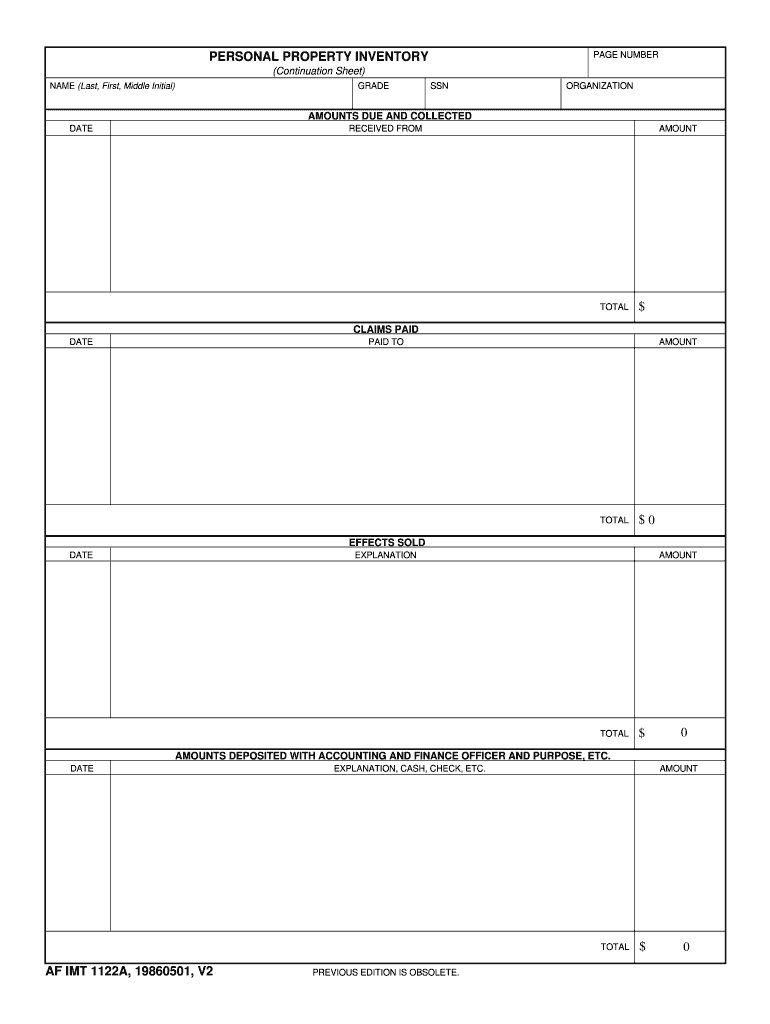

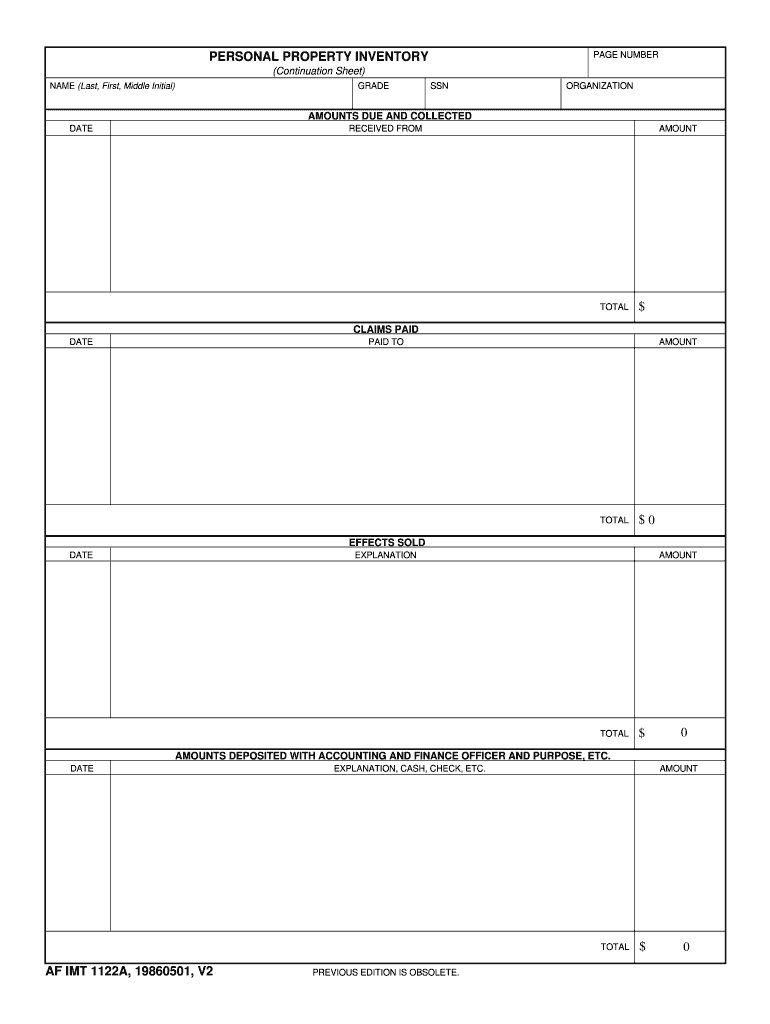

Get the free AMOUNTS DUE AND COLLECTED

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign amounts due and collected

Edit your amounts due and collected form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amounts due and collected form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit amounts due and collected online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit amounts due and collected. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out amounts due and collected

How to fill out amounts due and collected?

01

Start by gathering all relevant financial documents such as invoices, receipts, and payment records. This will help you accurately determine the amounts due and collected.

02

Identify the specific time period for which you are tracking the amounts due and collected. It could be a month, a quarter, or a year, depending on your reporting needs.

03

In your financial records, create separate columns or categories for amounts due and amounts collected. This will allow you to track these figures separately for better analysis and reporting.

04

For amounts due, record the total outstanding balances that customers owe your company. This includes any unpaid invoices or pending payments that are still outstanding at the end of the reporting period.

05

For amounts collected, record the total payments that you have received from customers during the reporting period. This can include cash, checks, credit card payments, or any other form of payment.

06

Calculate the net amount due by subtracting the amounts collected from the amounts due. This will give you a clear picture of how much you still have outstanding from customers.

07

It's essential to be accurate and diligent in recording the amounts due and collected. Ensure that all payments received are properly recorded and that any outstanding balances are updated promptly.

Who needs amounts due and collected?

01

Businesses: Companies of all sizes and industries need to track amounts due and collected to manage their cash flow effectively. It helps them understand their financial position and make informed decisions about spending and investments.

02

Accountants: Professionals responsible for managing the financial records of a business or providing financial advice rely on accurate and up-to-date amounts due and collected. It helps them analyze cash flow patterns, identify potential issues, and provide recommendations for improvement.

03

Financial Institutions: Lenders and financial institutions often require detailed information about amounts due and collected to assess the creditworthiness of a business or individual. This data helps them evaluate the ability to repay loans and make lending decisions.

04

Government Agencies: Tax authorities and regulatory bodies may also request information about amounts due and collected as part of financial reporting requirements. Compliance with these regulations is crucial to avoid penalties and legal consequences.

In conclusion, filling out amounts due and collected involves accurately tracking outstanding balances and payments received. This information is essential for businesses, accountants, financial institutions, and government agencies to manage finances, make informed decisions, and ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit amounts due and collected from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your amounts due and collected into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute amounts due and collected online?

Easy online amounts due and collected completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit amounts due and collected on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share amounts due and collected from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is amounts due and collected?

Amounts due and collected refer to the total sum of money that is owed and paid by individuals or businesses to a certain entity within a specific period of time.

Who is required to file amounts due and collected?

Businesses and individuals who have financial transactions that involve debts or payments are required to file amounts due and collected.

How to fill out amounts due and collected?

Amounts due and collected can be filled out by recording all relevant financial transactions, including debts and payments, in a detailed financial report or ledger.

What is the purpose of amounts due and collected?

The purpose of amounts due and collected is to keep track of all financial transactions, ensure accurate record-keeping, and facilitate proper reporting and analysis of financial data.

What information must be reported on amounts due and collected?

Information that must be reported on amounts due and collected includes the names of debtors and creditors, amounts owed and paid, due dates, and any relevant terms and conditions of the transactions.

Fill out your amounts due and collected online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amounts Due And Collected is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.