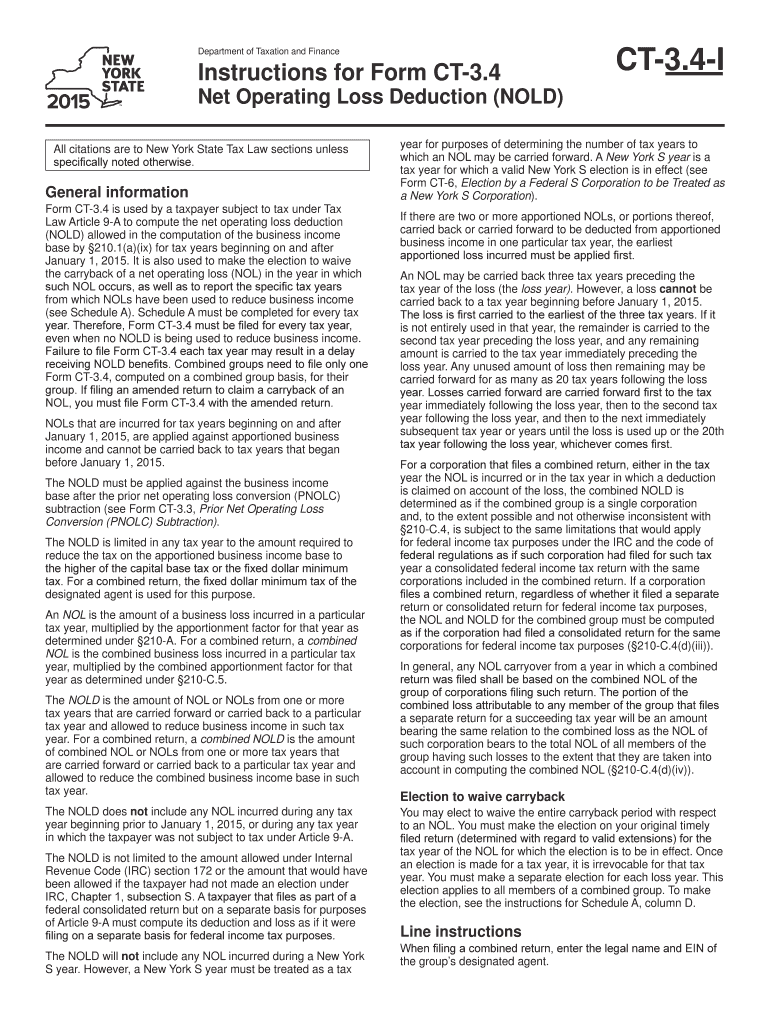

NY DTF CT-3/4-I 2015 free printable template

Get, Create, Make and Sign NY DTF CT-34-I

Editing NY DTF CT-34-I online

Uncompromising security for your PDF editing and eSignature needs

NY DTF CT-3/4-I Form Versions

How to fill out NY DTF CT-34-I

How to fill out NY DTF CT-3/4-I

Who needs NY DTF CT-3/4-I?

Instructions and Help about NY DTF CT-34-I

Hi, thank you for visiting our website at Sonic of CT comm today what I'd like to do is take a few moments to explain about Sonic of Connecticut about our first opening which is the first sonic in Connecticut and how it's going to work any issues that may occur during its opening and of course what to do when you get to sonic as you know is America's drive-in most of our business ok is created through our stalls in which you would drive up presses really cool red button get a friendly voice that comes on place your order and then a few minutes later your order comes out and any time you would ever need something during that time you would keep pressing the red button until you're done and of course drive away that is option one option two is you can go through a normal drive-thru as you would go to any of the other fast-food and quick service restaurants number three is we have a great covered heated patio that is one of the first of its kind in New England and you can go there and enjoy yourself is we call it a three season outdoor patio system which again has heat and has windshield walls and has all kinds of covered canopies for your enjoyment and again with a sonic all of our stalls all of our canned apiece and all of our patios have exclusive feature which is called Sonic radio so the whole drive-thru and driving experience is one that was very well thought of, and we hope you enjoy it once you get there now a couple of things you need to know during our opening will be taking place sometime the first part of July the dates will be announced soon if you haven't already become a member of our Facebook or Twitter please do so an easy way to do that is to go right to our website you click down one of the lower places it will take you right to Facebook and you can sign up there another important feature that we want to offer is friends and family friends and family will give you the opportunity for us to send all kinds of emails newsletters openings grand openings free giveaways coupons on a monthly basis, so we'll always keep you updated and informed in Saint you'll never have to wonder you know what specials are in Saint we will bring them to you, so we advise you to go ahead we call it constant contacts because that's what we are constantly contacted with you, and you sign up for that services absolutely free okay next as you know if you may have heard sonic is a very, very popular drive-in restaurant it's one of the few ones of its kind now since that what we have is called these Rock star openings where everybody will drive them around from about 120 miles to see us they'll drive for two three four hours at a time and because of this we have a lot more people than are typically at any type of fast-food facility so what we recommend or encourage is this for the first couple of weeks even to two to three weeks it will be busy ok we understand that, so we want to let everybody know that it will be if you want to come and need to come find we...

People Also Ask about

What form do I use for NY part-year resident?

What is it-558 form used for?

What is the IT-201 tax form?

What form does a full year resident of NYS file?

What is the full form of ITR?

How to fill out tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF CT-34-I to be eSigned by others?

How do I fill out NY DTF CT-34-I using my mobile device?

How do I complete NY DTF CT-34-I on an Android device?

What is NY DTF CT-3/4-I?

Who is required to file NY DTF CT-3/4-I?

How to fill out NY DTF CT-3/4-I?

What is the purpose of NY DTF CT-3/4-I?

What information must be reported on NY DTF CT-3/4-I?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.