Get the free Mortgage or Private Loan Application - dnb.lv

Show details

Mortgage or Private Loan Application Actual address Mobile phone Current employer Monthly salary after taxes Other regular income (per month) Working

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage or private loan

Edit your mortgage or private loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage or private loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage or private loan online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage or private loan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

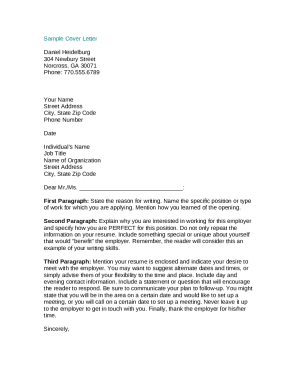

How to fill out mortgage or private loan

How to fill out a mortgage or private loan:

01

Research and compare lenders: Start by researching and comparing different lenders to find the best mortgage or private loan options available. Look for lenders that offer competitive interest rates, flexible terms, and a good reputation.

02

Gather necessary documents: To fill out a mortgage or private loan application, you'll need to gather several documents in advance. These may include proof of income, employment verification, bank statements, tax returns, identification documents, and any other relevant financial information.

03

Complete the application form: Once you have all the required documents, carefully fill out the application form provided by the lender. It's crucial to provide accurate and detailed information as any inaccuracies or omissions might delay the approval process.

04

Submit the application: After completing the application form, submit it to the lender along with all the supporting documents. Make sure to double-check that you haven't missed any required documents before sending it.

05

Wait for pre-approval or approval: Once the lender receives your application, they will review your financial information and credit history. If you meet their eligibility criteria, you may receive a pre-approval or full approval letter indicating the loan amount you qualify for.

06

Provide additional information if requested: In some cases, the lender might request additional information or documentation to complete the loan application process. Be responsive and provide the requested information promptly to ensure a smooth approval process.

07

Review the loan terms and conditions: If your application is approved, carefully review the loan terms and conditions provided by the lender. Pay attention to the interest rate, repayment period, any fees involved, and other important details. Ensure that you understand and are comfortable with all the terms before proceeding.

Who needs a mortgage or private loan:

01

Homebuyers: Individuals or families looking to purchase a house often require a mortgage loan to finance the purchase. A mortgage is a long-term loan specifically designed for homebuyers, which allows them to spread the cost of the property over several years.

02

Real estate investors: Real estate investors who want to buy properties for investment purposes may also need a mortgage or private loan. These loans help investors leverage their capital and expand their real estate portfolios.

03

Business owners or entrepreneurs: Small business owners or entrepreneurs may require a private loan to fund startup costs, expand their business, or cover unexpected expenses. Private loans can provide the necessary capital when traditional financing options are limited.

04

Individuals consolidating debt: If someone has multiple debts with high-interest rates, they may opt for a private loan to consolidate their debts into a single, more manageable monthly payment. This can help streamline their finances and potentially save money on interest payments.

05

Individuals with urgent financial needs: Sometimes unexpected financial situations arise, such as medical emergencies or home repairs, that require immediate funding. In such cases, a private loan can be a viable option to access fast cash.

Overall, both mortgages and private loans cater to different financial needs and situations. It's crucial to carefully assess your individual circumstances and seek professional advice before deciding on the best option for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage or private loan directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your mortgage or private loan as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit mortgage or private loan on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mortgage or private loan on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete mortgage or private loan on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your mortgage or private loan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is mortgage or private loan?

A mortgage is a loan to finance the purchase of a real estate property, while a private loan is a loan from an individual or non-bank entity.

Who is required to file mortgage or private loan?

Individuals or entities who have taken out a mortgage or private loan are required to file it with the appropriate authorities.

How to fill out mortgage or private loan?

To fill out a mortgage or private loan, you need to provide details about the loan amount, interest rate, repayment terms, and property details.

What is the purpose of mortgage or private loan?

The purpose of a mortgage or private loan is to provide funding for the purchase of real estate or other projects.

What information must be reported on mortgage or private loan?

Information such as loan amount, interest rate, repayment schedule, property details, and borrower information must be reported on a mortgage or private loan.

Fill out your mortgage or private loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Or Private Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.