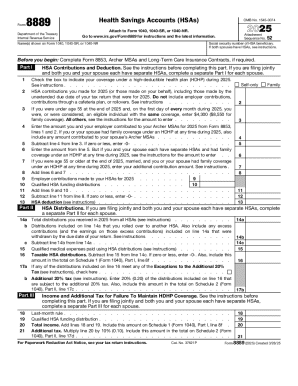

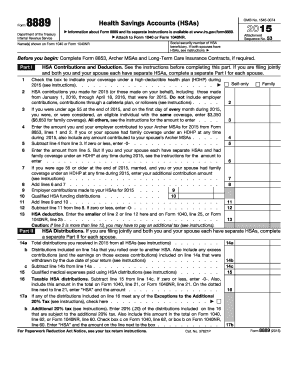

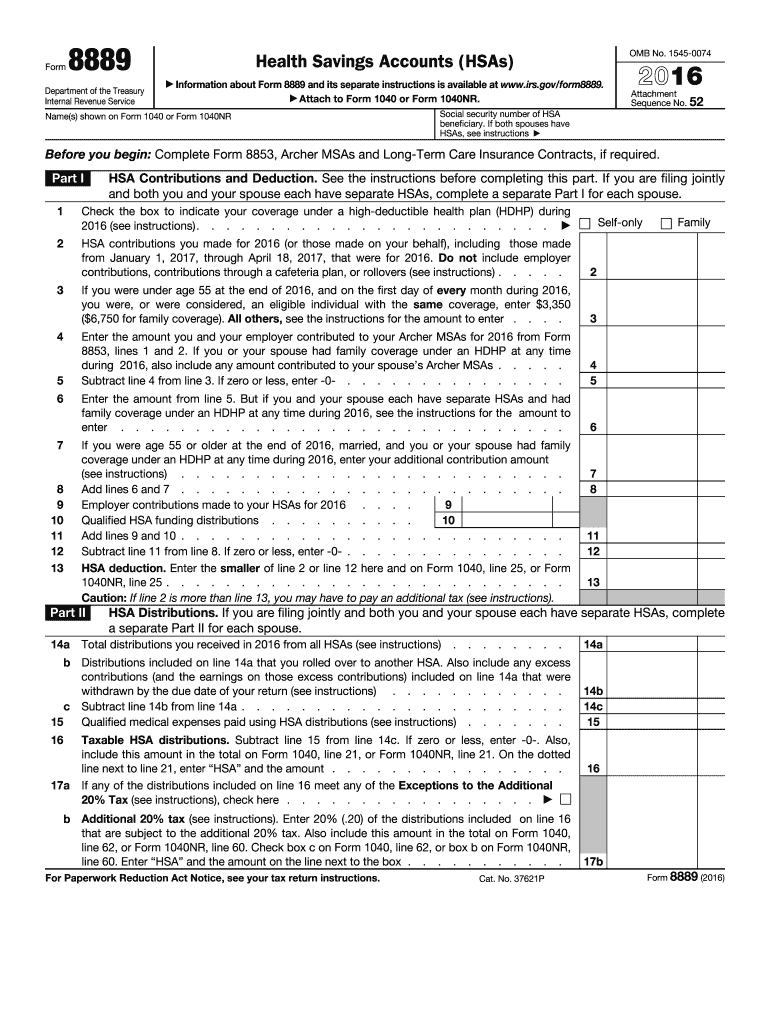

IRS 8889 2016 free printable template

Instructions and Help about IRS 8889

How to edit IRS 8889

How to fill out IRS 8889

About IRS 8 previous version

What is IRS 8889?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8889

What should I do if I need to correct mistakes on my IRS 8889?

If you need to correct mistakes on your IRS 8889, you should file an amended return. This process involves filling out a new IRS 8889 form with the correct information and marking it as 'amended.' Ensure you clearly indicate the changes made and attach any necessary documentation. It’s essential to submit the amended form as soon as possible to avoid potential issues with the IRS.

How can I track the status of my filed IRS 8889?

To track the status of your filed IRS 8889, you can utilize the IRS's online tool called 'Where’s My Refund?' or 'Where's My Amended Return?' depending on the nature of your submission. These tools allow you to see whether your form has been received and processed. Make sure to have your details ready, such as Social Security number and filing status, for accurate tracking.

What privacy measures should I be aware of when filing IRS 8889?

When filing your IRS 8889, it is crucial to consider privacy measures, such as using secure methods for submitting sensitive information. Ensure that any software used for e-filing complies with data security standards. Additionally, keep records in a secure location and limit access to your filing information to prevent identity theft and unauthorized disclosures.

What should I know if I'm filing the IRS 8889 on behalf of someone else?

If you’re filing the IRS 8889 on behalf of someone else, ensure you have proper authorization, such as a Power of Attorney (POA). Additionally, you should be aware of their personal and financial information to accurately complete the form. Be prepared to provide documentation supporting your right to file for another individual to avoid complications during processing.

What common errors should I look out for when completing my IRS 8889?

Common errors when completing IRS 8889 include incorrect Social Security numbers, mismatched names, and inaccurate financial reporting. It's vital to double-check all entries and ensure that the form is filled out correctly. Reviewing the previous year's form and current instructions can also help reduce mistakes, leading to a smoother filing process.