Get the free 1040x - ftp irs

Get, Create, Make and Sign 1040x - ftp irs

How to edit 1040x - ftp irs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1040x - ftp irs

How to fill out 1040x:

Who needs 1040x:

Instructions and Help about 1040x - ftp irs

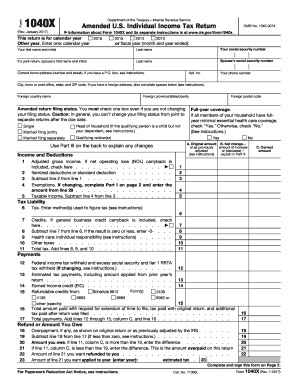

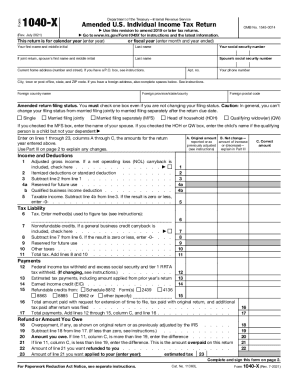

Hi this is John with PDF Techs right now we have form 1040x the amended us individual income tax return here on the screen so were going to spend a little time seeing how this form works this is the form that you would use if you made some kind of mistake on your original tax return your form 1040, and you needed to fix that, so I've already entered the names Social Security numbers and address for this married filing joint couple they also have one dependent, although that doesn't show on page 1 of 1040 X, so lets go ahead and see how this will work and were going to say that this is for year 2017, and I've already checked this box married filing joint and then over here we need to indicate whether they had full health care coverage all year and were going to say yes they did now let's suppose that on their original return they had one w2 and that's all they had for income which was 75000 so the first thing we need to do is enter the original amounts from the original tax return and then well adjust those later so well put 75000 in here like that and that carries over just to the corrected column but well were going to change that a little later when we make some Corrections and then on line two we need to enter their standard deduction which for a married filing joint return in 2017 is twelve thousand seven hundred so put that there and then with three exemptions one for each of them and one for their dependent their exemptions for 2017 is three times 4050 which is twelve thousand 150 like that so now their taxable income on line 5 shows up as fifty thousand 150, and now we need to and our the tax and if you look in the 1040 instructions in the tax table you'll see that the amount of tax on 50000 150 is sixty-five ninety-four there right like that, and then we need to tell the IRS how that tax was figured and the most common method and the ones that this taxpayer used was the tax table so well put that in their like that no they also had some income tax withheld on their w2 of 6800, so that goes on line 12 and on their original return they had a refund of 206 dollars which right now anyway shows up on line 22, but we need to put that on line 18 the overpayment on the original return of 206 so now their refund at least right now is zero because they haven't made any adjustments yet but well do that now so like I said earlier they had a w-2 form that they forgot to put on their original return excuse me and the amount of income on the w-2 the amount of wages its twelve thousand so put that there like that and the standard deduction doesn't change and the exemptions don't change, so their new taxable amount is 60 to 150 now if we go back in the tax table and look up the amount of tax for 60 to 150 we can see that that comes up to 83 94 whoops its 83 94, but we want to put just the increase and the increase is 1800, so the new tax is 83 94 and that's still from the tax table so well leave that alone so there we go like that and however on line 12...

People Also Ask about

How to calculate line 6 on 1040X?

What do I put on line 6 1040X?

What needs to be included with 1040X?

Can you file 1040X electronically?

How to do a 1040X amended return?

What is line 6 on tax return?

What goes with 1040X?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 1040x - ftp irs without leaving Google Drive?

How do I make edits in 1040x - ftp irs without leaving Chrome?

How do I complete 1040x - ftp irs on an iOS device?

What is 1040x?

Who is required to file 1040x?

How to fill out 1040x?

What is the purpose of 1040x?

What information must be reported on 1040x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.