement to understand its terms and conditions. Pay attention to the scope of services, fees, confidentiality clauses, and any other relevant provisions.

02

Provide accurate information: Fill in all the necessary details accurately. This includes your personal information, such as name, address, and contact details, as well as your tax filing service provider's information.

03

Define the scope of services: Clearly outline the specific services you require from the tax filing service provider. This may include tasks like preparing and filing tax returns, providing tax advice, and representing you in dealings with tax authorities.

04

Specify payment terms: Indicate how much you will pay for the services and the preferred payment method. Make sure to include any additional charges, such as late payment fees or expenses that may be incurred.

05

Maintain confidentiality: Address any confidentiality concerns by including a clause that ensures the protection of your sensitive financial information. This can help safeguard your privacy and prevent unauthorized disclosure.

06

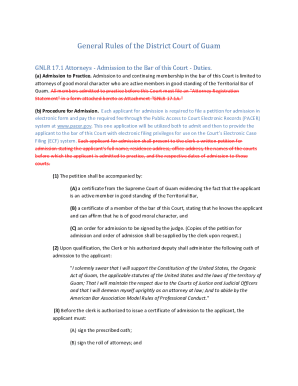

Include dispute resolution mechanisms: Determine how any potential disputes will be resolved. This may involve mediation, arbitration, or pursuing legal actions. Clear guidelines on dispute resolution can help prevent conflicts in the future.

07

Seek legal advice if needed: If you are unsure about any legal terms or provisions in the agreement, consider consulting an attorney to ensure your rights and interests are protected.

Who needs a tax filing services agreement?

A tax filing services agreement is beneficial for any individual or business that wants to outsource their tax filing responsibilities to a professional tax service provider. This can include small business owners, freelancers, self-employed individuals, and anyone who wants to ensure accurate and timely tax filings while minimizing the risk of errors or non-compliance.

By having a tax filing services agreement in place, both parties can establish clear expectations, protect their rights, and ensure a smooth working relationship throughout the tax filing process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the tax filing services agreement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax filing services agreement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out tax filing services agreement on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax filing services agreement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit tax filing services agreement on an Android device?

You can make any changes to PDF files, like tax filing services agreement, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is tax filing services agreement?

Tax filing services agreement is a contract between a taxpayer and a tax preparation service provider outlining the terms and conditions of the services to be provided for filing tax returns.

Who is required to file tax filing services agreement?

Any taxpayer who wants to avail the services of a tax preparation service provider may be required to file a tax filing services agreement.

How to fill out tax filing services agreement?

Tax filing services agreement can be filled out by providing details such as taxpayer's personal information, income sources, deductions, and any other relevant tax-related information.

What is the purpose of tax filing services agreement?

The purpose of tax filing services agreement is to ensure that both the taxpayer and the tax preparation service provider are on the same page regarding the services to be provided and the obligations of each party.

What information must be reported on tax filing services agreement?

The tax filing services agreement may require the reporting of taxpayer's personal details, income sources, deductions, and any other relevant tax information.

Fill out your tax filing services agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Filing Services Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.