IRS 2555 2016 free printable template

Show details

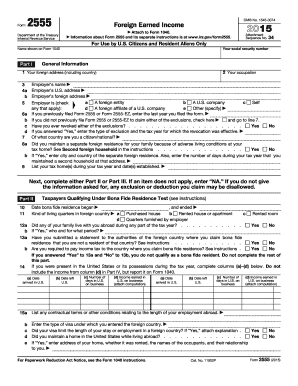

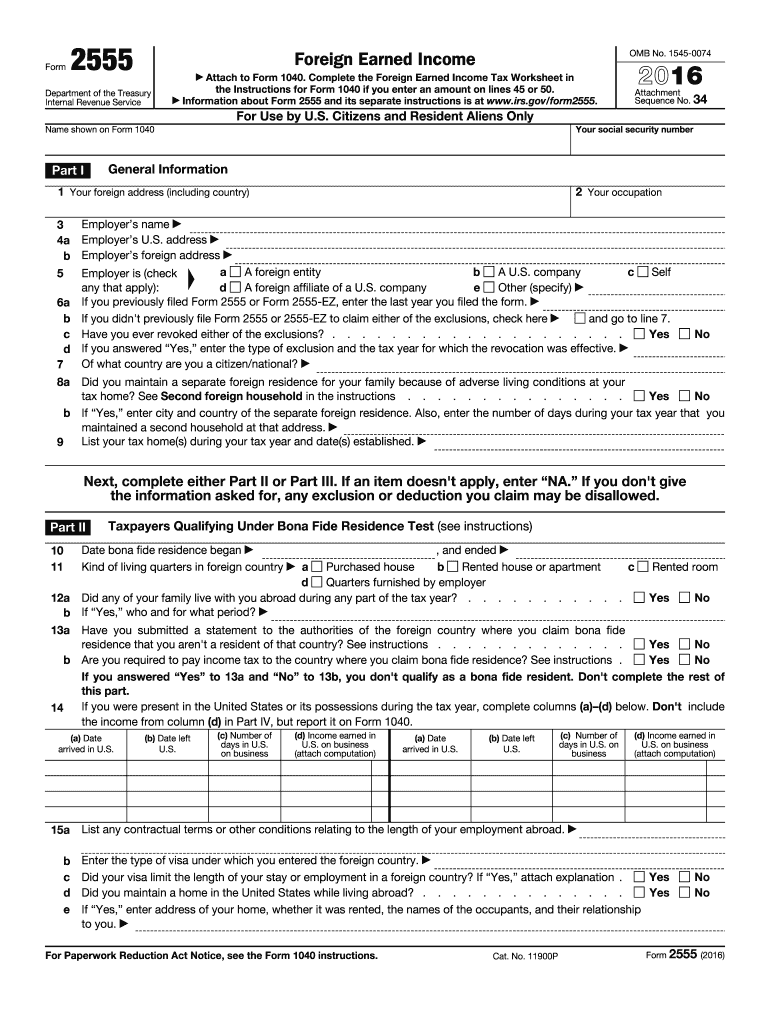

Line 36. Next to the amount on Form 1040 enter Form 2555. Add it to the total adjustments reported on that line. Information about Form 2555 and its separate instructions is at www.irs.gov/form2555. Department of the Treasury Internal Revenue Service Attachment Sequence No. 34 For Use by U.S. Citizens and Resident Aliens Only Your social security number Name shown on Form 1040 Part I General Information 1 Your foreign address including country 2 Your occupation Employer s name 4a Employer s...U.S. address b Employer s foreign address a A foreign entity b A U.S. company c Self Employer is check d any that apply A foreign affiliate of a U.S. company e Other specify 6a If you previously filed Form 2555 or Form 2555-EZ enter the last year you filed the form. b If you didn t previously file Form 2555 or 2555-EZ to claim either of the exclusions check here and go to line 7. See instructions and attach computation. Next to the amount enter Form 2555. On Form 1040 subtract this amount...from your income to arrive at total income on Form 1040 line 22 b line 27 is more than line 43. For Paperwork Reduction Act Notice see the Form 1040 instructions. Cat. No. 11900P Form 2555 2016 Page The physical presence test is based on the 12-month period from Enter your principal country of employment during your tax year. Form OMB No* 1545-0074 Foreign Earned Income Attach to Form 1040. Complete the Foreign Earned Income Tax Worksheet in the Instructions for Form 1040 if you enter an amount...on lines 45 or 50. c Have you ever revoked either of the exclusions. Yes d If you answered Yes enter the type of exclusion and the tax year for which the revocation was effective. Of what country are you a citizen/national No 8a Did you maintain a separate foreign residence for your family because of adverse living conditions at your tax home See Second foreign household in the instructions. b If Yes enter city and country of the separate foreign residence. Also enter the number of days during...your tax year that you maintained a second household at that address. List your tax home s during your tax year and date s established* Next complete either Part II or Part III. If an item doesn t apply enter NA. If you don t give the information asked for any exclusion or deduction you claim may be disallowed* Taxpayers Qualifying Under Bona Fide Residence Test see instructions Date bona fide residence began and ended Kind of living quarters in foreign country Purchased house Rented house or...apartment Quarters furnished by employer 12a Did any of your family live with you abroad during any part of the tax year. b If Yes who and for what period. Rented room 13a Have you submitted a statement to the authorities of the foreign country where you claim bona fide residence that you aren t a resident of that country See instructions. b Are you required to pay income tax to the country where you claim bona fide residence See instructions. this part. If you were present in the United States...or its possessions during the tax year complete columns a d below.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2555

How to edit IRS 2555

How to fill out IRS 2555

Instructions and Help about IRS 2555

How to edit IRS 2555

To edit IRS Form 2555, you can use pdfFiller’s online tools, which allow for direct modifications. After uploading the form, select the fields you wish to change and enter the updated information. Ensure all required fields are correctly completed before saving the edits. Once satisfied, save your edited document for submission.

How to fill out IRS 2555

To fill out IRS Form 2555, start by gathering necessary documents such as your tax identification number and any relevant financial records related to foreign income. Complete the personal information section, ensuring accuracy in your name and address. Detail your foreign income sources and any applicable deductions accurately. Use pdfFiller to fill in the form electronically, ensuring you follow the specified instructions for each line item. After completing the form, carefully review it for any errors before submission.

About IRS 2 previous version

What is IRS 2555?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2555?

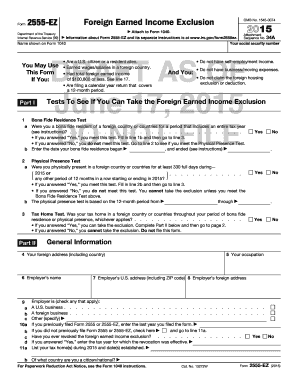

IRS Form 2555 is the "Foreign Earned Income Exclusion" application used by U.S. citizens and resident aliens to exclude certain foreign earned income from their taxable income. This form is essential for Americans working abroad who wish to reduce their U.S. tax liability for income earned in foreign countries.

What is the purpose of this form?

The primary purpose of IRS Form 2555 is to determine eligibility for the foreign earned income exclusion. By filing this form, taxpayers can exclude up to a specified limit of their foreign earned income from U.S. taxation, coupled with a housing exclusion or deduction if applicable. This facilitates tax relief for individuals earning income outside the U.S.

Who needs the form?

U.S. citizens and resident aliens who have earned income from foreign sources and meet specific residency or physical presence test criteria must file IRS Form 2555. If your foreign earnings exceed the exclusion threshold, this form is necessary to claim the exclusion for that income effectively.

When am I exempt from filling out this form?

If your total foreign earned income is below the exclusion limit or if you don't meet the qualifications of the residency or physical presence tests, you may be exempt from filing IRS Form 2555. Additionally, if all of your income is subject to U.S. tax or you do not have foreign earned income, the form is unnecessary.

Components of the form

IRS Form 2555 contains various components, including sections to report personal information, foreign earned income, deductions, and housing expenses. Key components include your qualifying foreign residence dates, the nature of your foreign income, and tabulation of housing expenses if claiming the housing exclusion or deduction. Accurate completion of each section is crucial for a successful submission.

Due date

The due date for IRS Form 2555 generally aligns with your regular income tax return, typically April 15 of the following tax year. However, if you are living abroad, you may receive an automatic extension until June 15. It’s essential to file timely to avoid penalties and complications.

Form vs. Form

What payments and purchases are reported?

Form 2555 does not require reporting specific payments or purchases. Instead, it focuses on reporting foreign earned income and any applicable housing costs relevant to the exclusion. Taxpayers should ensure that all income claimed is adequately tracked and documented for IRS purposes.

How many copies of the form should I complete?

Typically, you need to complete a single copy of IRS Form 2555 for submission. Additional copies may be necessary if you are filing multiple forms for different tax years or if the form needs to be submitted with other related documentation. Always keep a copy for your records.

What are the penalties for not issuing the form?

Failing to file IRS Form 2555 when required may result in penalties, including the loss of the foreign earned income exclusion. Taxpayers may also face interest on unpaid taxes if the exclusion remains unclaimed. It is crucial to adhere to filing requirements to avoid financial repercussions.

What information do you need when you file the form?

When filing IRS Form 2555, you will need information such as your tax identification details, employment information, proof of your foreign residence, and records of your foreign earned income and any applicable expenses for claiming deductions. Prepare this data in advance for a smooth filing process.

Is the form accompanied by other forms?

IRS Form 2555 may be filed along with other forms, such as Form 1040, the standard individual income tax return. Supporting documentation may also be necessary, depending on your specific tax situation and any additional claims you are making, such as for housing deductions.

Where do I send the form?

IRS Form 2555 should be submitted to the appropriate address indicated in the form's instructions, which typically depends on whether you are filing your return electronically or by mail. Ensure you double-check the address for accuracy to avoid delays in processing.

See what our users say