Get the free Microfinance Credit Guarantee Facility - Microfinance Gateway - microfinancegateway

Show details

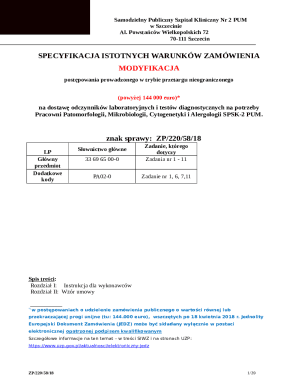

State Bank of Pakistan Microfinance Credit Guarantee Facility Microfinance Credit Guarantee Facility (MCG) 1. Objective of MCG Keeping in view the important role of microfinance in developing countries,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microfinance credit guarantee facility

Edit your microfinance credit guarantee facility form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microfinance credit guarantee facility form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit microfinance credit guarantee facility online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit microfinance credit guarantee facility. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out microfinance credit guarantee facility

How to fill out microfinance credit guarantee facility:

01

Obtain the application form from the appropriate microfinance institution or bank that offers the credit guarantee facility.

02

Carefully read through the instructions and requirements mentioned in the application form. Make sure you understand all the terms and conditions before proceeding.

03

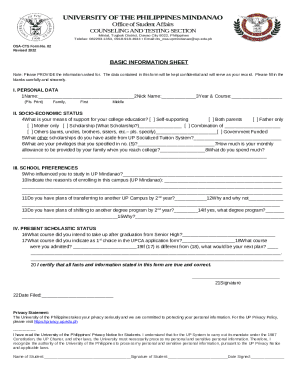

Fill in your personal details in the application form, including your full name, contact information, and identification details. Ensure that the information provided is accurate and up to date.

04

Provide details about your business or organization, such as its legal name, address, nature of the business, and the industry it operates in. This information helps the institution assess the viability of your business and its eligibility for the guarantee facility.

05

Specify the loan amount you are seeking and the purpose for which the funds will be utilized. Be clear and specific about your financial requirements and how the microfinance credit guarantee facility will support your business goals.

06

Attach any supporting documents required by the institution, such as financial statements, business plans, cash flow projections, or collateral documentation. These documents will help the institution evaluate the risk associated with your loan application.

07

Review the application form thoroughly before submission to ensure that all required sections have been completed accurately. Double-check for any errors or omissions that may delay the processing of your application.

Who needs microfinance credit guarantee facility:

01

Small and medium-sized enterprises (SMEs) that may have difficulty accessing conventional financing from banks or financial institutions.

02

Start-up businesses or entrepreneurs who lack sufficient collateral or credit history to secure traditional loans.

03

Individuals from low-income or disadvantaged backgrounds who require financial assistance to establish or expand their micro-enterprises.

04

Women-owned businesses that face additional barriers in accessing credit due to social or cultural factors.

05

Agricultural and rural enterprises that need funds for agricultural production, development, or agri-business activities.

Overall, the microfinance credit guarantee facility provides financial support to individuals and businesses that face challenges in obtaining loans from traditional sources. It aims to promote economic development, increase financial inclusion, and empower underserved communities by facilitating access to credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute microfinance credit guarantee facility online?

Completing and signing microfinance credit guarantee facility online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit microfinance credit guarantee facility straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing microfinance credit guarantee facility, you need to install and log in to the app.

How do I fill out microfinance credit guarantee facility on an Android device?

Use the pdfFiller app for Android to finish your microfinance credit guarantee facility. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is microfinance credit guarantee facility?

Microfinance credit guarantee facility is a mechanism that provides collateral or guarantee to microfinance institutions so they can obtain credit from banks or financial institutions.

Who is required to file microfinance credit guarantee facility?

Microfinance institutions are required to file for microfinance credit guarantee facility.

How to fill out microfinance credit guarantee facility?

To fill out microfinance credit guarantee facility, the microfinance institution needs to provide detailed information about their operations, financial standing, and the credits they are requesting guarantee for.

What is the purpose of microfinance credit guarantee facility?

The purpose of microfinance credit guarantee facility is to enable microfinance institutions to access credit easily and at lower interest rates, ultimately benefiting the underprivileged population they serve.

What information must be reported on microfinance credit guarantee facility?

The microfinance credit guarantee facility requires information about the microfinance institution's activities, financial performance, credit needs, and the specific guarantees they are requesting.

Fill out your microfinance credit guarantee facility online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microfinance Credit Guarantee Facility is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.