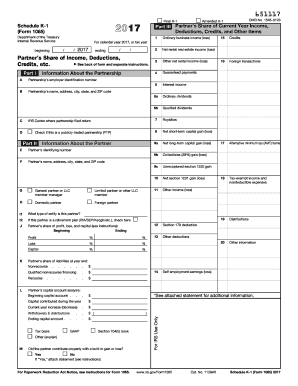

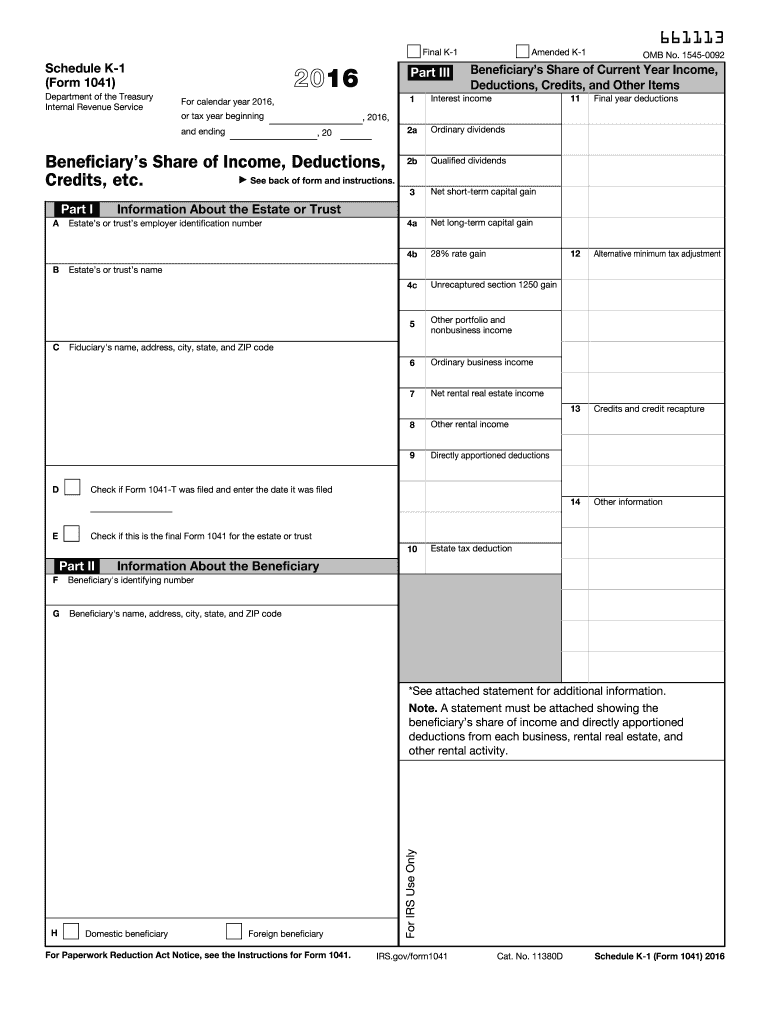

IRS 1041 - Schedule K-1 2016 free printable template

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

About IRS 1041 - Schedule K-1 2016 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

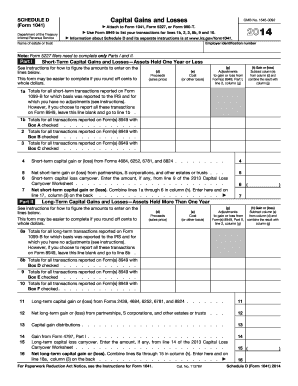

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041 - Schedule K-1

How can I correct mistakes on an already filed IRS 1041 - Schedule K-1?

To correct mistakes on an already filed IRS 1041 - Schedule K-1, you need to file an amended return. Use the original form, clearly mark it as 'Amended', and include the correct information. Additionally, it’s essential to provide an explanation for the changes made on the form to avoid processing delays.

What should I do if my e-filed IRS 1041 - Schedule K-1 is rejected?

If your e-filed IRS 1041 - Schedule K-1 is rejected, review the rejection code provided by the IRS. Common issues include incorrect taxpayer information or mismatches with IRS records. Address the highlighted problem, correct the errors, and resubmit your form promptly to avoid penalties.

How long should I retain records related to my IRS 1041 - Schedule K-1?

You should retain records related to your IRS 1041 - Schedule K-1 for at least three years from the date of filing. This retention period ensures you have the necessary documentation in case of an IRS audit or if discrepancies arise regarding your filings.

Can I e-sign my IRS 1041 - Schedule K-1?

Yes, e-signatures are acceptable on the IRS 1041 - Schedule K-1, provided they meet IRS requirements for electronic submissions. Ensure the e-signature process complies with all regulations to validate your submission and maintain authenticity.

What to do if I receive an IRS notice after submitting my Schedule K-1?

If you receive an IRS notice after submitting your Schedule K-1, read it carefully to understand the reason for the correspondence. Prepare any required documentation to respond, and follow the instructions provided in the notice to address the issue within the specified timeframe.

See what our users say