Get the free pdffiller

Show details

Property Tax Dispute Resolution InsightsDark Store Theory to Stop It from

Coming to a State Near You!

Judy S. Angel, Esq., and Lynn S. Line, Esq

Most ad valor em property tax systems value real property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

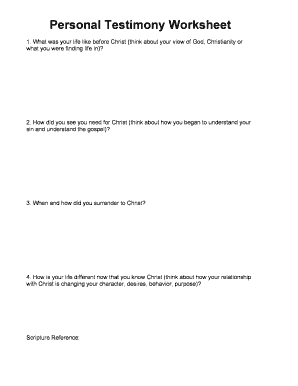

How to fill out pdffiller form

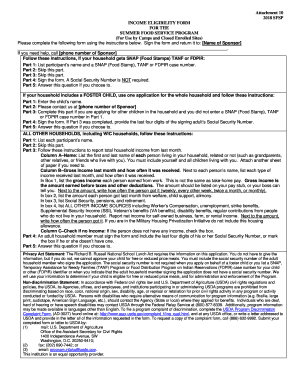

How to fill out property tax dispute resolution:

01

Gather all necessary documentation related to the property in question, such as property tax assessment notices, payment receipts, and any other relevant paperwork.

02

Review the property tax assessment notice thoroughly to understand the reasons for the dispute and identify any errors or discrepancies.

03

Contact the local tax department or tax assessor's office to obtain the appropriate forms for filing a property tax dispute resolution.

04

Fill out all required information on the forms accurately and provide supporting documentation where necessary. Be sure to include a detailed explanation of the reason for disputing the property tax assessment.

05

Submit the completed forms and supporting documents to the appropriate tax department or tax assessor's office within the specified deadline.

06

Await a response from the tax department regarding the property tax dispute resolution. This may include a hearing or review of the submitted information.

07

Prepare and gather additional evidence or supporting documents that may strengthen your case, if necessary.

08

Attend any scheduled hearings or meetings related to the property tax dispute resolution process, and present your case clearly and persuasively.

09

If the dispute is resolved in your favor, carefully review any revised property tax assessment notices received and ensure that the proper adjustments are made accordingly.

10

If the dispute is not resolved in your favor, you may consider seeking professional assistance from a tax attorney or consultant to further explore the options available to you.

Who needs property tax dispute resolution?

01

Property owners who believe that their property has been unfairly assessed for tax purposes.

02

Individuals or businesses who have received property tax assessment notices with errors or discrepancies.

03

Those who wish to challenge the valuation or classification of their property for property tax purposes.

04

Owners of properties where there have been changes to the property that may impact its assessed value, such as renovations or damage.

05

Anyone who wants to ensure that their property taxes are accurate and fair in accordance with local tax laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your pdffiller form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete pdffiller form online?

Easy online pdffiller form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in pdffiller form?

The editing procedure is simple with pdfFiller. Open your pdffiller form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is property tax dispute resolution?

Property tax dispute resolution is a process where property owners can challenge the assessed value of their property for tax purposes.

Who is required to file property tax dispute resolution?

Property owners who believe that the assessed value of their property is incorrect and want to dispute it.

How to fill out property tax dispute resolution?

Property owners can fill out the property tax dispute resolution form provided by their local tax authority, providing all relevant information and supporting documents.

What is the purpose of property tax dispute resolution?

The purpose of property tax dispute resolution is to ensure that property owners are paying the correct amount of property taxes based on the accurate assessment of their property.

What information must be reported on property tax dispute resolution?

Property owners must report information such as the current assessed value of their property, the disputed value, reasons for dispute, and any supporting documentation.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.